Petty cash policy (Connecticut): Free template

Petty cash policy (Connecticut)

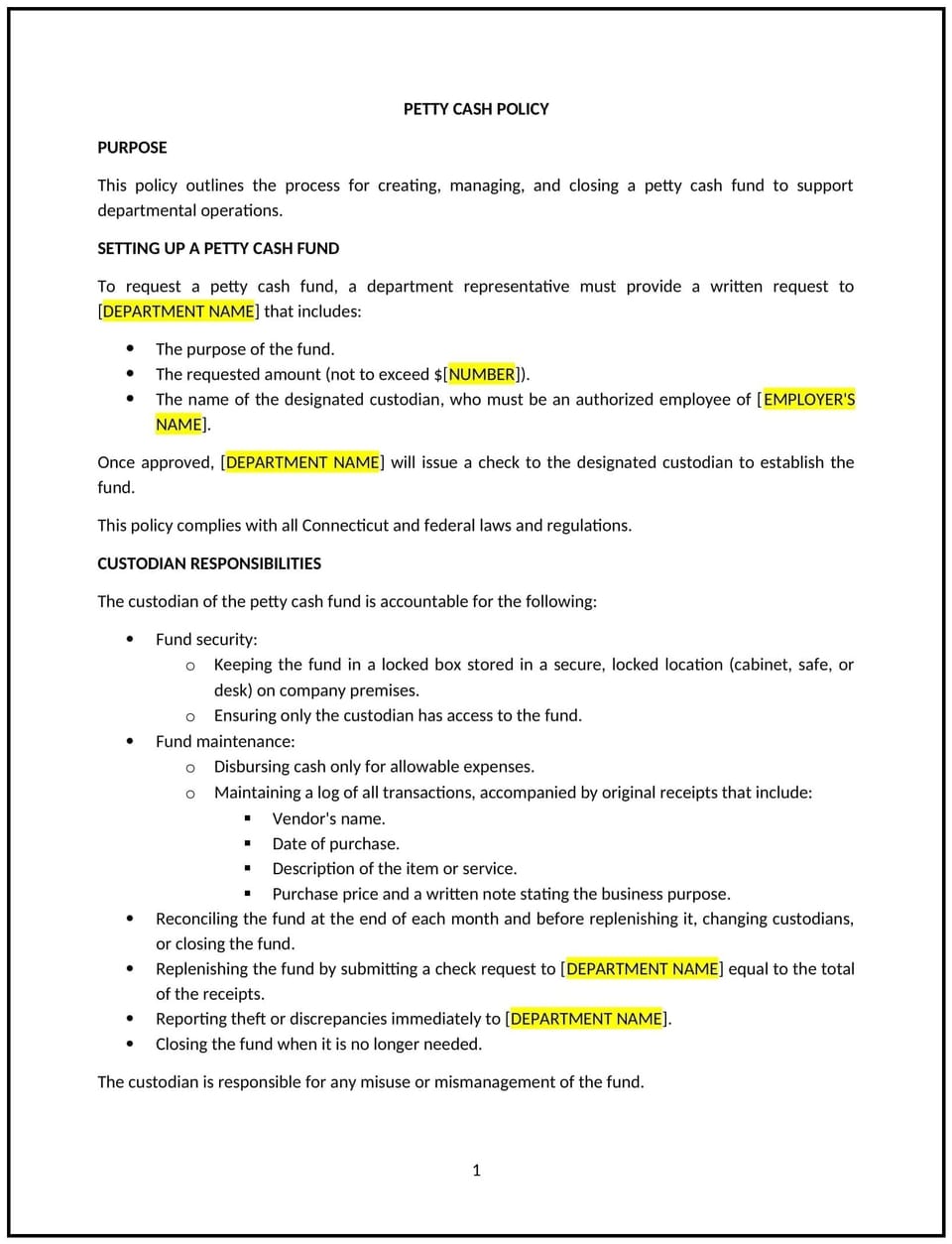

A petty cash policy helps Connecticut businesses manage small, day-to-day expenses that are not practical to process through formal procurement or accounts payable systems. This policy outlines how petty cash should be handled, including the procedures for requesting, disbursing, and replenishing petty cash funds, as well as how to track and document expenditures.

