Petty cash policy (Hawaiʻi): Free template

Petty cash policy (Hawaiʻi)

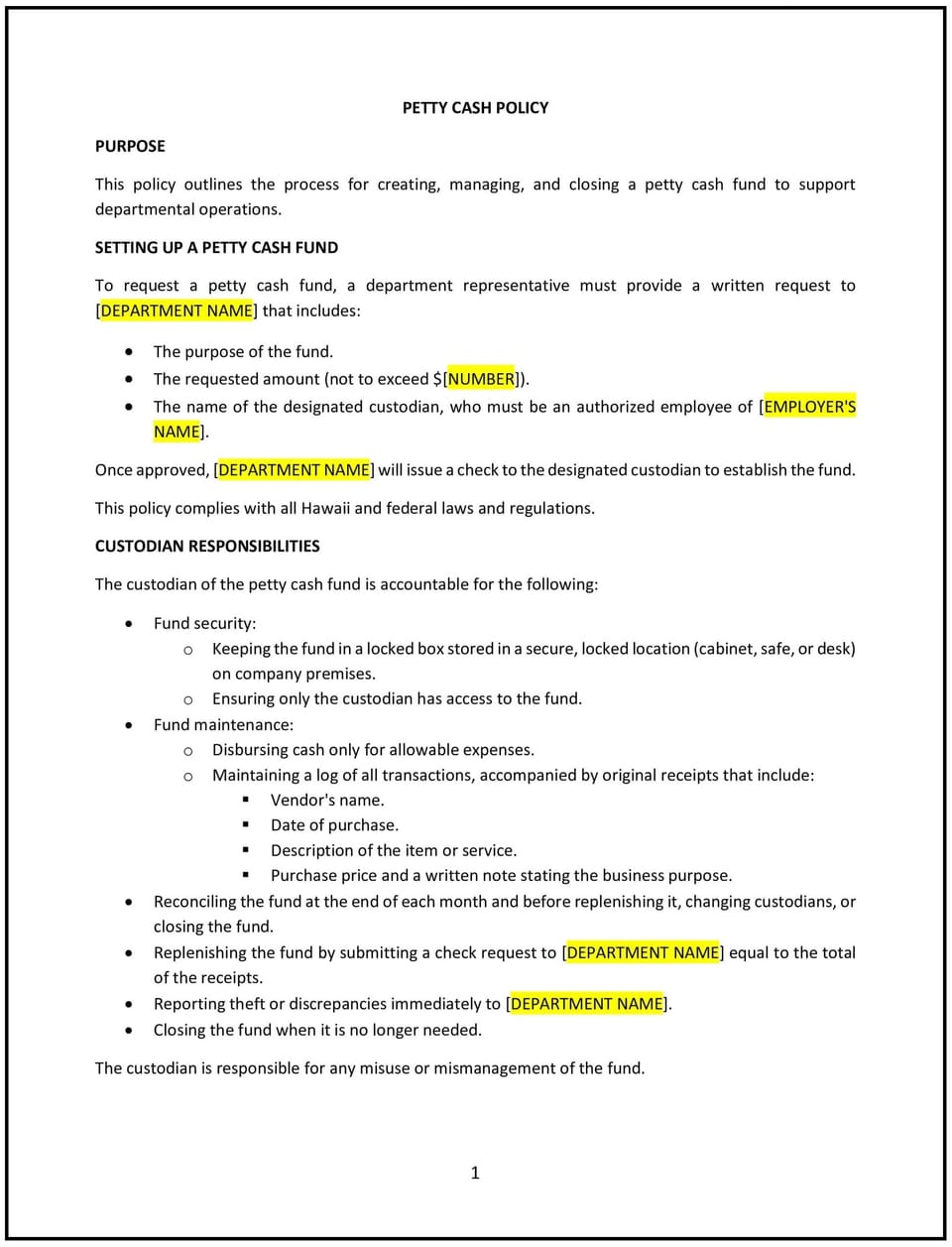

A petty cash policy helps Hawaiʻi businesses establish clear guidelines for managing small, routine expenses that arise during daily operations. This policy outlines procedures for setting up, using, replenishing, and safeguarding petty cash funds, while addressing Hawaiʻi’s unique business environment. It is designed to promote accountability, transparency, and efficient financial management.

