Petty cash policy (Indiana): Free template

Petty cash policy (Indiana): Free template

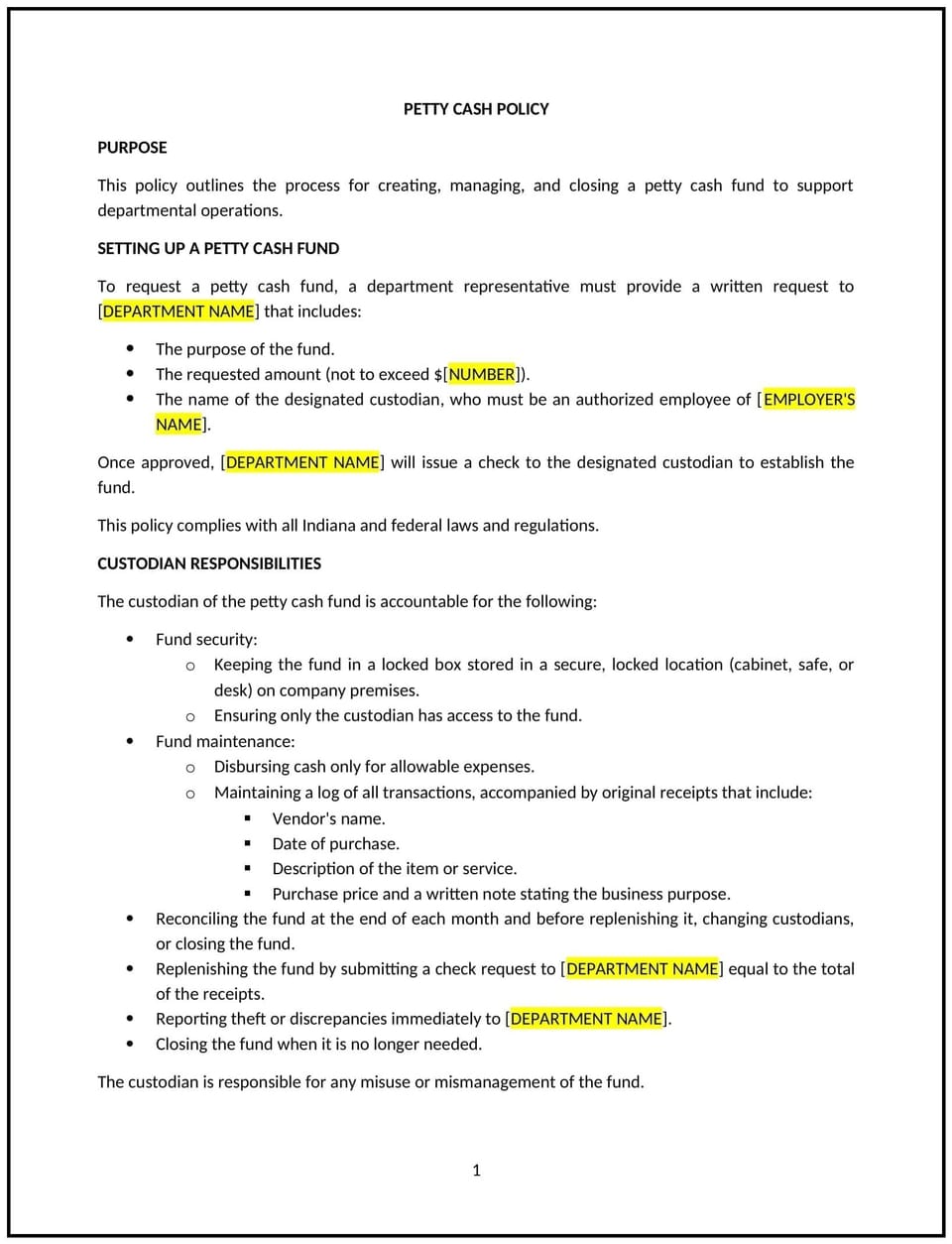

This petty cash policy helps Indiana businesses establish clear guidelines for managing small cash expenses, ensuring proper tracking, security, and accountability. It provides instructions for maintaining petty cash funds, documenting transactions, and reconciling balances to minimize misuse or discrepancies. Whether covering minor office supplies, travel expenses, or other small purchases, this template supports businesses in maintaining accurate records and efficient cash management.

