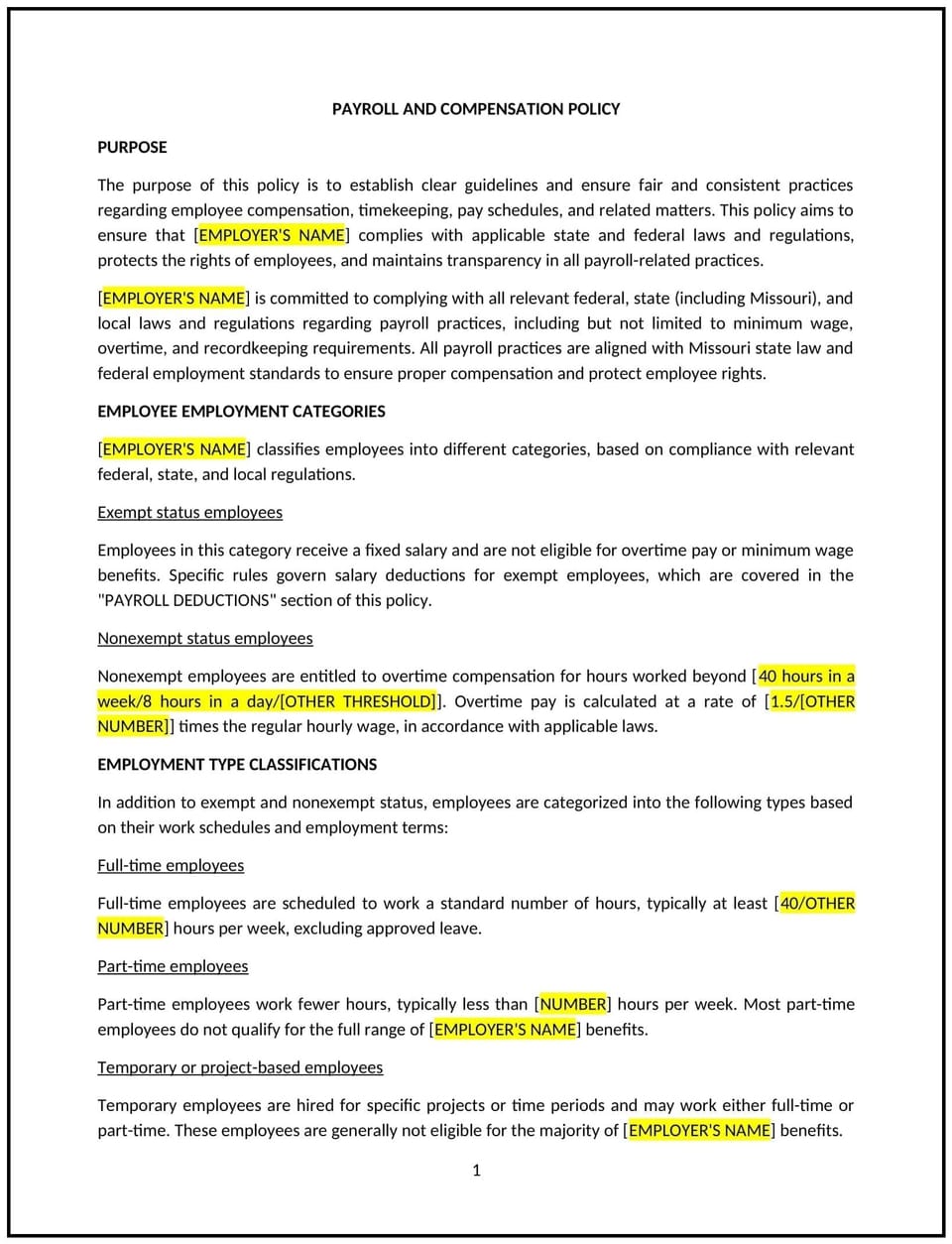

Payroll and compensation policy (Missouri): Free template

Payroll and compensation policy (Missouri)

A payroll and compensation policy helps businesses in Missouri manage the structure and distribution of employee wages, salaries, bonuses, and other forms of compensation. This policy outlines how employees will be compensated for their work, the process for salary or wage determination, payment schedules, and any additional compensation benefits. It aims to ensure fairness, transparency, and consistency in how employees are paid while maintaining compliance with state and federal laws.

By adopting this policy, businesses can maintain a well-structured payroll system, improve employee satisfaction, and reduce the risk of payroll-related issues or disputes.

How to use this payroll and compensation policy (Missouri)

- Define compensation structure: Clearly outline how employees’ pay will be determined, including whether they are salaried or hourly, how pay rates are set, and any additional bonuses, incentives, or commissions that may apply.

