Petty cash policy (Kansas): Free template

Petty cash policy (Kansas)

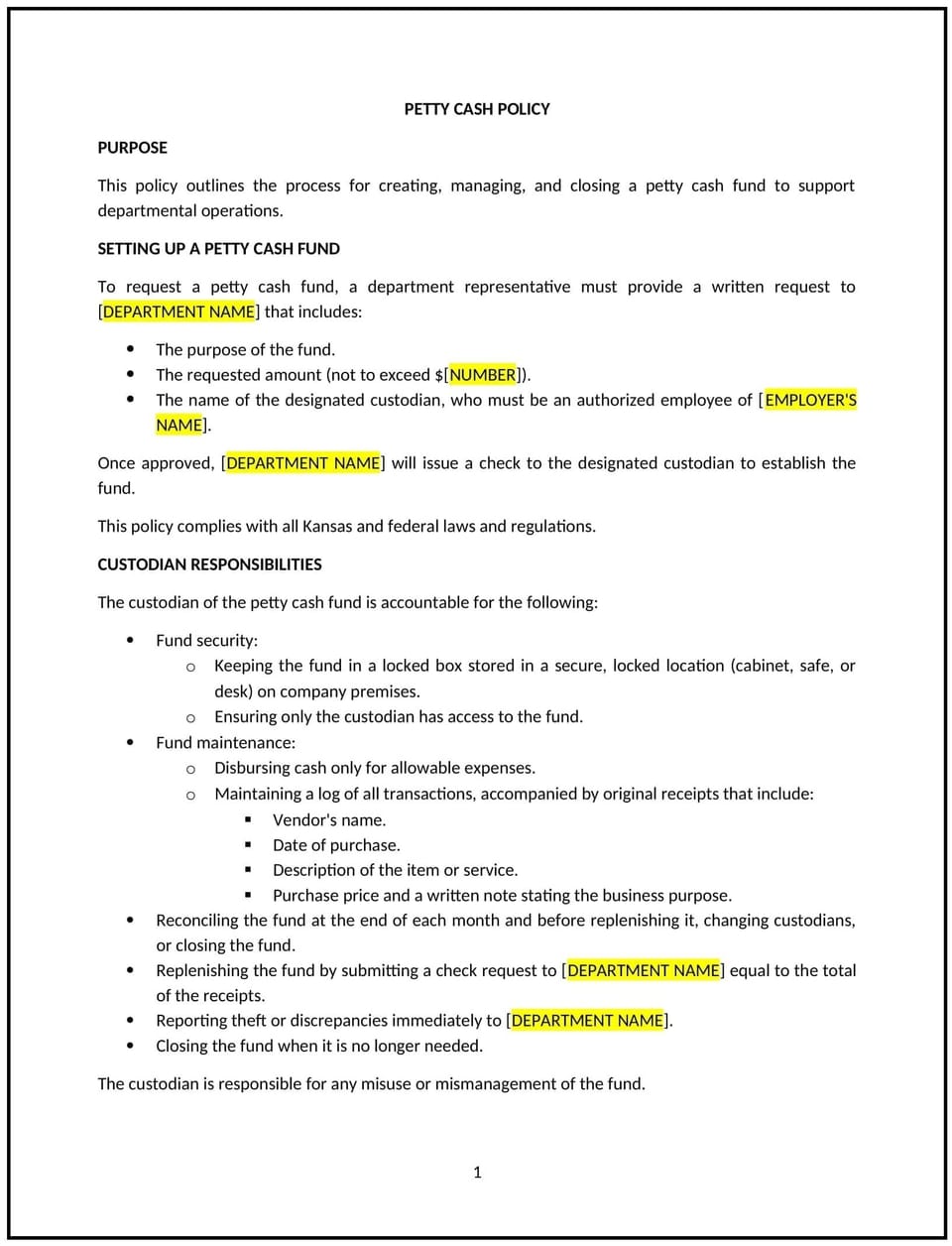

A petty cash policy helps Kansas businesses manage small, incidental expenses that cannot be paid through regular accounts payable channels. This policy outlines how petty cash is allocated, who is responsible for managing it, and the procedures for handling reimbursements, ensuring that all petty cash transactions are documented and transparent.

By implementing this policy, businesses can manage minor expenses efficiently while maintaining proper controls to prevent misuse of company funds.

How to use this petty cash policy (Kansas)

- Define petty cash usage: Businesses should specify what types of expenses are acceptable for petty cash use, such as office supplies, small equipment repairs, or employee reimbursements for minor purchases related to work.

