Petty cash policy (Georgia): Free template

Petty cash policy (Georgia)

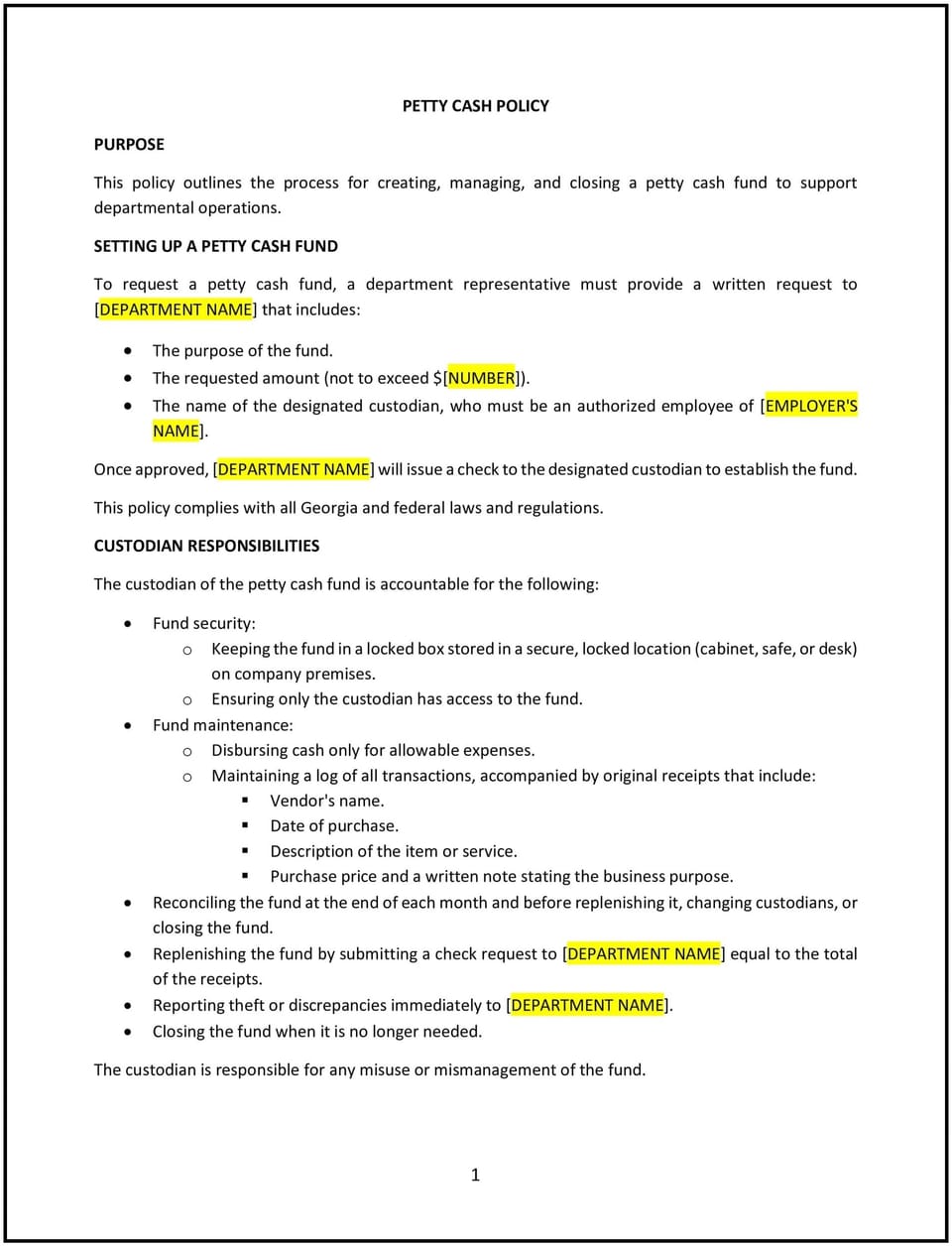

This petty cash policy is designed to help Georgia businesses manage small cash transactions effectively and securely. The policy outlines procedures for establishing, using, and reconciling petty cash funds to ensure accountability and minimize misuse.

By implementing this policy, businesses can streamline minor expenses, maintain accurate records, and support operational efficiency.

How to use this petty cash policy (Georgia)

- Establish a fund limit: Define the maximum amount of petty cash to be maintained at any given time, considering business needs.

- Appoint a custodian: Assign responsibility for managing the petty cash fund to a specific individual, such as an office manager or finance team member.

- Define allowable expenses: Clearly specify the types of expenses that can be covered by petty cash, such as office supplies or small travel reimbursements.

- Require receipts: Ensure that all petty cash transactions are documented with receipts and include a description of the expense.

- Implement withdrawal procedures: Outline the process for requesting petty cash, including approval requirements and documentation.

- Reconcile regularly: Conduct periodic reconciliations to verify that cash on hand matches transaction records and receipts.

- Address shortages or overages: Include steps for investigating and resolving discrepancies in the petty cash fund.

- Review and update regularly: Periodically assess the policy to reflect changes in Georgia-specific business practices or financial management standards.

Benefits of using this petty cash policy (Georgia)

Implementing this policy provides several advantages for Georgia businesses:

- Improves accountability: Clear procedures reduce the risk of errors or misuse of petty cash.

- Enhances efficiency: A dedicated petty cash fund streamlines small purchases and reduces administrative burdens.

- Supports transparency: Well-documented transactions promote trust and ensure accurate financial records.

- Reduces discrepancies: Regular reconciliations help identify and address potential issues promptly.

- Reflects Georgia-specific practices: Tailoring the policy to local business needs ensures its relevance and practicality.

Tips for using this petty cash policy (Georgia)

- Communicate guidelines: Ensure all employees understand the policy and the types of expenses eligible for petty cash.

- Secure the fund: Store petty cash in a locked and secure location accessible only to authorized personnel.

- Use standardized forms: Provide forms for documenting petty cash requests, approvals, and reconciliations.

- Limit cash handling: Restrict access to the petty cash fund to reduce the risk of theft or errors.

- Monitor usage trends: Regularly review petty cash expenses to identify patterns and adjust the fund limit if necessary.

Q: What is the purpose of a petty cash fund?

A: A petty cash fund is used to cover small, incidental expenses that are not practical to process through regular payment methods.

Q: Who is responsible for managing the petty cash fund?

A: A designated custodian, such as an office manager or finance team member, should oversee the fund and maintain accurate records.

Q: What types of expenses are allowable under this policy?

A: Allowable expenses typically include small purchases like office supplies, local travel costs, or minor repairs.

Q: How often should petty cash be reconciled?

A: Reconciliation should occur regularly, such as weekly or monthly, to ensure accuracy and accountability.

Q: What should businesses do if there is a discrepancy in the petty cash fund?

A: Discrepancies should be investigated promptly, with documentation of findings and steps taken to resolve the issue.

Q: Can employees access petty cash without prior approval?

A: No, employees should follow the established process for requesting and receiving petty cash, including obtaining necessary approvals.

Q: How often should this policy be reviewed?

A: The policy should be reviewed annually or as needed to reflect changes in Georgia business practices or financial management standards.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.