- Set pay schedules: Specify the frequency of pay periods, such as weekly, bi-weekly, semi-monthly, or monthly, and the method of payment (e.g., direct deposit, paper checks).

- Address overtime and hours: Clearly define how overtime will be calculated for hourly employees, including the applicable pay rates (typically time and a half) and the conditions under which overtime is paid.

- Include benefits and bonuses: Detail any additional compensation benefits such as health insurance, retirement contributions, paid time off, and performance bonuses, ensuring that employees understand the full scope of their compensation package.

- Set pay equity standards: Ensure that the pay structure aligns with company policies on equity, including non-discrimination and pay for performance, and that it complies with Missouri’s and federal equal pay laws.

- Outline payroll deductions: Specify the mandatory and voluntary deductions from employees’ paychecks, such as federal and state taxes, insurance premiums, retirement contributions, and garnishments, and how they will be handled.

- Establish payroll dispute procedures: Create a system for employees to raise concerns or disputes about their pay or compensation, and ensure there is a clear, fair process for resolving these issues.

- Review regularly: Periodically review and update the policy to ensure it aligns with changes in Missouri state law, federal regulations, or the business’s compensation practices.

Benefits of using this payroll and compensation policy (Missouri)

This policy provides several benefits for businesses in Missouri:

- Ensures fairness and transparency: A clear payroll and compensation policy ensures that employees understand how their pay is determined, promoting fairness and reducing misunderstandings.

- Enhances employee satisfaction: By providing clear, consistent compensation practices, businesses can foster a positive workplace culture and increase employee morale and retention.

- Minimizes legal risks: This policy helps businesses comply with state and federal laws regarding wages, overtime, and payroll practices, reducing the risk of lawsuits or penalties.

- Promotes pay equity: By setting standards for pay equity and non-discrimination, businesses can create a more inclusive work environment and avoid potential pay disparities.

- Reduces payroll errors: A structured and formal payroll system reduces the likelihood of errors or discrepancies in employee pay, leading to fewer disputes and a smoother payroll process.

- Supports organizational goals: A comprehensive payroll and compensation policy ensures that compensation strategies are aligned with the business’s financial goals, helping to attract and retain top talent.

Tips for using this payroll and compensation policy (Missouri)

- Communicate the policy clearly: Ensure that all employees are aware of the payroll and compensation policy, including how their pay is calculated, when they will be paid, and the benefits they are entitled to receive.

- Review pay regularly: Conduct periodic reviews of employee pay to ensure that it remains competitive within the market and aligned with the company’s compensation strategy.

- Maintain payroll accuracy: Implement a system for verifying payroll records to ensure that all employee hours, bonuses, and deductions are accurately recorded and paid.

- Address employee concerns promptly: Set up a system for addressing any payroll-related concerns or disputes that employees may have, ensuring that they are resolved in a timely and fair manner.

- Monitor changes in laws: Stay updated on changes in Missouri state law and federal regulations related to wages, tax rates, and payroll practices, and adjust the policy as needed to stay compliant.

- Review regularly: Periodically review the policy to ensure it remains aligned with the business’s compensation strategy and legal requirements, and to address any employee feedback or concerns.

Q: Why should businesses in Missouri adopt a payroll and compensation policy?

A: Businesses should adopt this policy to ensure transparency, fairness, and consistency in their compensation practices, minimize payroll errors, comply with state and federal laws, and improve employee satisfaction and retention.

Q: How is compensation determined?

A: Compensation is typically determined based on an employee’s role, experience, skills, and market rates. Businesses should clearly outline how salaries or hourly wages are set and whether additional compensation, such as bonuses or commissions, applies.

Q: How often will employees be paid?

A: The pay schedule will be defined in the policy, such as weekly, bi-weekly, semi-monthly, or monthly. The policy should also specify the method of payment, such as direct deposit or paper checks.

Q: How is overtime calculated?

A: Overtime is calculated based on the applicable state and federal law, typically at time-and-a-half for hours worked beyond 40 hours per week for non-exempt employees.

Q: Are bonuses or commissions included in compensation?

A: Businesses should clarify whether employees are eligible for performance-based bonuses, commissions, or other incentives, and explain how these additional compensation elements are determined and paid.

Q: How will payroll deductions be handled?

A: Payroll deductions will include mandatory deductions such as taxes and insurance premiums, as well as voluntary deductions such as retirement contributions. The policy should explain how these deductions are calculated and applied.

Q: How should employees report payroll discrepancies?

A: Employees should be encouraged to report any payroll discrepancies or concerns to HR or payroll personnel. The policy should outline the process for resolving issues in a timely and fair manner.

Q: How often should businesses review their payroll and compensation policy?

A: Businesses should review the policy regularly, at least annually, to ensure it remains aligned with legal requirements, industry standards, and the company’s evolving compensation strategy.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.