- Set funding limits: The policy should outline the maximum amount of petty cash that can be kept on hand and the process for replenishing the fund when it reaches a certain threshold.

- Assign responsibility: A designated employee should be responsible for managing the petty cash fund, including handling disbursements, tracking expenses, and ensuring that the fund is properly accounted for.

- Implement record-keeping procedures: Businesses should require that all petty cash transactions be documented, including receipts, purpose of the expenditure, and approval from a manager. A petty cash log should be maintained for tracking purposes.

- Set approval guidelines: Petty cash disbursements should require approval from a designated manager or supervisor to ensure that funds are used appropriately.

- Monitor and audit: Businesses should periodically audit petty cash records to ensure that funds are being used appropriately and that all disbursements are properly documented.

- Review and update regularly: Businesses should periodically review the petty cash policy to ensure it aligns with company needs, legal requirements, and industry best practices.

Benefits of using a petty cash policy (Kansas)

- Promotes financial control: A petty cash policy provides clear guidelines for handling small transactions, ensuring that funds are used responsibly and within approved limits.

- Reduces the risk of fraud or misuse: By tracking expenses and requiring documentation for each disbursement, businesses can minimize the potential for unauthorized or improper use of petty cash.

- Increases transparency: Clear record-keeping and approval procedures help ensure that all petty cash transactions are transparent and can be reviewed if necessary.

- Improves budgeting: A defined petty cash policy allows businesses to better track small expenses and maintain accurate financial records, making it easier to stay within budget.

- Enhances employee accountability: By assigning responsibility for the petty cash fund to a designated employee, businesses encourage accountability and ensure proper management of company resources.

- Streamlines small purchases: The petty cash system allows businesses to handle small, routine expenses quickly and without the need for formal purchase orders or invoicing processes.

Tips for using this petty cash policy (Kansas)

- Communicate the policy clearly: Businesses should ensure that all employees understand the purpose of petty cash, the types of expenses allowed, and the approval process for accessing the fund.

- Keep accurate records: Businesses should maintain a detailed log of all petty cash transactions, including receipts, dates, amounts, and the purpose of each expenditure.

- Regularly audit the petty cash fund: Businesses should conduct periodic audits of the petty cash fund to ensure that the money is being used appropriately and that all records are up to date.

- Implement a maximum withdrawal limit: To prevent misuse, businesses should establish a maximum amount that can be withdrawn from petty cash for individual transactions.

- Require approval for all disbursements: Businesses should require that all petty cash disbursements be approved by a supervisor or manager to ensure funds are used for legitimate business purposes.

- Review and replenish the petty cash fund: Businesses should have a process in place to review the petty cash fund regularly and replenish it as necessary to maintain the designated amount.

Q: Why should Kansas businesses implement a petty cash policy?

A: Businesses should implement a petty cash policy to manage small, incidental expenses efficiently, ensure proper controls over cash handling, and reduce the risk of fraud or misuse of company funds.

Q: What types of expenses can be paid using petty cash?

A: Petty cash can be used for small, routine expenses such as office supplies, postage, minor repairs, or employee reimbursements for small work-related purchases. The policy should outline acceptable uses for petty cash.

Q: How much petty cash should a business keep on hand?

A: The policy should specify a maximum petty cash fund limit based on the size of the business and the volume of small transactions. This limit should be set to cover minor expenses without holding excessive cash.

Q: Who is responsible for managing petty cash?

A: The policy should designate an employee (such as an office manager or administrative staff member) who is responsible for managing the petty cash fund, tracking disbursements, and maintaining records.

Q: How should businesses handle petty cash replenishment?

A: Businesses should establish a process for replenishing the petty cash fund once it reaches a set threshold. This process should include submitting receipts and completing documentation for approval before funds are replenished.

Q: What records are required for petty cash transactions?

A: Businesses should require that all petty cash transactions be documented with receipts and a log that includes the date, amount, purpose, and approval for each disbursement.

Q: How often should businesses audit petty cash?

A: Businesses should conduct periodic audits of the petty cash fund, ideally quarterly or semi-annually, to ensure that records are accurate and that funds are being used appropriately.

Q: How should businesses handle misused petty cash?

A: If misuse of petty cash is identified, businesses should follow a clear process for addressing the issue, which may include additional training, corrective action, or disciplinary measures, depending on the severity of the violation.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.