Petty cash policy (Arkansas) Free template

Petty cash policy (Arkansas)

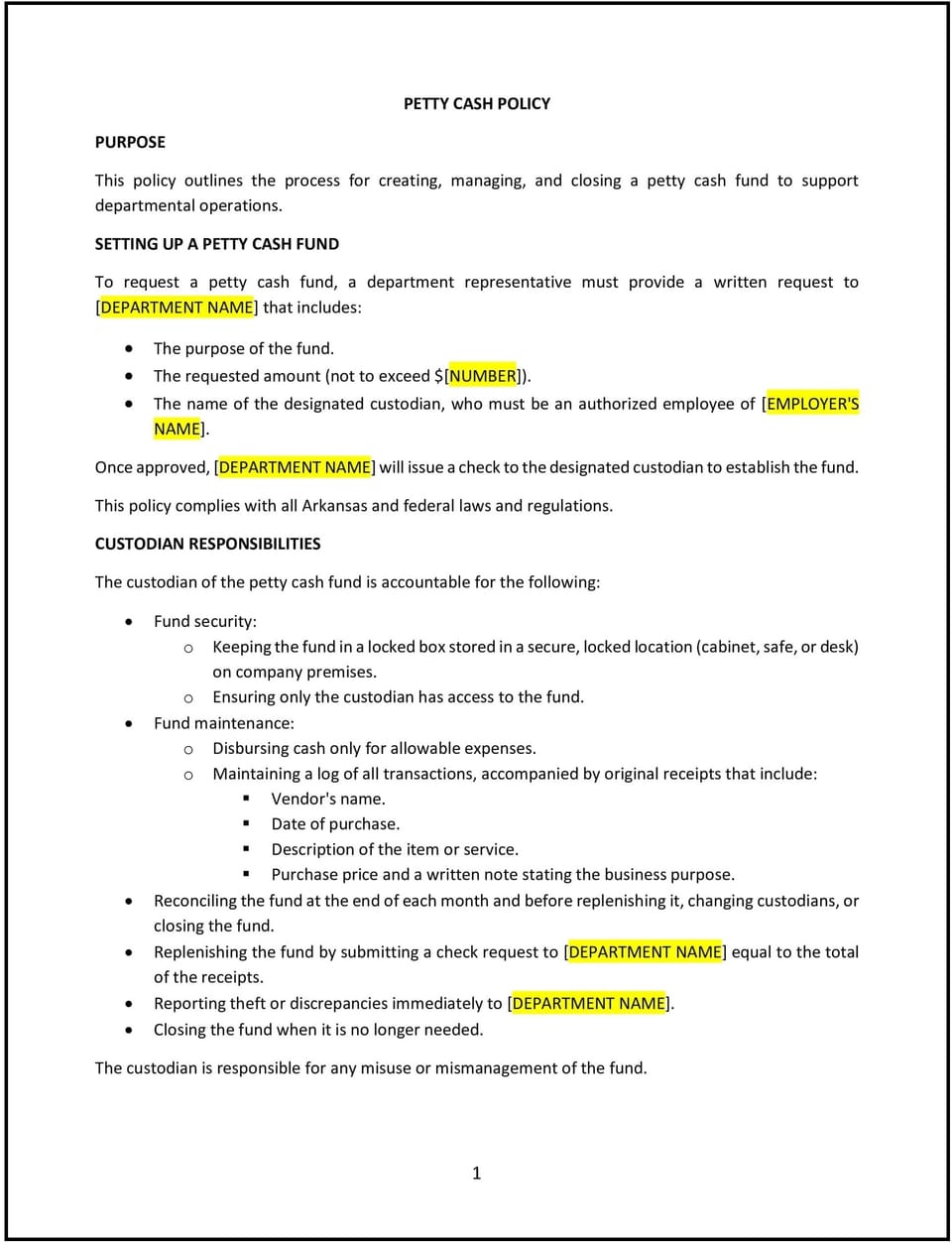

In Arkansas, a petty cash policy provides businesses with guidelines for managing small, day-to-day expenses through a petty cash fund. This policy ensures proper handling, accountability, and security of petty cash transactions, minimizing financial risks and supporting compliance with recordkeeping requirements.

This policy outlines the purpose of petty cash, authorized uses, and procedures for accessing, replenishing, and auditing the fund. By implementing this policy, Arkansas businesses can manage petty cash effectively while maintaining transparency and control.

How to use this petty cash policy (Arkansas)

- Define fund usage: Clearly specify allowable expenses, such as office supplies or minor travel costs, and prohibit unauthorized uses.

- Establish fund limits: Set a maximum amount for the petty cash fund to ensure financial control and prevent misuse.

- Outline access procedures: Identify employees authorized to access petty cash and the process for requesting funds.

- Maintain accurate records: Require detailed documentation for all petty cash transactions, including receipts and expense logs.

- Conduct regular audits: Schedule periodic reviews of petty cash usage to ensure accountability and detect discrepancies.

Benefits of using this petty cash policy (Arkansas)

This policy offers several advantages for Arkansas businesses:

- Promotes financial accountability: Ensures proper documentation and oversight of petty cash transactions.

- Supports compliance: Aligns with Arkansas-specific financial recordkeeping requirements and federal regulations for small business expenses.

- Reduces misuse: Establishes clear guidelines and controls to prevent unauthorized or fraudulent use of petty cash.

- Simplifies expense management: Provides a streamlined process for handling small, routine expenses efficiently.

- Enhances transparency: Maintains clear records of petty cash usage, building trust and accountability within the business.

Tips for using this petty cash policy (Arkansas)

- Address Arkansas-specific considerations: Include any state-level requirements for maintaining financial records or handling cash transactions.

- Train employees: Educate authorized personnel on proper petty cash handling and documentation procedures.

- Use secure storage: Keep petty cash in a locked box or safe to prevent theft or unauthorized access.

- Review spending limits: Periodically assess the fund's maximum amount to ensure it aligns with the business’s current needs.

- Update regularly: Revise the policy to reflect changes in business practices, expenses, or financial regulations.

Q: How does this policy benefit the business?

A: This policy ensures the proper management of petty cash, reduces risks of misuse, and supports compliance with financial recordkeeping regulations.

Q: What types of expenses can petty cash be used for?

A: Petty cash can be used for small, routine expenses such as office supplies, postage, or minor travel costs, as outlined in the policy.

Q: How does this policy support compliance with Arkansas regulations?

A: The policy incorporates best practices for financial accountability and aligns with state and federal requirements for maintaining accurate expense records.

Q: What steps should the business take to secure petty cash?

A: The business should store petty cash in a locked, secure location, restrict access to authorized personnel, and conduct regular audits to ensure proper usage.

Q: How can the business maintain accurate records of petty cash usage?

A: The business should require receipts for all transactions, maintain an expense log, and reconcile the fund regularly to ensure transparency and accountability.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.