Petty cash policy (Iowa).: Free template

Petty cash policy (Iowa)

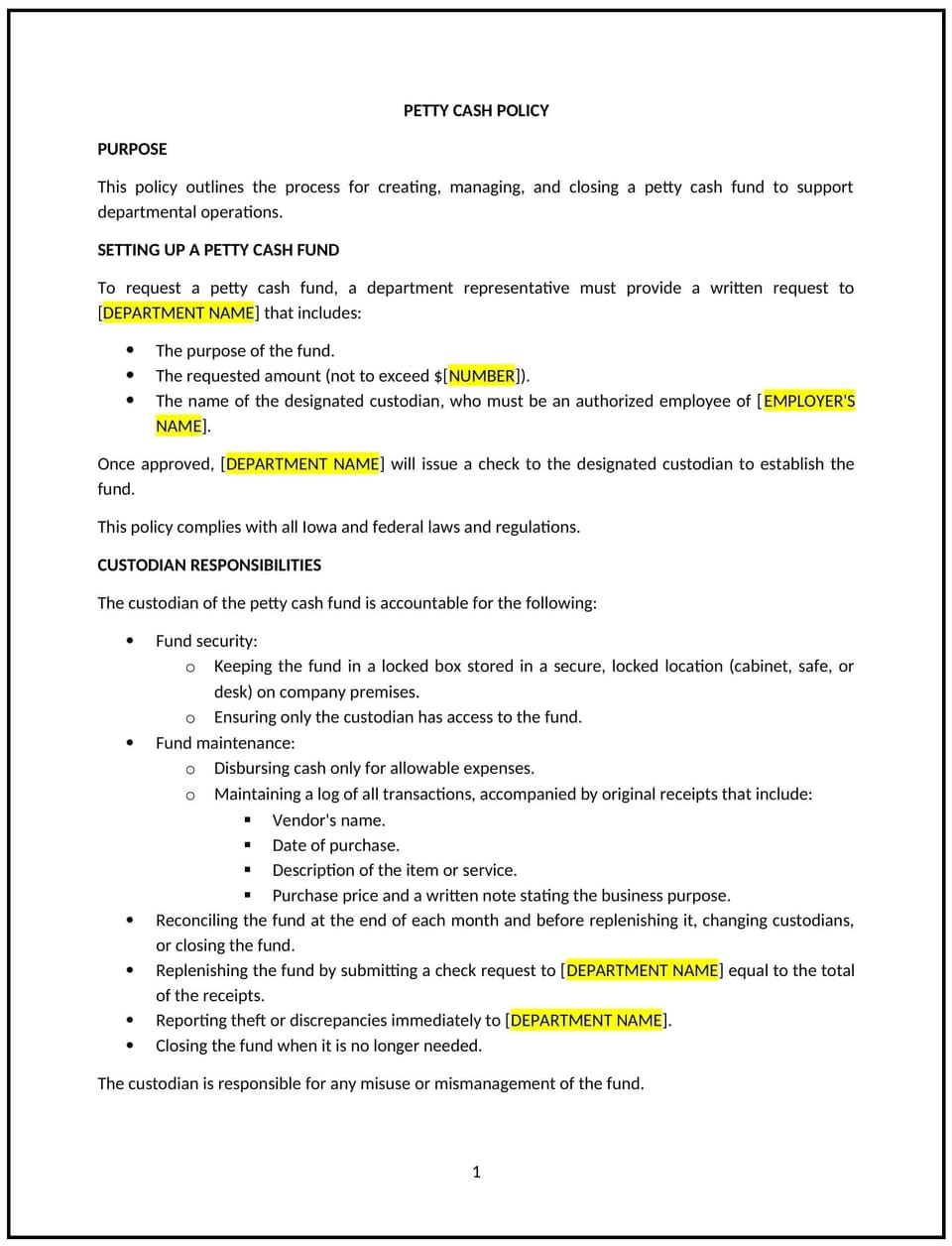

A petty cash policy helps Iowa businesses manage small, everyday expenses that are too minor to justify a formal purchase order or invoice. This policy outlines how petty cash funds should be handled, the types of expenses that qualify for reimbursement, and the procedures for maintaining accurate records of disbursements. By implementing this policy, businesses can maintain control over small cash transactions, minimize the risk of fraud, and ensure that petty cash funds are used appropriately.

By adopting this policy, businesses can streamline their reimbursement process for small purchases, while ensuring accountability and transparency in handling company funds.

How to use this petty cash policy (Iowa)

- Define petty cash: Specify what qualifies as petty cash, such as small office supplies, transportation costs, or emergency expenses, and establish a clear monetary limit for each transaction.

- Set cash fund limits: Define the maximum amount of petty cash that can be held at any given time. This could include a single fund or several funds based on different departments or locations.

- Establish approval procedures: Set clear guidelines for who can approve petty cash disbursements and under what circumstances. This helps prevent unauthorized use of company funds.

