Petty cash policy (Alabama): Free template

Petty cash policy (Alabama)

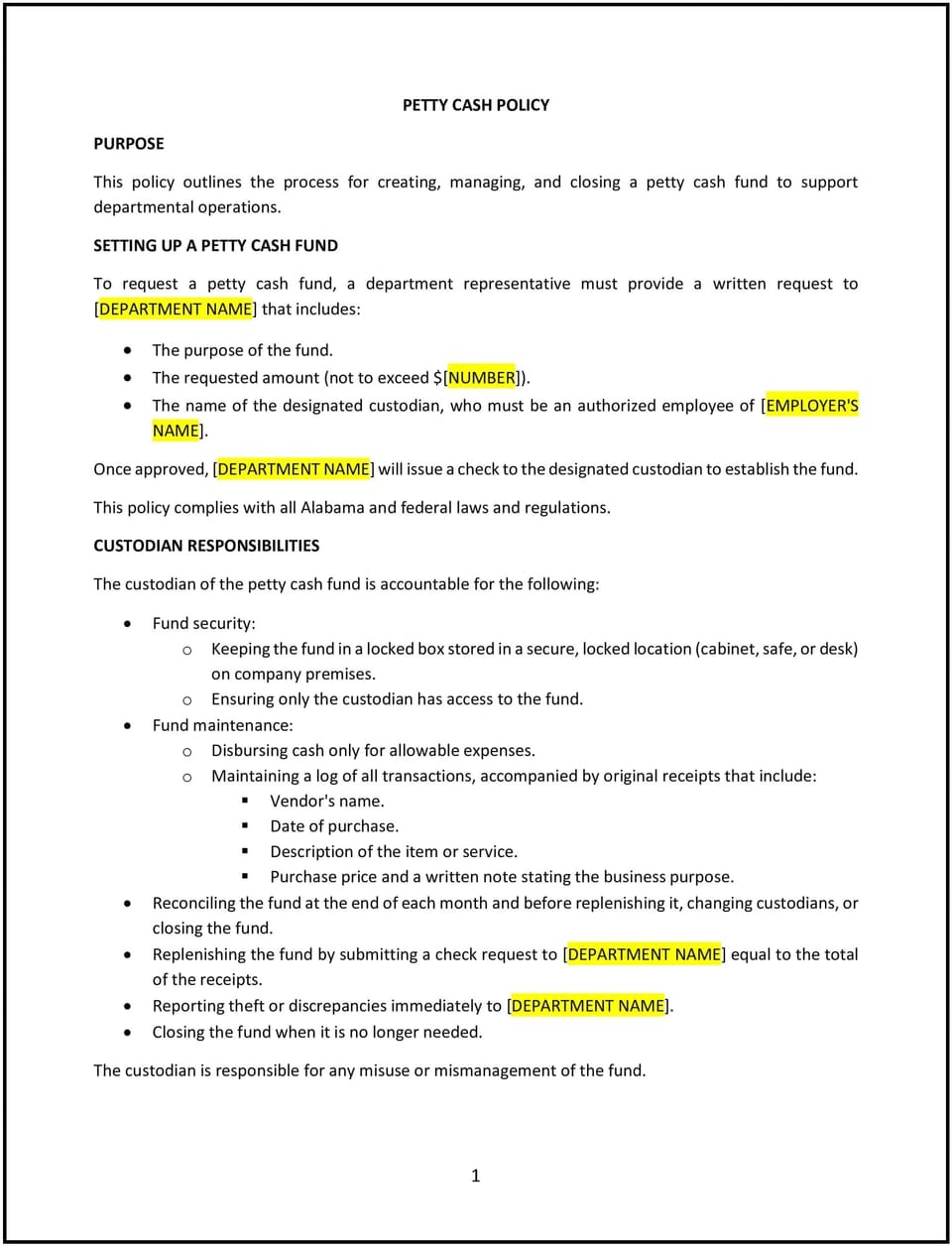

A petty cash policy provides guidelines for managing and using small amounts of cash for minor business expenses. For SMBs in Alabama, this policy ensures accountability, proper documentation, and compliance with financial practices, reducing the risk of misuse or discrepancies.

This policy outlines procedures for setting up, accessing, and reconciling petty cash funds, helping businesses streamline minor transactions while maintaining control over expenditures.

How to use this petty cash policy (Alabama)

- Define petty cash use: Specify the types of expenses that qualify for petty cash reimbursement, such as office supplies, parking fees, or small team refreshments.

- Establish fund limits: Set a maximum amount for petty cash, ensuring it remains manageable and appropriate for minor expenses.

- Assign responsibility: Designate a custodian to manage the petty cash fund, including distribution, recordkeeping, and reconciliation.

- Require documentation: Include a process for employees to provide receipts and complete petty cash request forms for all transactions.

- Outline reconciliation procedures: Detail how and when the petty cash fund should be reviewed, replenished, and audited to ensure accuracy and accountability.

Benefits of using a petty cash policy (Alabama)

A petty cash policy simplifies small transactions while ensuring proper oversight. Here’s how it helps:

- Promotes accountability: Tracks and documents all petty cash usage to prevent errors or misuse.

- Improves efficiency: Provides a convenient way to handle minor expenses without requiring lengthy approval processes.

- Enhances transparency: Ensures clear documentation of expenditures, fostering trust in financial management.

- Reduces risk: Minimizes potential fraud or discrepancies by implementing proper controls and monitoring.

- Supports compliance: Aligns petty cash practices with Alabama and federal financial regulations.

Tips for implementing a petty cash policy (Alabama)

- Train custodians: Provide guidance to petty cash custodians on managing the fund responsibly and maintaining accurate records.

- Use petty cash forms: Require employees to complete standardized forms for all requests, including details of the expense and attached receipts.

- Set spending thresholds: Establish limits for individual transactions to prevent inappropriate use of the fund.

- Conduct regular audits: Schedule periodic reviews of the petty cash fund to reconcile balances and identify any discrepancies.

- Replenish funds systematically: Ensure a clear process for replenishing the fund when it reaches a specified minimum balance.

Q: What types of expenses can be paid using petty cash?

A: Petty cash is typically used for minor, one-time expenses such as small office supplies, local travel expenses, or emergency purchases.

Q: Who manages the petty cash fund?

A: A designated custodian, often an office manager or finance team member, is responsible for overseeing and reconciling the petty cash fund.

Q: Is there a limit to how much petty cash can be spent at once?

A: Yes, but it depends on the policy and company guidelines.

Q: What documentation is required for petty cash use?

A: Employees are often required to provide a completed petty cash form with detailed expense information and an original receipt.

Q: How often is a petty cash fund reconciled?

A: A petty cash fund is reconciled regularly, such as monthly or after a set number of transactions, to ensure accuracy and accountability.

Q: Can petty cash be used for personal expenses?

A: No, petty cash is strictly for business-related expenses and misuse may result in disciplinary action.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.