By implementing this policy, businesses can ensure the responsible use of petty cash, maintain accurate records, and prevent misuse of funds, while maintaining efficiency for minor business expenses.

How to use this petty cash policy (Connecticut)

- Define petty cash usage: Specify the types of expenses that can be paid with petty cash, such as office supplies, minor repairs, or transportation costs, and exclude large or routine purchases that should be processed through formal accounts payable channels.

- Establish a petty cash fund: Set the maximum amount of petty cash the company will maintain at any given time, ensuring it is sufficient to cover small expenses while avoiding excessive fund amounts.

- Assign responsibility: Appoint a petty cash custodian who is responsible for overseeing the fund, including disbursing cash, maintaining accurate records, and ensuring proper documentation for each transaction.

- Set disbursement guidelines: Specify the process for requesting and disbursing petty cash, including who is authorized to request funds, how requests should be documented, and the approval process for disbursement.

- Maintain proper documentation: Ensure that every petty cash transaction is documented with receipts or vouchers, and require employees to submit a detailed explanation of the expense along with supporting documentation.

- Replenishment and reconciliation: Define the process for replenishing the petty cash fund, including how often the fund should be reviewed, how funds will be replenished, and the reconciliation procedure to ensure the balance is accurate.

- Monitor and audit: Establish periodic audits of the petty cash fund to ensure that it is being used appropriately and that all transactions are properly documented and accounted for.

Benefits of using this petty cash policy (Connecticut)

This policy offers several benefits for Connecticut businesses:

- Prevents misuse: By setting clear guidelines and tracking petty cash use, businesses can reduce the risk of misuse or theft of company funds.

- Improves financial control: Provides a clear framework for managing minor expenses and ensures that funds are used appropriately and in compliance with company policy.

- Increases efficiency: Allows for a quick and efficient way to handle small, incidental expenses without bogging down formal financial processes, while still maintaining control.

- Promotes transparency: Ensures that all petty cash transactions are documented, providing transparency and accountability in how business funds are spent.

- Enhances compliance: Helps businesses comply with financial management best practices and relevant state or federal regulations, particularly around expense reporting and auditing.

Tips for using this petty cash policy (Connecticut)

- Communicate the policy clearly: Ensure all employees understand the guidelines for using petty cash, including what is and is not permissible, and the process for requesting and documenting expenses.

- Assign clear responsibilities: Designate a petty cash custodian who will manage the fund, approve requests, and ensure proper record-keeping.

- Set clear transaction limits: Establish reasonable limits for individual petty cash disbursements to avoid large or unapproved transactions.

- Maintain accurate records: Ensure that every petty cash transaction is documented with appropriate receipts or vouchers, and regularly review these records to ensure accuracy.

- Review periodically: Conduct periodic reviews and audits of the petty cash fund to ensure proper use, adequate documentation, and compliance with company policies.

Q: How does this policy benefit my business?

A: The policy ensures responsible management of petty cash, reduces the risk of misuse, and maintains financial control over small business expenses, making it easier to track and report expenditures.

Q: What types of expenses are allowed to be paid with petty cash?

A: Petty cash can be used for minor, day-to-day expenses that do not warrant the use of formal accounts payable processes, such as office supplies, transportation, or small repairs. Large or regular purchases should be handled through other payment methods.

Q: How is petty cash replenished?

A: The petty cash fund is replenished once the amount has been used, typically after submitting receipts and documentation for expenses. The policy should specify the process for requesting and replenishing the fund.

Q: Who is responsible for managing the petty cash fund?

A: A designated petty cash custodian is responsible for managing the fund, overseeing disbursements, ensuring proper documentation, and reconciling the fund regularly.

Q: How often should this policy be reviewed?

A: The policy should be reviewed annually or whenever there are changes in financial regulations or business practices to ensure it remains effective and compliant with state and federal guidelines.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.