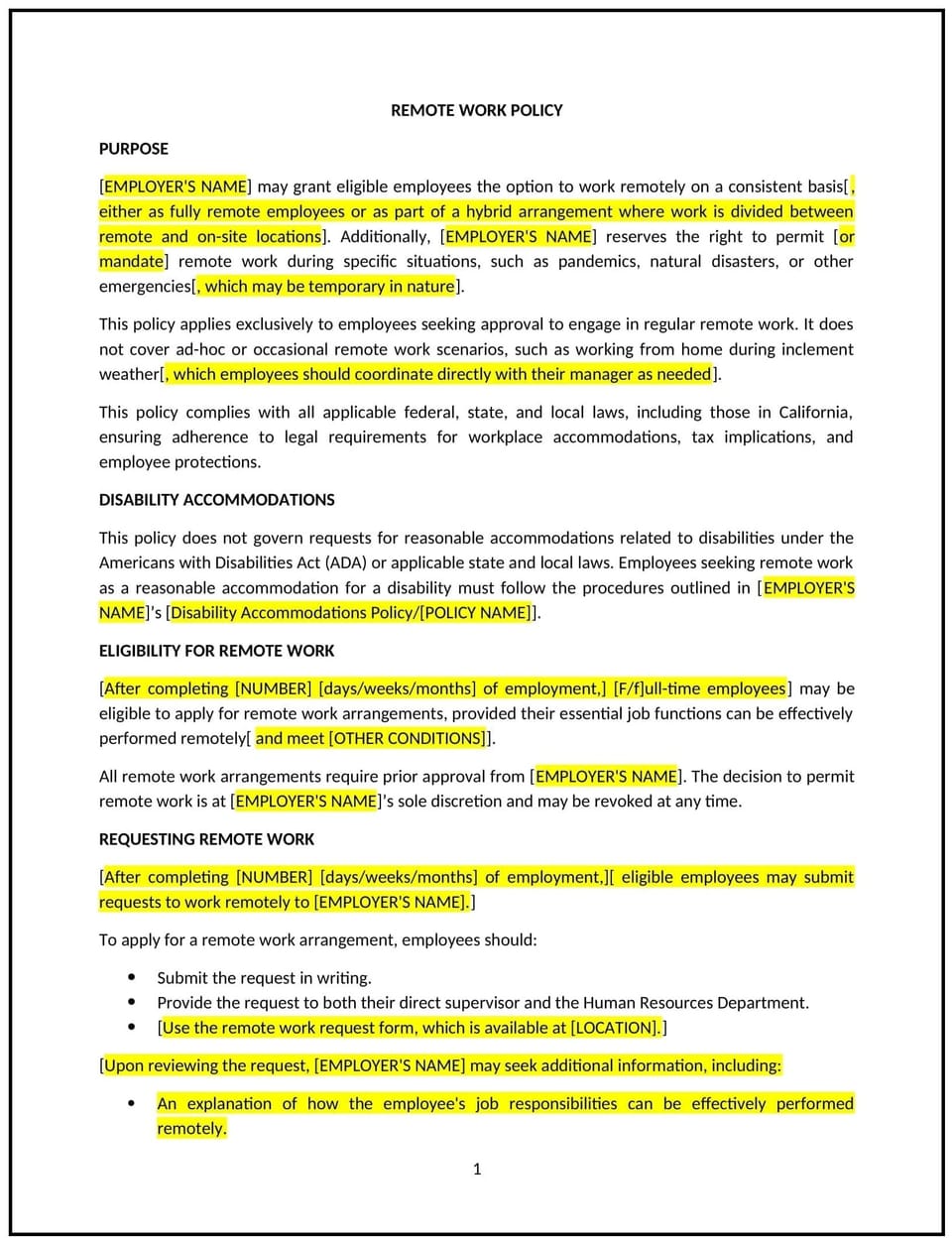

Remote work policy (California): Free template

Remote work policy (California)

In California, a remote work policy provides businesses with guidelines for managing employees who work from home or other off-site locations. This policy ensures compliance with California labor laws, including wage and hour requirements, workplace safety standards, and reimbursement obligations under California Labor Code Section 2802.

This policy outlines expectations for remote work arrangements, including scheduling, communication, and equipment usage. By implementing this policy, California businesses can promote flexibility, maintain productivity, and support compliance with state regulations.

How to use this remote work policy (California)

- Define eligibility: Specify which roles or employees are eligible for remote work based on job requirements and business needs.

- Outline expectations: Clarify work hours, availability, and communication protocols for remote employees to ensure alignment with business operations.

- Address equipment and expenses: Provide guidelines for the use of business-owned equipment and reimbursement of necessary work-related expenses as required by California law.

- Ensure workplace safety: Require remote employees to maintain a safe and ergonomic workspace to comply with California’s workplace safety standards.

- Monitor performance: Establish methods for evaluating remote employees’ performance to ensure accountability and productivity.

Benefits of using this remote work policy (California)

This policy offers several advantages for California businesses:

- Supports compliance: Reflects California laws regarding reimbursement of business expenses and workplace safety for remote employees.

- Promotes flexibility: Enables employees to work remotely while maintaining alignment with business objectives.

- Enhances productivity: Sets clear expectations for remote work, helping employees stay focused and accountable.

- Reduces risks: Minimizes potential legal disputes related to wage and hour compliance or expense reimbursements.

- Builds trust: Demonstrates the business’s commitment to supporting employees’ work-life balance.

Tips for using this remote work policy (California)

- Reflect California-specific laws: Address expense reimbursement requirements and other state labor regulations affecting remote work arrangements.

- Train managers: Provide guidance on effectively managing and supporting remote employees.

- Use secure systems: Implement IT security protocols to protect business data when employees work remotely.

- Encourage communication: Promote regular check-ins and open lines of communication to maintain team cohesion and productivity.

- Review regularly: Update the policy to reflect changes in California laws, technology, or business practices.

Q: How does this policy benefit the business?

A: This policy supports compliance with California labor laws, enhances productivity, and provides a framework for managing remote work effectively.

Q: What expenses are reimbursable under this policy?

A: Reimbursable expenses may include internet costs, office supplies, and other necessary work-related expenses, as outlined in the policy.

Q: How does this policy support compliance with California laws?

A: The policy reflects California Labor Code Section 2802, ensuring proper reimbursement for necessary expenses incurred during remote work.

Q: What steps should employees take to request remote work?

A: Employees should submit a formal request to their manager or HR, outlining how remote work aligns with their role and the business’s needs.

Q: How can the business ensure productivity in remote work arrangements?

A: The business can set clear expectations, provide necessary tools, and conduct regular performance evaluations to maintain accountability.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.