- Implement record-keeping requirements: Require employees to document all petty cash transactions, including receipts and purpose of expenditure. Maintain a ledger or spreadsheet to track the balance of the petty cash fund.

- Assign responsibility: Designate one or more employees responsible for overseeing the petty cash fund, ensuring that funds are dispensed and replenished appropriately, and that all transactions are documented.

- Replenish funds: Establish a process for replenishing the petty cash fund when it gets low. This should involve submitting a request with detailed documentation of disbursements and receipts.

- Conduct audits: Regularly audit petty cash funds to ensure proper handling, accurate record-keeping, and adherence to policy guidelines.

- Review and update regularly: Periodically review the petty cash policy to ensure it remains aligned with business needs, financial practices, and any changes in applicable regulations.

Benefits of using this petty cash policy (Iowa)

This policy offers several key benefits for Iowa businesses:

- Improves financial control: A petty cash policy helps businesses track and manage small cash transactions, preventing misuse or mismanagement of company funds.

- Increases transparency: Clear procedures for handling petty cash ensure that all transactions are properly documented and can be audited, reducing the risk of fraud or error.

- Streamlines minor purchases: By establishing a formal process for small expenses, businesses can quickly and efficiently handle necessary purchases without the delays of formal requisitions or approvals.

- Reduces administrative burden: With a defined policy in place, businesses can reduce the time and effort spent on managing small transactions and focus more on larger financial tasks.

- Enhances accountability: Assigning responsibility for managing petty cash funds ensures that someone is accountable for proper usage and reporting, improving overall financial stewardship.

- Ensures compliance with internal controls: By regularly auditing petty cash funds and requiring documentation for disbursements, businesses maintain compliance with internal financial control procedures.

Tips for using this petty cash policy (Iowa)

- Communicate guidelines clearly: Ensure that all employees understand what types of expenses qualify for petty cash and the procedures for requesting and documenting transactions.

- Set limits on petty cash usage: Establish clear limits for petty cash disbursements to prevent excessive spending on minor expenses. Review these limits regularly to ensure they align with business needs.

- Require receipts for all transactions: Employees should always provide receipts for petty cash expenditures, and any missing receipts should be documented with a valid explanation.

- Track disbursements regularly: Keep an up-to-date record of all petty cash disbursements to avoid discrepancies in the fund balance. This should include tracking both the amounts dispensed and the reason for each transaction.

- Designate a responsible custodian: Assign one employee or department to manage petty cash to ensure accountability and consistency in handling funds.

- Implement periodic audits: Regular audits of petty cash funds should be performed to identify any discrepancies and ensure that the funds are being used in accordance with company policy.

- Keep petty cash funds secure: Petty cash should be stored in a locked box or secure location to prevent theft or unauthorized access.

Q: Why should Iowa businesses implement a petty cash policy?

A: Businesses should implement a petty cash policy to ensure that small expenses are handled efficiently, tracked accurately, and used appropriately, reducing the risk of fraud and improving financial accountability.

Q: What types of expenses are covered by petty cash?

A: Petty cash is typically used for small, everyday expenses such as office supplies, transportation costs, and emergency purchases that are too minor to require formal purchase orders or invoices.

Q: Who can approve petty cash disbursements?

A: Petty cash disbursements should be approved by designated employees or managers who have the authority to authorize these expenses. The policy should clearly define who is authorized to approve transactions.

Q: How should petty cash transactions be documented?

A: Each petty cash transaction should be documented with a receipt or an explanation of the expense, along with the amount spent and the purpose of the transaction. These records should be kept in a ledger or tracking system.

Q: How often should the petty cash fund be replenished?

A: Petty cash should be replenished when the fund balance gets low, typically based on a pre-determined threshold. This process should include submitting a request with supporting documentation for all disbursements.

Q: How much petty cash should a business keep on hand?

A: The amount of petty cash held should be determined based on the business’s needs and the frequency of small expenses. The policy should define the maximum amount of petty cash that can be held at any time.

Q: How can businesses prevent misuse of petty cash?

A: Businesses can prevent misuse by establishing clear guidelines for what constitutes a legitimate petty cash expense, requiring documentation for all transactions, assigning responsibility for managing the fund, and conducting regular audits.

Q: Can petty cash be used for personal expenses?

A: No, petty cash should only be used for business-related expenses. The policy should specify that any personal use of petty cash is prohibited and subject to disciplinary action.

Q: How often should businesses review their petty cash policy?

A: Businesses should review their petty cash policy regularly, at least annually, to ensure it meets business needs, aligns with internal controls, and complies with any applicable regulations.

Q: What should businesses do if there is a discrepancy in the petty cash fund?

A: If there is a discrepancy in the petty cash fund, businesses should conduct an immediate investigation, review transaction records, and take corrective action as necessary, which may include disciplinary measures if misuse is found.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.