Petty cash policy (Illinois): Free template

Petty cash policy (Illinois)

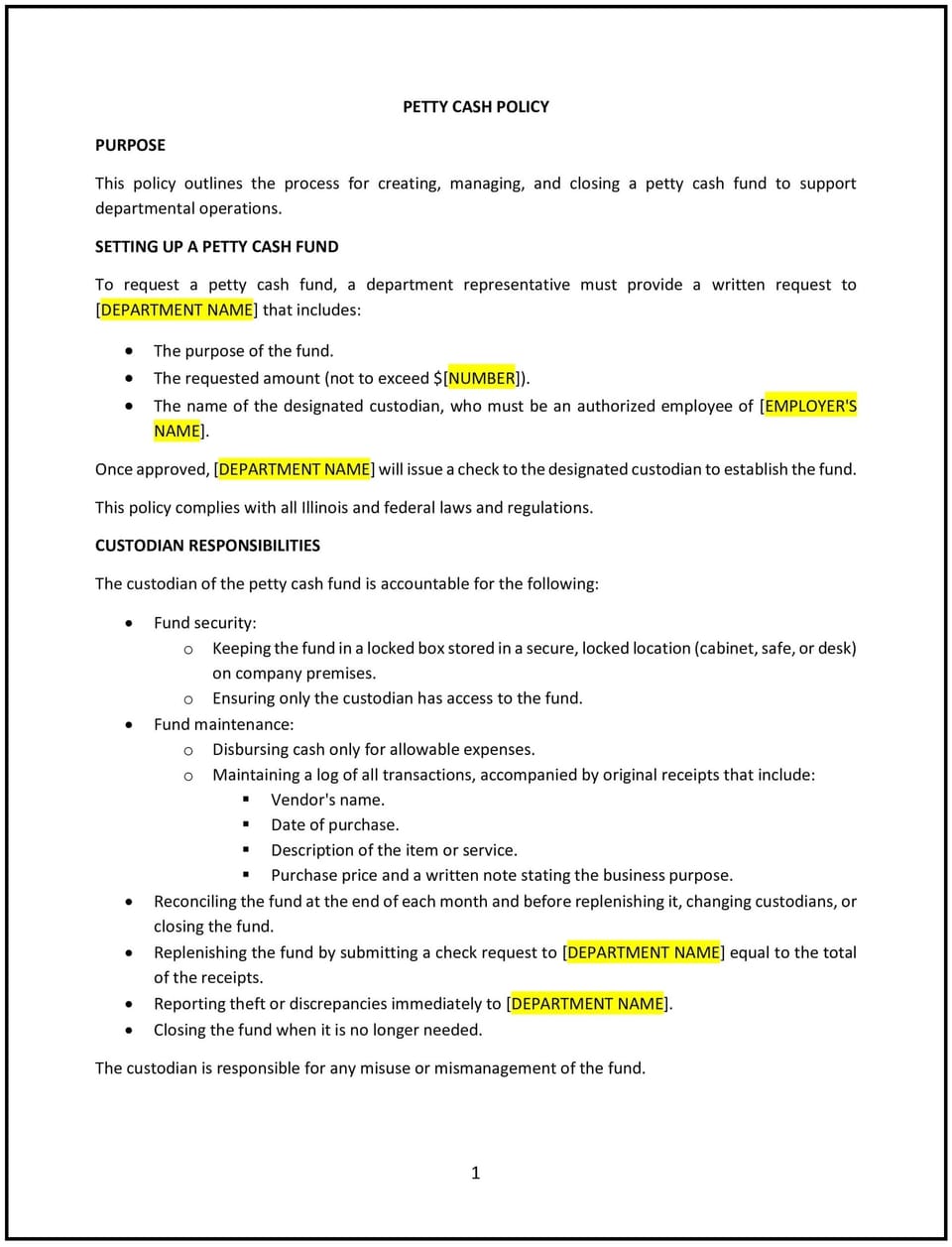

This petty cash policy is designed to help Illinois businesses manage small, incidental expenses effectively. It outlines procedures for establishing, using, and reconciling petty cash funds while promoting compliance with Illinois accounting and tax regulations.

By adopting this policy, businesses can maintain accurate records, reduce misuse, and streamline the handling of minor expenses.

How to use this petty cash policy (Illinois)

- Define petty cash use: Specify the types of expenses that petty cash can cover, such as office supplies, minor repairs, or staff reimbursements for small purchases.

- Establish fund limits: Set a maximum limit for the petty cash fund and individual transactions to prevent misuse.

- Assign responsibility: Designate a custodian to manage the petty cash fund, including issuing cash and maintaining records.

- Outline requisition procedures: Require employees to submit a request, including the purpose and estimated amount, before receiving petty cash.

- Include reconciliation guidelines: Detail procedures for reconciling the petty cash fund regularly, such as matching receipts to disbursed amounts and verifying balances.

- Address documentation requirements: Require employees to provide receipts or proof of purchase for all petty cash transactions.

- Prohibit misuse: Emphasize that petty cash should not be used for personal expenses or non-business-related purposes.

- Monitor compliance: Conduct periodic audits to ensure proper management and alignment with company policies.

Benefits of using this petty cash policy (Illinois)

This policy provides several benefits for Illinois businesses:

- Enhances accountability: Establishes clear guidelines for managing and using petty cash funds.

- Improves recordkeeping: Ensures accurate documentation of all transactions for auditing and tax purposes.

- Reduces misuse: Mitigates risks of fraud or inappropriate use of petty cash.

- Streamlines expenses: Simplifies the handling of minor, day-to-day business expenses.

- Strengthens compliance: Aligns with Illinois accounting and financial reporting regulations.

Tips for using this petty cash policy (Illinois)

- Communicate the policy: Share the policy with employees and ensure it is included in the employee handbook.

- Train custodians: Provide training to custodians on managing petty cash, tracking expenses, and conducting reconciliations.

- Limit access: Restrict access to petty cash funds to authorized personnel only.

- Automate tracking: Use software or tools to maintain digital records of petty cash transactions and reconciliations.

- Update regularly: Revise the policy to reflect changes in Illinois laws or company financial practices.

Q: What types of expenses are covered under this policy?

A: Petty cash can be used for minor business-related expenses, such as office supplies, small repairs, or staff reimbursements for incidental purchases.

Q: How much can employees request from petty cash?

A: The maximum amount for petty cash transactions is determined by the company’s policy, typically capped at a specific dollar amount.

Q: Who is responsible for managing the petty cash fund?

A: A designated petty cash custodian is responsible for issuing funds, maintaining records, and reconciling the petty cash account.

Q: What documentation is required for petty cash transactions?

A: Employees must provide receipts or proof of purchase for all petty cash disbursements to ensure proper recordkeeping.

Q: How often should the petty cash fund be reconciled?

A: The fund should be reconciled regularly, such as weekly or monthly, depending on the volume of transactions.

Q: Can petty cash be used for personal expenses?

A: No, petty cash is strictly for business-related expenses and cannot be used for personal purposes.

Q: How are discrepancies in petty cash reconciliations handled?

A: Any discrepancies should be reported to the custodian and investigated promptly to ensure accuracy and compliance.

Q: How often is this policy reviewed?

A: This policy is reviewed annually or whenever significant changes occur in Illinois laws or company practices.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.