Petty cash policy (Arizona): Free template

Petty cash policy (Arizona)

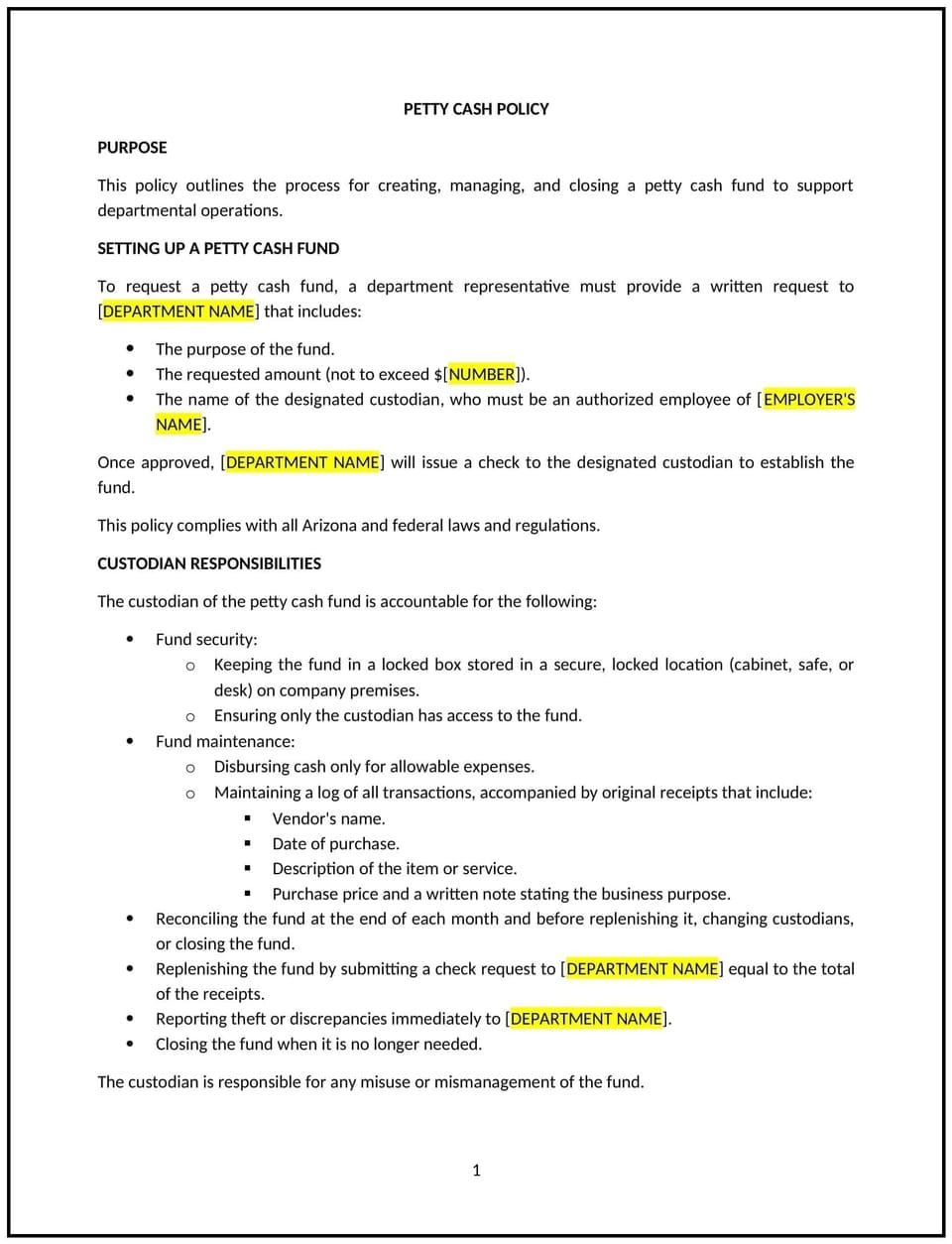

In Arizona, a petty cash policy provides businesses with clear guidelines for managing small cash expenditures that are not practical to process through regular accounts payable systems. This policy ensures transparency, accountability, and proper handling of minor expenses.

This policy outlines the procedures for requesting, approving, and disbursing petty cash, as well as the responsibilities for reconciliation and reporting. By implementing this policy, Arizona businesses can streamline small purchases while minimizing the risk of misuse or financial errors.

How to use this petty cash policy (Arizona)

- Define the petty cash fund: Specify the maximum amount of money allocated for petty cash and any restrictions on its use, such as for office supplies or travel expenses.

- Set approval procedures: Outline the process for requesting petty cash, including required documentation and managerial approval.

- Establish record-keeping requirements: Require detailed records of all petty cash transactions, including receipts and the purpose of each expense.

- Reconciliation procedures: Specify how often petty cash should be reconciled and who is responsible for ensuring the fund is balanced and accounted for.

- Define security measures: Ensure petty cash is stored securely and that only authorized employees have access to the fund.

Benefits of using a petty cash policy (Arizona)

This policy offers several advantages for Arizona businesses:

- Increases efficiency: Streamlines small purchases and eliminates the need for processing minor expenses through more complex systems.

- Enhances accountability: Requires detailed records and approval processes to ensure funds are used appropriately.

- Prevents misuse: Clearly outlines who can access petty cash and the types of expenses allowed, reducing the risk of fraud or unauthorized use.

- Supports compliance: Ensures proper record-keeping and reconciliation, reducing the risk of errors or non-compliance with financial regulations.

- Improves financial control: Provides businesses with a clear framework for managing small expenses within budget limits.

Tips for using a petty cash policy (Arizona)

- Address Arizona-specific considerations: Reflect any state-specific regulations regarding record-keeping or business practices that may affect petty cash usage.

- Keep records organized: Maintain a ledger to track petty cash transactions and ensure all receipts are properly documented.

- Conduct regular audits: Perform periodic audits of the petty cash fund to ensure proper use and reconcile any discrepancies.

- Set clear limits: Establish clear limits for the amount of petty cash available for specific purposes, ensuring it is not used for large purchases.

- Review periodically: Update the policy as business needs change, ensuring it remains relevant and effective.

Q: What types of expenses can be paid using petty cash?

A: Petty cash can be used for small, incidental expenses such as office supplies, postage, or minor travel expenses that are not practical to process through regular accounts payable.

Q: How is petty cash tracked and recorded?

A: All petty cash transactions must be documented with receipts, including the date, purpose, and amount spent. A petty cash ledger should be used to maintain a detailed record of all disbursements.

Q: Who is authorized to access petty cash?

A: Only designated employees, such as a finance manager or office administrator, should have access to petty cash, ensuring proper oversight and security.

Q: How often should petty cash be reconciled?

A: Petty cash should be reconciled on a regular basis, typically monthly, to ensure the fund is accurate and that all expenses are accounted for.

Q: How does this policy support compliance with Arizona laws?

A: The policy ensures proper record-keeping, accountability, and financial control, aligning with Arizona's financial regulations and best practices for managing business expenses.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.