By implementing this policy, Indiana businesses can streamline petty cash operations, reduce errors, and promote financial transparency.

How to use this petty cash policy (Indiana)

- Define petty cash usage: Clearly specify the types of expenses that petty cash can cover, such as office supplies, small repairs, or employee reimbursements under a certain amount. Outline any restrictions to prevent misuse.

- Set a petty cash fund limit: Establish a maximum amount for the petty cash fund and define when replenishment should occur, such as when the balance falls below a set threshold.

- Designate a custodian: Assign a responsible individual to oversee the petty cash fund, including approving transactions, recording expenses, and reconciling balances.

- Create a documentation process: Require all petty cash transactions to be accompanied by receipts or vouchers detailing the date, amount, purpose, and recipient of the expense.

- Implement reconciliation procedures: Schedule regular reconciliations of the petty cash fund, comparing the remaining balance with transaction records to ensure accuracy.

- Establish security measures: Specify how the petty cash fund should be stored, such as in a locked drawer or safe, and limit access to authorized personnel only.

- Outline the reimbursement process: Define how employees can request petty cash, including approval requirements and documentation needed for reimbursement.

- Review and update regularly: Periodically review the petty cash policy to ensure it remains aligned with business needs and complies with Indiana-specific financial regulations.

Benefits of using this petty cash policy (Indiana)

Implementing this policy provides several key benefits for Indiana businesses:

- Ensures proper fund management: Helps maintain accurate records of petty cash transactions and balances, reducing errors or discrepancies.

- Promotes accountability: Assigning a custodian and requiring documentation ensures that all transactions are authorized and traceable.

- Enhances financial transparency: Establishes clear guidelines for petty cash usage, minimizing the risk of misuse or unauthorized spending.

- Improves efficiency: Streamlines small purchases and reimbursements without requiring the use of formal payment methods.

- Supports compliance: Aligns with financial best practices and Indiana regulations for cash management.

- Increases security: Limits access to the petty cash fund and ensures proper storage to reduce risks of theft or loss.

Tips for using this petty cash policy (Indiana)

- Communicate the policy effectively: Share the policy with employees during onboarding and provide periodic reminders to ensure everyone understands the procedures for accessing and using petty cash.

- Monitor fund usage: Track petty cash expenditures regularly to identify trends or unusual activity that may require further review.

- Limit fund size: Keep the petty cash fund at a reasonable amount to reduce financial exposure in case of errors or misuse.

- Require receipts for all transactions: Ensure every petty cash expense is supported by a receipt or voucher to maintain accurate records.

- Train the custodian: Provide training to the designated petty cash custodian on their responsibilities, including tracking, reconciling, and securing the fund.

- Audit periodically: Conduct periodic internal audits of the petty cash fund to verify accuracy and identify areas for improvement.

Q: What types of expenses can petty cash cover?

A: Petty cash is typically used for small, incidental expenses such as office supplies, minor repairs, or employee reimbursements under a certain amount, as defined by the policy.

Q: Who is responsible for managing the petty cash fund?

A: A designated custodian is responsible for managing the petty cash fund, including approving transactions, recording expenses, and reconciling balances.

Q: How often should the petty cash fund be reconciled?

A: The petty cash fund should be reconciled regularly, such as weekly or monthly, depending on the volume of transactions and the fund's size.

Q: What documentation is required for petty cash transactions?

A: All transactions must be supported by receipts or vouchers detailing the date, amount, purpose, and recipient of the expense.

Q: How should the petty cash fund be secured?

A: The petty cash fund should be stored in a locked drawer or safe with access limited to the custodian and other authorized personnel.

Q: What happens if discrepancies are found during reconciliation?

A: Discrepancies should be investigated promptly by the custodian or management to identify the cause and take corrective action, such as updating records or implementing additional controls.

Q: Can employees request petty cash for personal expenses?

A: No, petty cash is strictly for business-related expenses and cannot be used for personal purposes.

Q: How should the petty cash policy be updated?

A: The policy should be reviewed periodically and updated as needed to reflect changes in business operations or Indiana-specific regulations.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.