Petty cash policy (Delaware): Free template

Petty cash policy (Delaware)

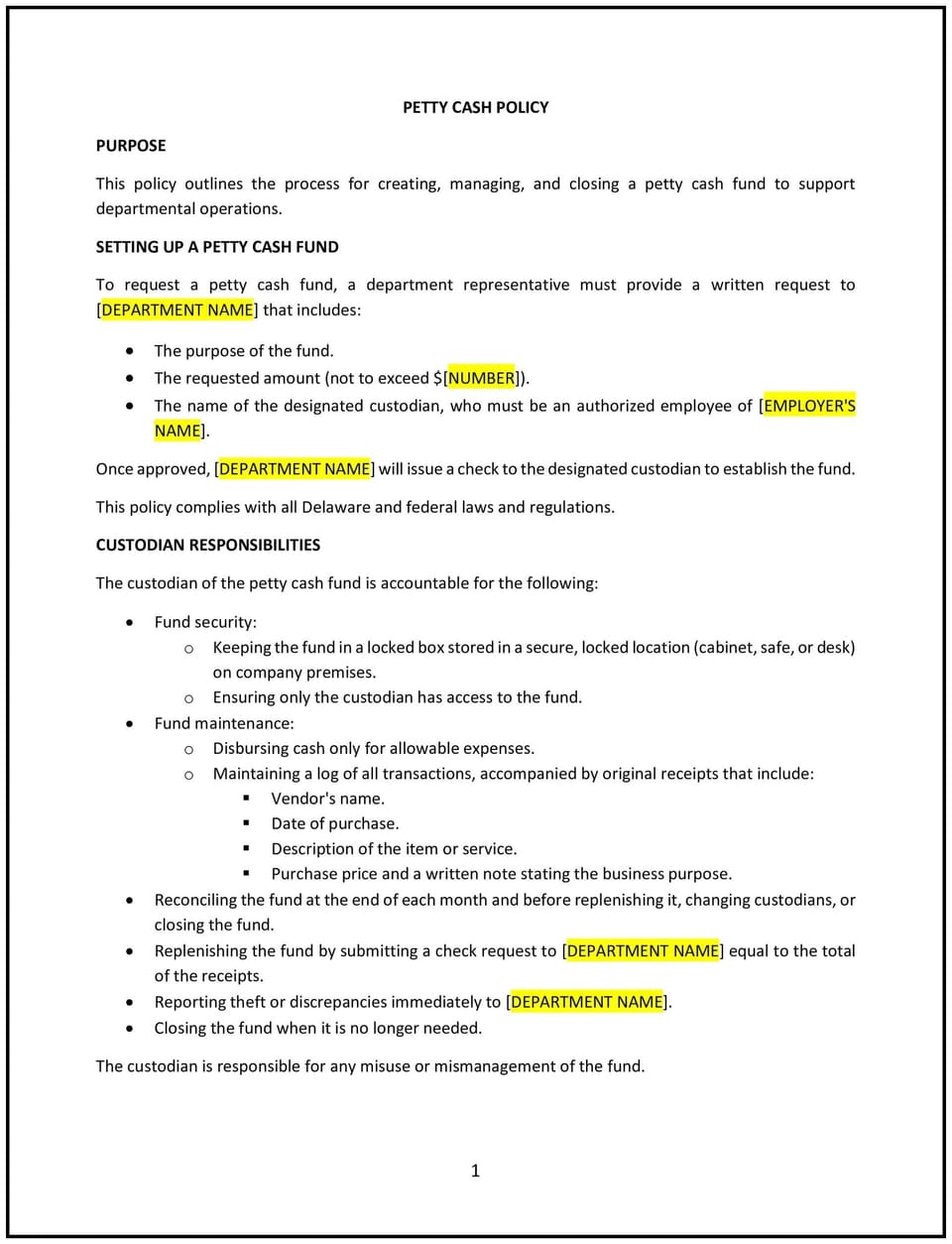

A petty cash policy helps Delaware businesses manage small, day-to-day cash expenses efficiently while maintaining proper oversight and accountability. This policy outlines procedures for establishing, accessing, and reconciling petty cash funds to prevent misuse and ensure accurate recordkeeping.

By implementing this policy, businesses can streamline minor expense management while safeguarding financial integrity and ensuring compliance with Delaware accounting practices.

How to use this petty cash policy (Delaware)

- Define allowable expenses: Specify what types of expenses can be reimbursed through petty cash, such as office supplies, minor repairs, or local travel costs.

- Establish fund limits: Set a maximum amount for the petty cash fund and individual transactions to maintain financial control.

- Designate custodians: Assign responsibility for managing petty cash to a designated custodian who oversees disbursements and recordkeeping.

- Require documentation: Mandate that receipts or vouchers are submitted for every transaction to ensure accountability and transparency.

- Reconcile regularly: Include procedures for periodic reconciliation of the petty cash fund to track expenses and identify discrepancies.

- Address replenishment: Outline the process for replenishing petty cash, including approval requirements and documentation submission.

Benefits of using this petty cash policy (Delaware)

This policy offers several benefits for Delaware businesses:

- Enhances accountability: Provides clear guidelines for managing and documenting petty cash transactions, reducing the risk of misuse.

- Simplifies expense management: Streamlines the handling of small, routine expenses without needing formal procurement processes.

- Ensures compliance: Aligns with Delaware accounting standards and best practices for financial management.

- Improves transparency: Promotes accurate recordkeeping and oversight, fostering trust and accountability.

- Reduces financial risks: Establishes controls to prevent overspending or fraudulent activity.

Tips for using this petty cash policy (Delaware)

- Communicate the policy clearly: Ensure employees understand the purpose, limits, and procedures for accessing petty cash.

- Train custodians: Provide training on proper recordkeeping, reconciliation, and reporting to maintain compliance with the policy.

- Use a tracking system: Implement a manual or digital ledger to document all petty cash transactions and reconcile the fund efficiently.

- Conduct audits: Schedule periodic audits to verify the accuracy of petty cash records and address discrepancies promptly.

- Review regularly: Update the policy to reflect changes in Delaware accounting practices, business needs, or internal controls.

Q: Why is a petty cash policy important for my business?

A: This policy ensures efficient management of small expenses, promotes accountability, and reduces the risk of misuse or errors in petty cash handling.

Q: What expenses are typically allowed under this policy?

A: Allowable expenses may include small office supplies, minor repairs, postage, or other routine business needs within the set limits.

Q: Who is responsible for managing the petty cash fund?

A: The policy designates a custodian responsible for disbursing funds, maintaining records, and reconciling the account regularly.

Q: How can my business prevent misuse of petty cash?

A: Require documentation for all transactions, set spending limits, conduct regular reconciliations, and perform periodic audits to maintain oversight.

Q: How often should this policy be reviewed?

A: This policy should be reviewed annually or whenever Delaware accounting regulations or company financial practices change to ensure continued compliance and effectiveness.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.