Payroll and compensation policy (Maine): Free template

Payroll and compensation policy (Maine): Free template

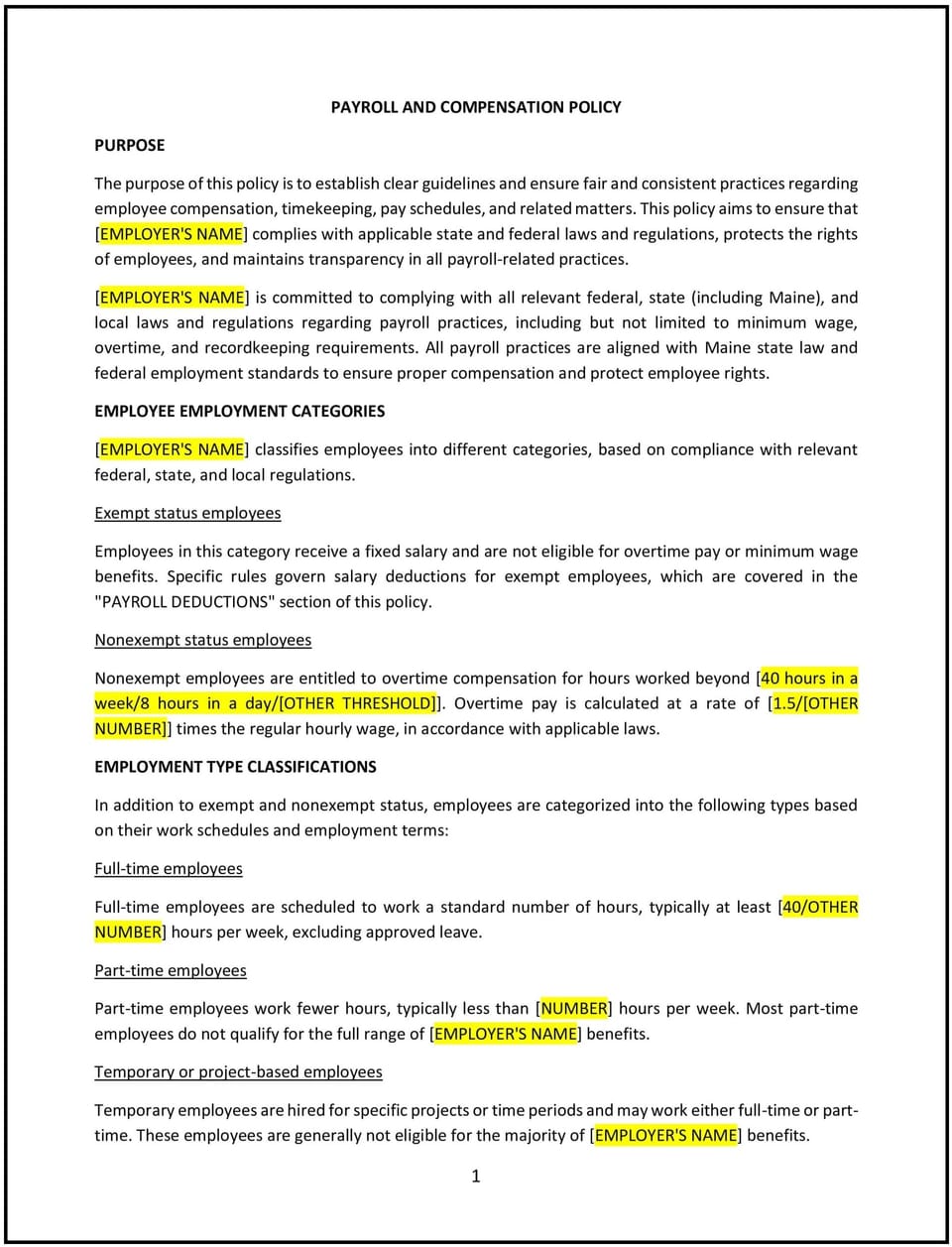

This payroll and compensation policy is designed to help Maine businesses establish clear guidelines for compensating employees fairly and managing payroll processes. It outlines pay periods, salary structures, benefits, while supporting compliance with Maine and federal wage laws, ensuring employees are paid correctly and on time.

