Petty cash policy (Alaska): Free template

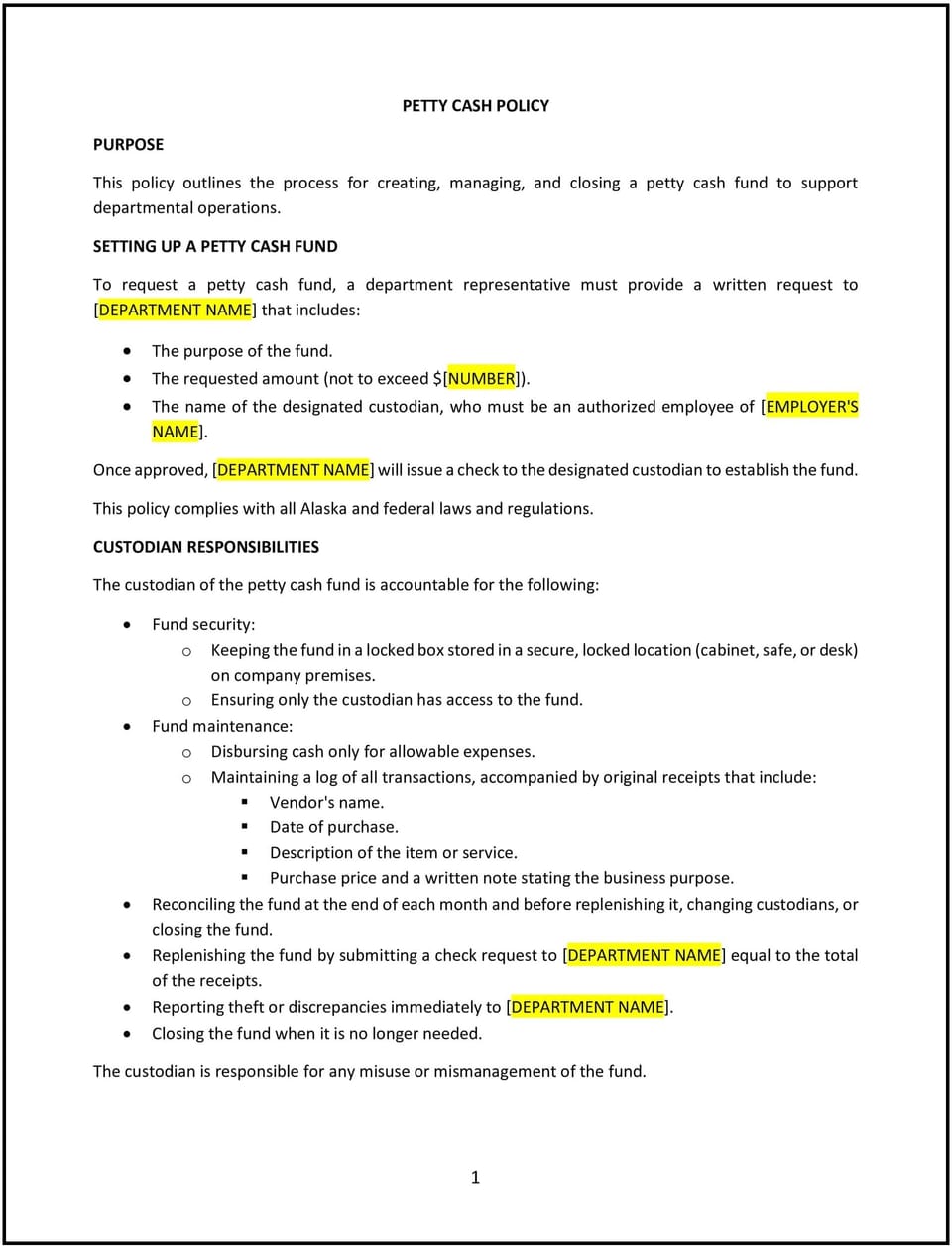

Petty cash policy (Alaska)

In Alaska, a petty cash policy outlines the guidelines for managing and using small amounts of cash kept on hand to cover minor business expenses. This policy ensures proper oversight and accountability, minimizing the risk of misuse or errors.

By implementing a petty cash policy, businesses can streamline small transactions while maintaining transparency and financial control.

How to use this petty cash policy (Alaska)

- Define petty cash usage: Specify the types of expenses petty cash can be used for, such as office supplies, parking fees, or small reimbursements.

- Set a cash limit: Establish a maximum amount of cash that can be kept in the petty cash fund at any time.

- Assign responsibilities: Designate a custodian responsible for managing, tracking, and replenishing the petty cash fund.

- Document transactions: Require receipts and detailed records for all petty cash expenditures to ensure accountability.

- Establish replenishment procedures: Include steps for replenishing the petty cash fund, such as submitting expense reports and reconciling the balance.

Benefits of using a petty cash policy (Alaska)

A petty cash policy provides several advantages for businesses in Alaska. Here’s how it helps:

- Enhances accountability: Ensures all petty cash transactions are documented and monitored, reducing the risk of misuse.

- Promotes efficiency: Simplifies the process of handling minor expenses without the need for lengthy reimbursement procedures.

- Supports compliance: Provides a structured approach to managing petty cash, helping businesses adhere to financial best practices.

- Improves transparency: Clarifies how petty cash is used, tracked, and replenished, fostering trust among employees and management.

- Reduces errors: Minimizes discrepancies by implementing consistent record-keeping and reporting practices.

Tips for using a petty cash policy (Alaska)

- Tailor for business needs: Adjust cash limits and usage guidelines based on the size and nature of your business operations in Alaska.

- Secure the fund: Keep the petty cash fund in a locked drawer or safe and limit access to the designated custodian.

- Conduct audits: Perform regular audits to verify the balance and ensure all transactions are properly documented.

- Use digital tools: Consider implementing petty cash management software to track expenditures and streamline record-keeping.

- Update regularly: Revise the policy periodically to reflect changes in business needs or financial management practices.

Q: What types of expenses can petty cash be used for?

A: Petty cash is typically used for minor business expenses such as office supplies, parking fees, or small reimbursements, as outlined in the policy.

Q: How should businesses secure the petty cash fund?

A: The fund should be stored in a locked drawer or safe, with access limited to the designated petty cash custodian.

Q: What documentation is required for petty cash transactions?

A: Receipts and a detailed record of each transaction must be maintained to ensure accountability and proper tracking.

Q: How often should petty cash be replenished?

A: Replenishment should occur when the fund reaches a set minimum balance or as needed to maintain operational efficiency.

Q: How often should this policy be reviewed?

A: Review the policy annually or whenever changes occur in financial management practices or operational needs.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.