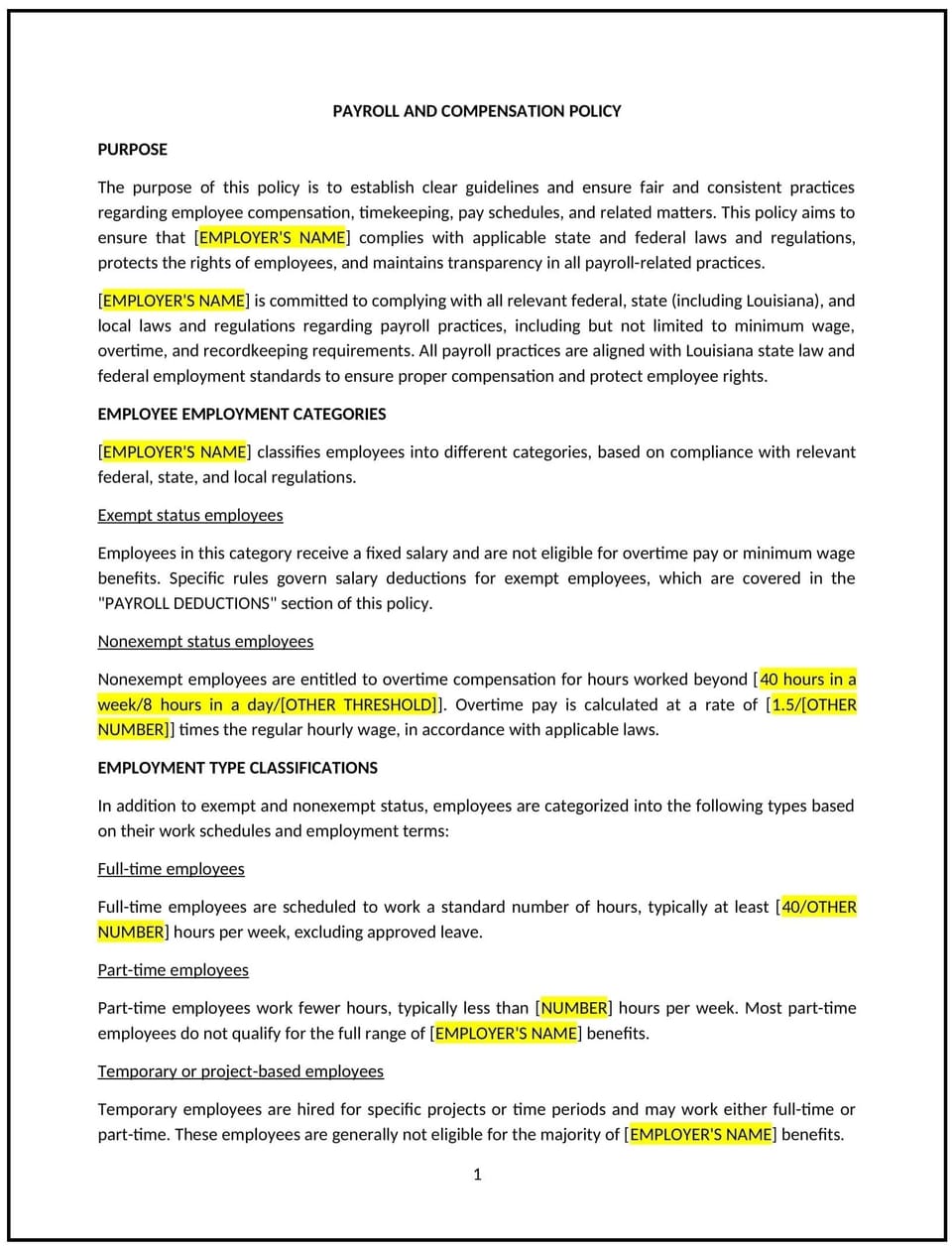

Payroll and compensation policy (Louisiana): Free template

Payroll and compensation policy (Louisiana)

This payroll and compensation policy is designed to help Louisiana businesses establish clear guidelines for managing employee pay, including schedules, methods, and adjustments. It outlines responsibilities for both employees and employers to ensure transparency and accuracy in compensation practices.

By implementing this policy, businesses can maintain fairness, reduce misunderstandings, and streamline payroll processes.

How to use this payroll and compensation policy (Louisiana)

- Define pay schedules: Clearly specify pay periods, such as weekly, biweekly, or monthly, and include payment dates.

- Outline payment methods: Provide information on acceptable payment methods, such as direct deposit, paper checks, or payroll cards.

- Address deductions: Explain permissible deductions, including taxes, benefits, or other authorized amounts.

- Include overtime and bonuses: Detail how overtime pay or bonuses are calculated and when they will be disbursed.

- Communicate adjustments: Specify procedures for addressing changes in pay due to promotions, role changes, or errors.

- Provide reporting procedures: Outline how employees can report payroll discrepancies or concerns.

Benefits of using a payroll and compensation policy (Louisiana)

Implementing this policy provides several advantages for Louisiana businesses:

- Promotes transparency: Ensures employees understand how and when they will be paid.

- Enhances trust: Builds confidence in the company’s payroll processes by providing clear guidelines.

- Reduces disputes: Clarifies expectations around pay, deductions, and adjustments.

- Simplifies processes: Establishes consistent procedures for managing payroll and compensation.

- Reflects Louisiana-specific needs: Adapts to local wage laws and business practices.

Tips for using this payroll and compensation policy (Louisiana)

- Communicate clearly: Share the policy with employees during onboarding and provide regular updates as needed.

- Train payroll staff: Ensure payroll personnel are knowledgeable about the policy and equipped to handle employee inquiries.

- Maintain accurate records: Keep detailed records of hours worked, deductions, and payments to prevent disputes.

- Address errors promptly: Establish a process for correcting payroll errors and communicating changes to employees.

- Review regularly: Update the policy to reflect changes in business operations or Louisiana-specific regulations.

Q: What is the standard pay schedule under this policy?

A: The standard pay schedule is typically biweekly, but businesses may choose other intervals, such as weekly or monthly, as outlined in the policy.

Q: What payment methods are available to employees?

A: Employees may receive payment via direct deposit, paper checks, or payroll cards, depending on company preferences.

Q: How can employees report payroll discrepancies?

A: Employees should notify HR or payroll staff immediately, providing details about the issue for prompt resolution.

Q: Are overtime and bonuses covered under this policy?

A: Yes, the policy outlines how overtime pay and bonuses are calculated and disbursed.

Q: What deductions are included in employee paychecks?

A: Deductions typically include taxes, benefits contributions, and any other authorized amounts, as specified in the policy.

Q: How are payroll adjustments handled for promotions or role changes?

A: Adjustments are made based on the effective date of the change, and employees are notified of updates to their pay.

Q: How often should this policy be reviewed?

A: The policy should be reviewed annually or when changes in payroll practices or Louisiana-specific requirements occur.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.