Petty cash policy (Kentucky): Free template

Petty cash policy (Kentucky)

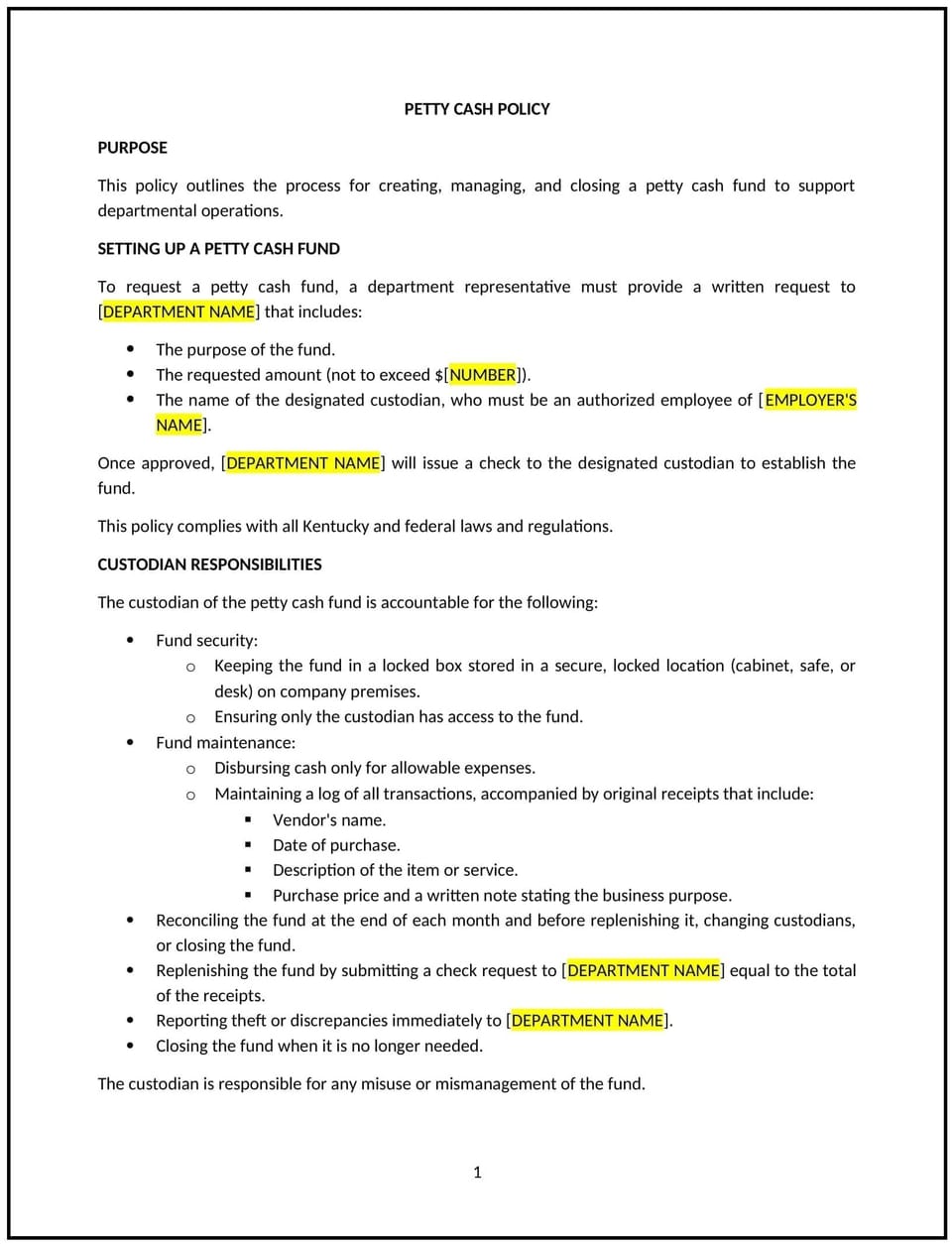

A petty cash policy provides Kentucky businesses with guidelines for managing small cash transactions. This policy ensures that petty cash funds are used appropriately, tracked accurately, and safeguarded against misuse.

By adopting this policy, businesses can streamline minor expenses, maintain accountability, and reduce the risk of errors or fraud.

How to use this petty cash policy (Kentucky)

- Define petty cash usage: Specify the types of expenses eligible for petty cash, such as office supplies, small reimbursements, or emergency purchases.

- Set fund limits: Establish the maximum amount of petty cash that can be kept on hand and the spending cap for individual transactions.

- Outline access and custody: Assign responsibility for managing petty cash to a designated custodian, who is accountable for its security and usage.

- Require documentation: Ensure all petty cash transactions are supported by receipts, vouchers, or other proof of purchase.

- Include replenishment procedures: Provide guidelines for replenishing petty cash funds, including approval processes and record reconciliation.

- Address security measures: Outline steps to safeguard petty cash, such as keeping it in a locked box and limiting access to authorized personnel.

- Schedule regular audits: Require periodic reviews of petty cash records to ensure compliance with the policy and identify discrepancies.

Benefits of using this petty cash policy (Kentucky)

This policy provides several key benefits for Kentucky businesses:

- Streamlines minor expenses: Allows businesses to efficiently handle small, immediate purchases without disrupting operations.

- Enhances accountability: Tracks all transactions with proper documentation, ensuring funds are used responsibly.

- Reduces fraud risks: Establishes controls and oversight to prevent misuse or mismanagement of petty cash.

- Promotes consistency: Standardizes procedures for managing petty cash across the organization.

- Supports financial accuracy: Ensures petty cash transactions are accurately recorded and reconciled with financial records.

Tips for using this petty cash policy (Kentucky)

- Communicate the policy: Ensure employees understand how and when petty cash can be used by sharing the policy during onboarding and training.

- Train custodians: Provide training for petty cash custodians on their responsibilities, including record-keeping and security practices.

- Limit petty cash usage: Encourage employees to use petty cash only for eligible expenses, as outlined in the policy.

- Review periodically: Update the policy to reflect changes in Kentucky regulations, business operations, or financial practices.

- Conduct surprise audits: Perform unannounced audits to verify petty cash usage and identify potential issues promptly.

Q: What types of expenses are eligible for petty cash?

A: Petty cash is typically used for small expenses like office supplies, parking fees, or other minor, immediate purchases.

Q: Who is responsible for managing petty cash?

A: A designated petty cash custodian is responsible for overseeing the fund, securing it, and maintaining accurate records.

Q: What is the spending limit for petty cash transactions?

A: The policy sets a cap on individual petty cash transactions, which should align with the business’s operational needs.

Q: How are petty cash funds replenished?

A: Funds are replenished by submitting documentation, such as receipts and a reconciliation report, for approval and processing.

Q: What measures are in place to secure petty cash?

A: Petty cash is stored in a locked box or drawer, with access restricted to authorized personnel.

Q: What should be done if a discrepancy is found during an audit?

A: Any discrepancies should be reported immediately to management or the finance team for investigation and resolution.

Q: How often are petty cash records audited?

A: Audits may be conducted periodically or on a surprise basis to ensure proper management and compliance with the policy.

Q: How often should the petty cash policy be reviewed?

A: The policy should be reviewed regularly to ensure it remains aligned with Kentucky laws, business practices, and financial procedures.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.