By implementing this policy, Maine businesses can promote transparency, ensure legal compliance, and maintain employee satisfaction through consistent compensation practices.

How to use this payroll and compensation policy (Maine)

- Define compensation structure: Outline the types of compensation offered, including salary, hourly wages, bonuses, commissions, and benefits, and specify how they are determined.

- Set pay periods: Clearly state the pay schedule, such as weekly, bi-weekly, or monthly, and ensure it aligns with Maine labor laws.

- Address overtime and break policies: Specify the conditions under which overtime pay is applicable, as well as any meal or rest break requirements, in compliance with Maine and federal law.

- Include deductions and withholdings: Detail the standard payroll deductions, such as federal and state taxes, benefits contributions, retirement plan contributions, and any other legal or voluntary deductions.

- Explain payment methods: Specify how employees will be paid (e.g., via direct deposit, checks) and any policies around payroll discrepancies or issues.

- Provide benefits: Outline the benefits offered, such as health insurance, retirement plans, paid time off, and any other compensation-related perks.

- Review regularly: Update the policy as necessary to reflect changes in Maine state laws, federal regulations, or company practices.

Benefits of using this payroll and compensation policy (Maine)

Implementing this policy provides several benefits for Maine businesses:

- Ensures compliance: Aligns with Maine wage laws, tax regulations, and labor standards, reducing legal risks.

- Promotes fairness: Creates a transparent and consistent compensation system that treats employees equitably.

- Enhances employee satisfaction: Demonstrates the business’s commitment to fair pay and benefits, improving retention and morale.

- Reduces payroll errors: Provides clear guidelines for payroll procedures, minimizing the risk of mistakes in compensation.

- Increases trust: Builds employee trust by providing clarity and reliability around pay practices.

Tips for using this payroll and compensation policy (Maine)

- Communicate the policy: Share the policy with all employees during onboarding and ensure it is easily accessible, such as in the employee handbook.

- Maintain payroll records: Keep accurate and up-to-date records of all payments, deductions, and benefits for auditing and compliance purposes.

- Train HR staff: Provide training for HR staff on payroll processing, tax requirements, and resolving any discrepancies promptly.

- Monitor compliance: Regularly review payroll practices to ensure they comply with Maine state laws and federal regulations, including overtime and tax laws.

- Be transparent: Communicate clearly with employees about how their compensation is calculated, including benefits and deductions.

- Stay informed: Regularly check for updates to Maine labor laws and federal regulations to ensure the policy remains compliant.

Q: How often are employees paid under this policy?

A: Employees are paid according to the pay schedule set by the business, which may be weekly, bi-weekly, or monthly, as outlined in the policy.

Q: Are employees entitled to overtime pay?

A: Yes, employees are entitled to overtime pay in accordance with Maine and federal wage laws, typically at a rate of 1.5 times their regular hourly rate for hours worked beyond 40 in a workweek.

Q: What payroll deductions are employees subject to?

A: Standard deductions include federal and state taxes, Social Security, Medicare, and any voluntary deductions such as benefits contributions or retirement savings.

Q: How should employees report payroll discrepancies?

A: Employees should report any payroll discrepancies or issues to HR or their manager, who will investigate and resolve the issue promptly.

Q: How can employees receive their pay?

A: Employees will be paid via direct deposit or checks, as specified in the policy, and the business will provide pay stubs with details of earnings and deductions.

Q: Are benefits included in compensation?

A: Yes, the policy should outline any additional benefits, such as health insurance, paid time off, and retirement plans, as part of the total compensation package.

Q: How often should businesses review their payroll and compensation policy?

A: Businesses should review the policy annually or whenever there are updates to Maine labor laws or federal regulations affecting payroll or compensation practices.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.