Petty cash policy (California): Free template

Petty cash policy (California)

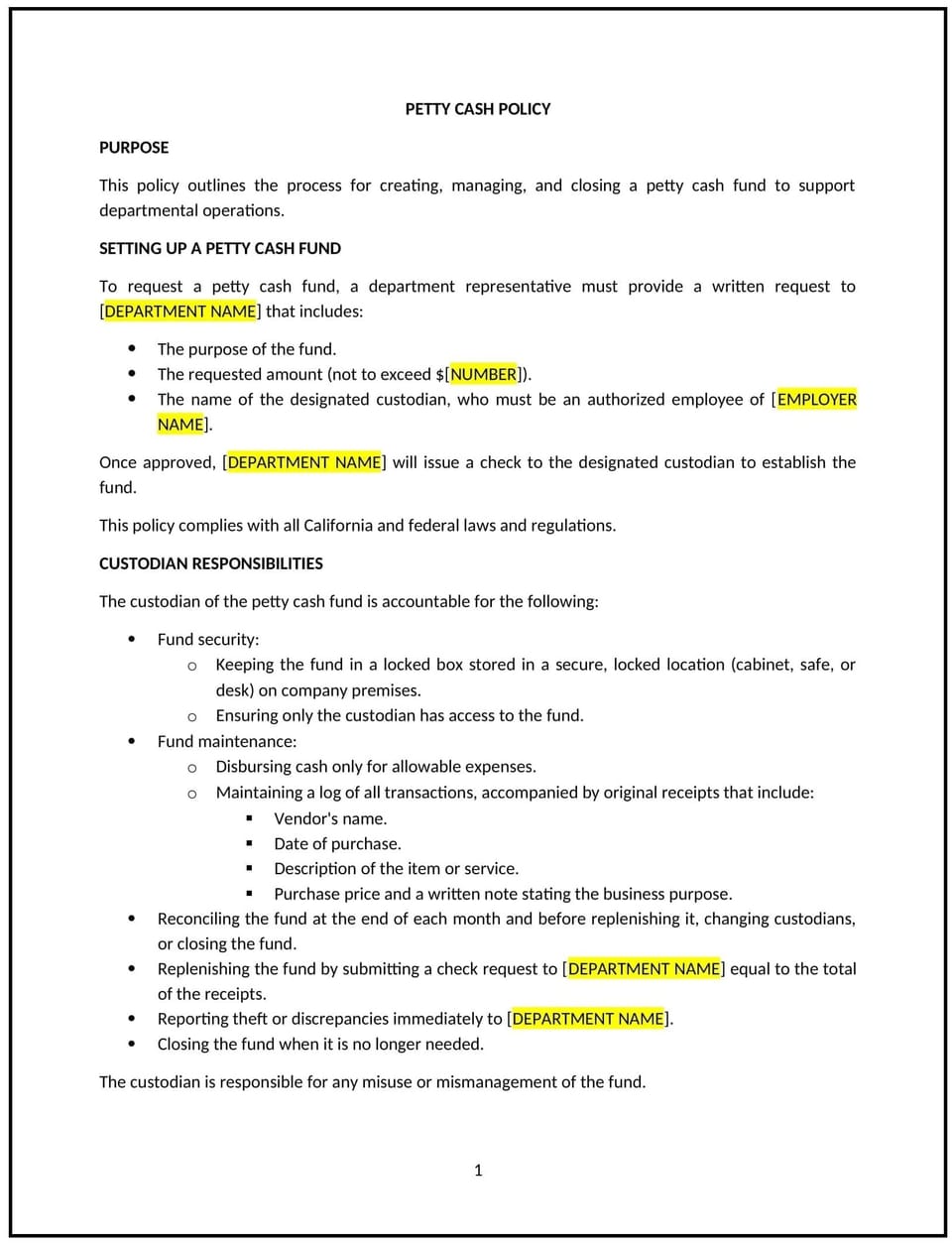

In California, a petty cash policy provides businesses with guidelines for managing small cash transactions, such as purchasing office supplies or reimbursing minor expenses. This policy ensures proper usage, accountability, and compliance with California laws governing financial management and recordkeeping.

This policy outlines procedures for establishing petty cash funds, authorizing transactions, and maintaining accurate records. By implementing this policy, California businesses can streamline small purchases while minimizing financial risks.

How to use this petty cash policy (California)

- Define fund purpose: Specify the types of expenses petty cash may be used for, such as small, immediate purchases necessary for business operations.

- Assign responsibilities: Identify individuals authorized to manage and access the petty cash fund, ensuring accountability.

- Set fund limits: Establish maximum limits for individual transactions and the total fund amount to control spending.

- Require documentation: Implement procedures for recording all petty cash transactions, including receipts and expense details.

- Conduct audits: Regularly review and reconcile the petty cash fund to ensure proper usage and prevent misuse.

Benefits of using this petty cash policy (California)

This policy offers several advantages for California businesses:

- Supports compliance: Reflects California recordkeeping laws, ensuring proper documentation of financial transactions.

- Promotes accountability: Clarifies roles and responsibilities for managing petty cash funds.

- Enhances efficiency: Streamlines the process for handling minor expenses without requiring complex approval workflows.

- Reduces risks: Minimizes the potential for misuse or mismanagement of petty cash funds.

- Improves transparency: Provides clear guidelines for all employees on how petty cash may be used and managed.

Tips for using this petty cash policy (California)

- Reflect California-specific laws: Ensure compliance with state recordkeeping requirements for financial transactions.

- Train employees: Provide guidance to employees on proper petty cash usage and documentation procedures.

- Limit access: Restrict petty cash handling to authorized personnel to prevent unauthorized use.

- Use secure storage: Keep petty cash funds in a locked, secure location accessible only to designated individuals.

- Review regularly: Update the policy as needed to reflect changes in California laws or business practices.

Q: How does this policy benefit the business?

A: This policy supports compliance with California laws, promotes accountability in managing petty cash, and ensures efficient handling of minor expenses.

Q: What types of expenses can petty cash be used for?

A: Petty cash can be used for small, immediate purchases, such as office supplies, parking fees, or minor repairs, as defined in the policy.

Q: How does this policy support compliance with California laws?

A: The policy reflects state recordkeeping requirements, ensuring proper documentation of all petty cash transactions.

Q: What steps should employees take to request petty cash?

A: Employees should submit a request to the petty cash custodian, provide a description of the expense, and retain receipts for reimbursement.

Q: How can the business prevent misuse of petty cash funds?

A: The business can limit access, set transaction limits, require documentation for all expenses, and conduct regular audits to ensure proper use.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.