By implementing this policy, businesses in Hawaiʻi can streamline expense tracking, reduce the risk of misuse, and maintain accurate financial records.

How to use this petty cash policy (Hawaiʻi)

- Define petty cash: Clearly explain what petty cash is and its purpose, such as covering small, incidental expenses like office supplies or minor repairs.

- Establish a petty cash fund: Specify the amount of money allocated to the petty cash fund and the process for setting it up.

- Assign responsibility: Designate a custodian to manage the petty cash fund and outline their duties, such as disbursing funds and maintaining records.

- Set spending limits: Define the maximum amount that can be disbursed for a single transaction and the types of expenses eligible for petty cash.

- Require documentation: Outline the process for documenting petty cash transactions, including receipts and log entries.

- Replenish the fund: Describe the procedure for replenishing the petty cash fund when it runs low, including approval processes and record-keeping.

- Conduct regular audits: Schedule periodic reviews of the petty cash fund to ensure accuracy and identify any discrepancies.

- Communicate the policy: Share the policy with relevant staff and provide training on its procedures to ensure proper implementation.

- Review and update the policy: Regularly assess the policy’s effectiveness and make adjustments as needed to reflect changes in business needs or financial practices.

Benefits of using this petty cash policy (Hawaiʻi)

This policy offers several advantages for Hawaiʻi businesses:

- Promotes accountability: Clear guidelines help prevent misuse of petty cash and ensure funds are used appropriately.

- Simplifies expense tracking: Structured procedures for documenting transactions make it easier to track and reconcile petty cash expenses.

- Enhances transparency: Employees understand how petty cash funds are managed, fostering trust and accountability.

- Reduces risk: Proper safeguards and regular audits minimize the risk of errors, theft, or mismanagement.

- Improves efficiency: Streamlined processes for disbursing and replenishing petty cash save time and reduce administrative burdens.

- Supports financial accuracy: Accurate record-keeping ensures petty cash transactions are properly reflected in financial statements.

- Builds trust: A clear and transparent policy demonstrates the business’s commitment to responsible financial management.

Tips for using this petty cash policy (Hawaiʻi)

- Communicate the policy effectively: Share the policy with relevant staff and provide training on its procedures to ensure proper implementation.

- Use a secure location: Store petty cash in a locked box or drawer to prevent unauthorized access.

- Maintain detailed records: Keep accurate logs of all transactions, including receipts and supporting documentation.

- Conduct regular audits: Schedule periodic reviews of the petty cash fund to ensure accuracy and identify any discrepancies.

- Be transparent: Clearly explain the policy’s purpose, benefits, and expectations to employees to build trust and cooperation.

- Review the policy periodically: Update the policy as needed to reflect changes in business needs or financial practices.

Q: Why should Hawaiʻi businesses adopt a petty cash policy?

A: Businesses should adopt this policy to promote accountability, streamline expense tracking, and reduce the risk of misuse or errors in managing petty cash.

Q: What types of expenses are suitable for petty cash?

A: Petty cash should be used for small, routine expenses, such as office supplies, minor repairs, or postage. Larger or recurring expenses should be handled through other financial processes.

Q: How much money should businesses allocate to a petty cash fund?

A: The amount should be based on the business’s needs and the frequency of small expenses. Businesses should start with a modest amount and adjust as necessary.

Q: Who should manage the petty cash fund?

A: Businesses should designate a custodian, such as an office manager or administrative staff member, to oversee the petty cash fund and ensure proper documentation.

Q: How often should businesses replenish the petty cash fund?

A: Businesses should replenish the fund when it runs low or reaches a predetermined threshold, ensuring sufficient funds are available for ongoing needs.

Q: What documentation is required for petty cash transactions?

A: Businesses should require receipts for all transactions and maintain a log detailing the date, amount, purpose, and recipient of each disbursement.

Q: How often should businesses audit the petty cash fund?

A: Businesses should conduct regular audits, such as monthly or quarterly, to ensure accuracy and identify any discrepancies.

Q: What should businesses do if discrepancies are found during an audit?

A: Businesses should investigate discrepancies promptly, address any issues, and update procedures as needed to prevent future occurrences.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.