Petty cash policy (Mississippi): Free template

Petty cash policy (Mississippi)

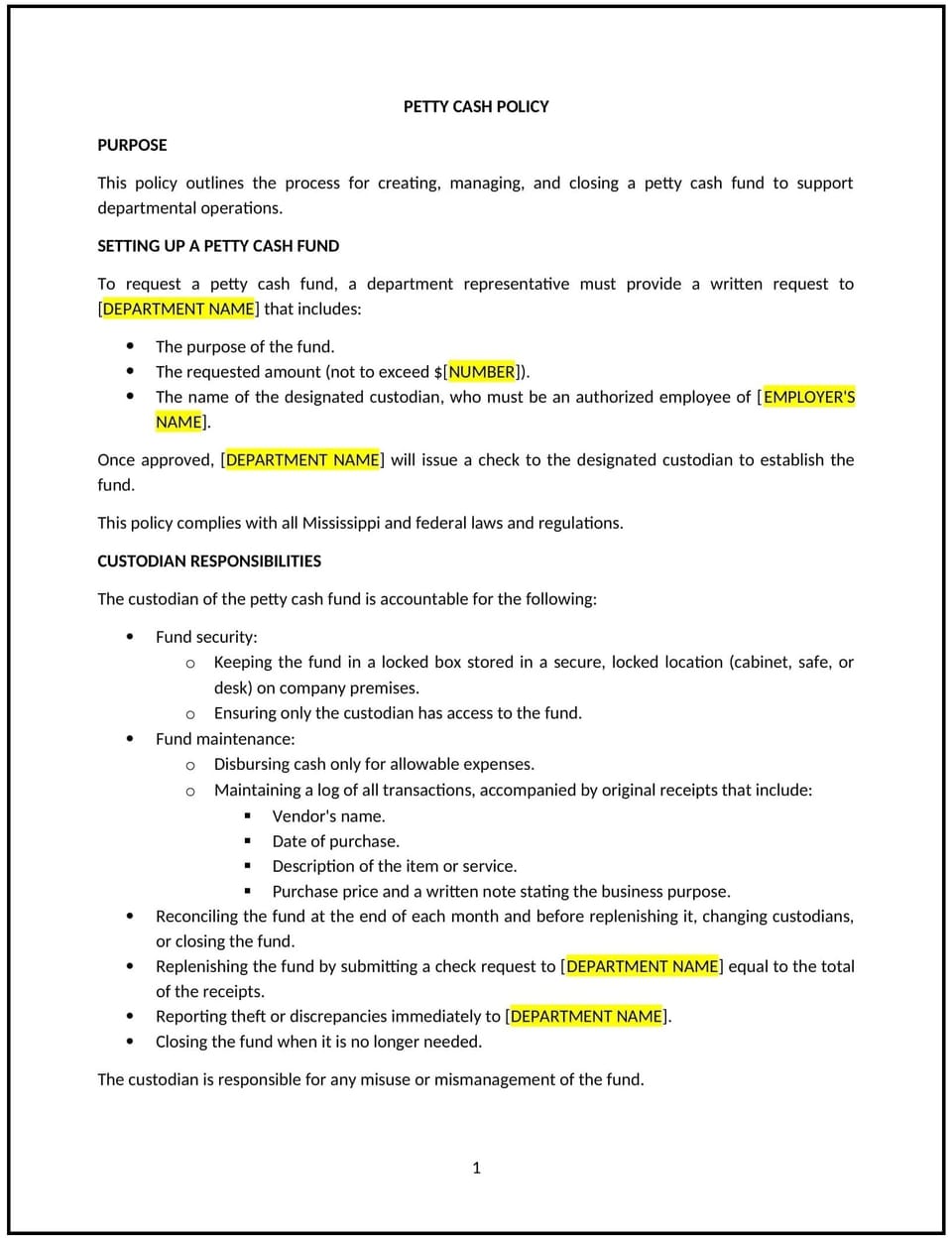

A petty cash policy provides Mississippi businesses with guidelines on managing small cash transactions for day-to-day expenses. This policy helps businesses control cash usage, prevent misuse, and ensure accurate tracking of minor purchases. It also establishes procedures for issuing, replenishing, and reconciling petty cash funds.

By implementing this policy, businesses can maintain financial accountability while allowing employees to handle small expenses efficiently.

How to use this petty cash policy (Mississippi)

- Define petty cash usage: Specify the types of expenses covered, such as office supplies, minor repairs, and business-related reimbursements.

- Set cash limits: Establish a maximum amount for petty cash transactions and the total balance maintained in the petty cash fund.

- Assign a custodian: Designate an employee responsible for managing petty cash, disbursing funds, and maintaining records.

- Establish disbursement procedures: Require employees to submit a request form or provide receipts before receiving petty cash.

- Require transaction documentation: Maintain a log for all petty cash transactions, including date, amount, purpose, and recipient.

- Set replenishment guidelines: Outline when and how the petty cash fund should be replenished, including documentation requirements.

- Implement reconciliation procedures: Conduct regular audits to compare petty cash records with actual funds to identify discrepancies.

- Secure petty cash storage: Keep funds in a locked cash box or secure location accessible only to authorized personnel.

- Review and update the policy regularly: Ensure the petty cash process remains efficient and aligns with business needs.

Benefits of using this petty cash policy (Mississippi)

This policy offers several benefits for Mississippi businesses:

- Improves financial control: Helps track small cash transactions and prevent unauthorized use.

- Reduces administrative burden: Allows employees to handle minor expenses without requiring formal purchase approvals.

- Increases transparency: Provides a structured approach to managing and documenting petty cash use.

- Minimizes fraud risks: Establishes oversight measures to prevent mismanagement or misuse of petty cash.

- Enhances efficiency: Enables quick access to cash for necessary business expenses.

Tips for using this petty cash policy (Mississippi)

- Limit access to petty cash: Only authorized employees should handle petty cash to maintain security and accountability.

- Require receipts for all expenses: Employees should submit receipts for every transaction to support proper record-keeping.

- Conduct periodic audits: Regularly reviewing petty cash records helps identify discrepancies and maintain accuracy.

- Keep petty cash usage minimal: Encourage employees to use standard purchasing processes for larger expenses.

- Train employees on petty cash procedures: Ensure all staff members understand when and how petty cash can be used.

Q: Why should Mississippi businesses have a petty cash policy?

A: A petty cash policy helps businesses manage small cash transactions effectively, ensuring accountability and preventing misuse.

Q: What types of expenses should be covered by petty cash?

A: Businesses should use petty cash for minor, work-related expenses such as office supplies, postage, and small emergency repairs.

Q: How should businesses track petty cash transactions?

A: Businesses should maintain a log recording each transaction, including date, amount, purpose, and supporting receipts.

Q: Who should be responsible for managing petty cash?

A: A designated custodian, such as an office manager or accounting staff, should oversee petty cash distribution and record-keeping.

Q: How often should petty cash be reconciled?

A: Businesses should conduct petty cash reconciliations weekly or monthly to verify accuracy and detect any discrepancies.

Q: What should businesses do if petty cash is missing?

A: If funds are missing, businesses should conduct an internal review, notify management, and update security measures if necessary.

Q: Can businesses use petty cash for employee advances?

A: Petty cash should not be used for personal loans or salary advances. It should only cover small, approved business expenses.

Q: How often should this policy be reviewed?

A: Businesses should review the policy annually to ensure it aligns with financial management best practices.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.