Petty cash policy (Louisiana): Free template

Petty cash policy (Louisiana)

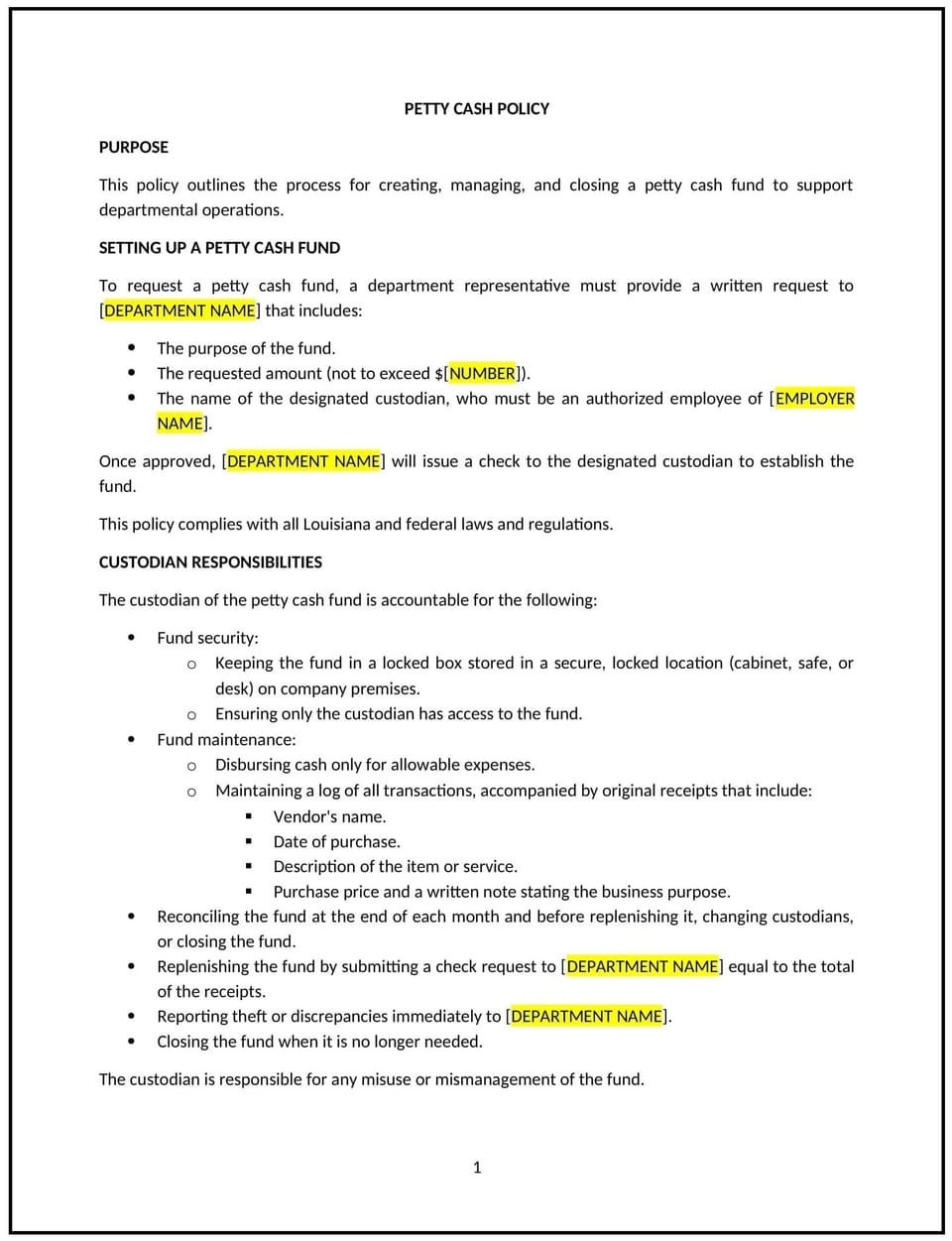

This petty cash policy is designed to help Louisiana businesses manage small, day-to-day cash transactions effectively. It outlines procedures for using, replenishing, and safeguarding petty cash to ensure accountability and prevent misuse.

By implementing this policy, businesses can streamline minor expenses while maintaining transparency and control over cash usage.

How to use this petty cash policy (Louisiana)

- Define purpose: Specify the types of expenses eligible for petty cash use, such as office supplies or small travel reimbursements.

- Set cash limits: Establish maximum allowable amounts for individual transactions and the total petty cash fund.

- Designate a custodian: Assign responsibility for managing and securing the petty cash fund to a specific individual or department.

- Outline usage procedures: Provide steps for requesting petty cash, including required approvals and documentation.

- Include reconciliation guidelines: Detail how the petty cash fund should be reconciled, including tracking expenses and replenishment.

- Communicate security measures: Emphasize the importance of securely storing petty cash and limiting access to authorized personnel.

Benefits of using a petty cash policy (Louisiana)

Implementing this policy provides several advantages for Louisiana businesses:

- Enhances control: Establishes clear procedures for managing petty cash transactions.

- Promotes transparency: Reduces potential for misuse by tracking and documenting cash usage.

- Streamlines operations: Simplifies handling of small, immediate business expenses.

- Reduces risks: Safeguards petty cash through secure storage and limited access.

- Reflects Louisiana-specific needs: Adapts to local business practices and operational requirements.

Tips for using this petty cash policy (Louisiana)

- Train custodians: Ensure petty cash custodians understand their responsibilities and recordkeeping requirements.

- Keep accurate records: Maintain a log of all petty cash transactions, including receipts and approval documentation.

- Limit cash access: Restrict access to authorized personnel and use locked storage for security.

- Monitor usage: Conduct regular reconciliations to ensure the fund’s accuracy and identify any discrepancies.

- Update regularly: Revise the policy as needed to reflect changes in business practices or Louisiana-specific considerations.

Q: What types of expenses are eligible for petty cash use?

A: Petty cash can be used for small, immediate expenses such as office supplies, parking fees, or minor travel reimbursements, as outlined in the policy.

Q: Who is responsible for managing the petty cash fund?

A: A designated petty cash custodian is responsible for managing, securing, and reconciling the fund.

Q: How are petty cash transactions documented?

A: Each transaction should be logged with supporting receipts, approval signatures, and details of the expense.

Q: What is the maximum amount allowed for a petty cash transaction?

A: The policy specifies a maximum amount, typically set to ensure the fund is used only for minor expenses.

Q: How is the petty cash fund replenished?

A: The custodian submits a reconciliation report and requests additional funds to restore the balance to its original amount.

Q: What security measures are required for petty cash?

A: Petty cash should be stored in a locked, secure location with access limited to authorized personnel.

Q: How often should the petty cash fund be reconciled?

A: The fund should be reconciled regularly, such as weekly or monthly, to ensure accuracy and prevent discrepancies.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.