Third-party agents policy (Iowa): Free template

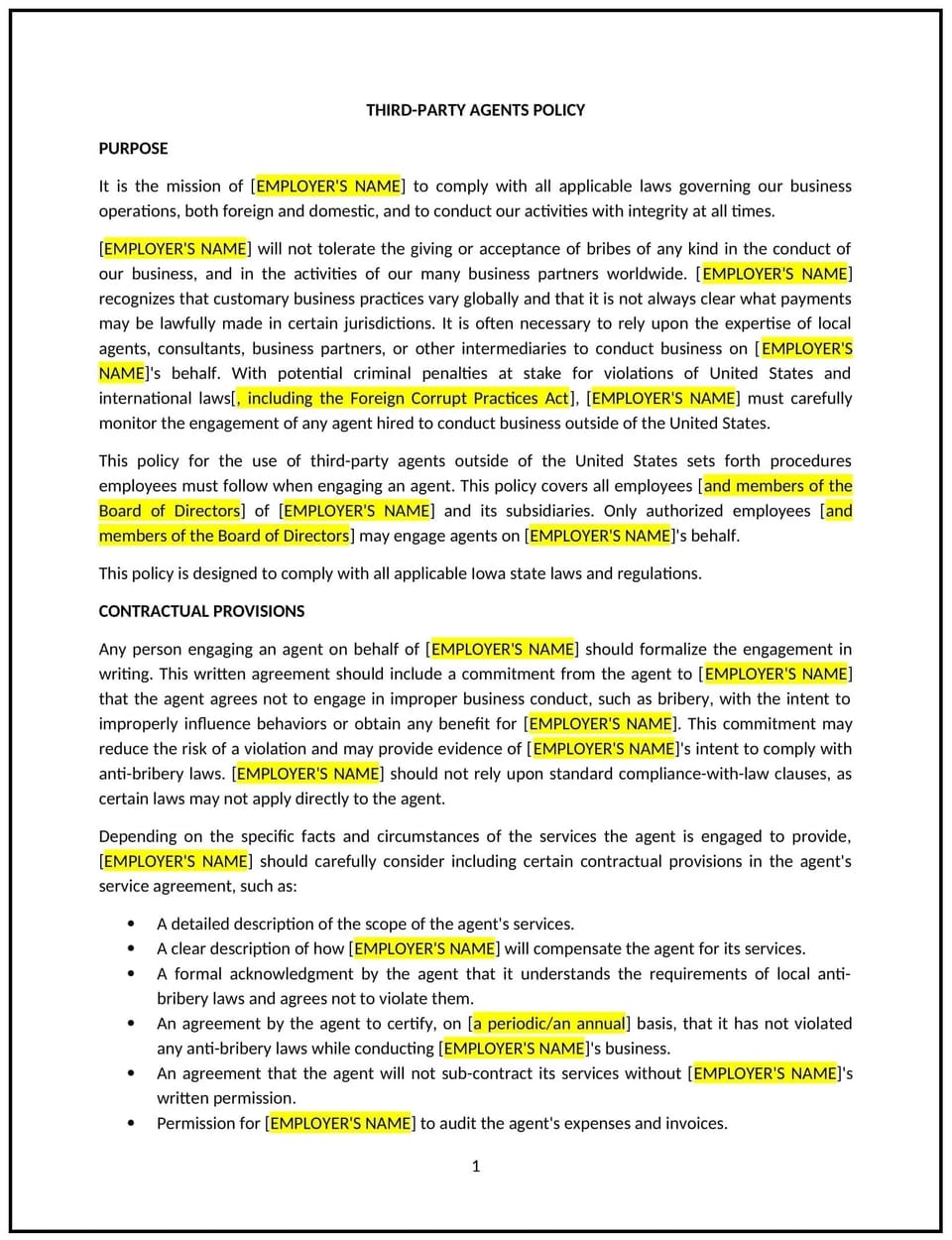

Third-party agents policy (Iowa)

A third-party agents policy helps Iowa businesses define expectations and guidelines for working with third-party vendors, contractors, and agents. This policy ensures that third-party agents act in a manner consistent with the company’s values, business practices, and legal obligations. It addresses the selection, management, and oversight of third-party relationships, focusing on issues like contract terms, confidentiality, risk management, and compliance with applicable laws and regulations.

By implementing this policy, businesses can mitigate risks associated with third-party relationships, ensure consistency in how agents represent the business, and protect sensitive company information.

How to use this third-party agents policy (Iowa)

- Define third-party agents: Specify what constitutes a third-party agent, including vendors, contractors, consultants, and other external parties who perform work on behalf of the business.

- Set selection criteria: Establish clear criteria for selecting third-party agents, such as qualifications, reputation, compliance with industry standards, and alignment with company values.

- Address contracts and agreements: Require that all third-party relationships are governed by formal contracts or agreements that clearly define the scope of work, performance expectations, payment terms, confidentiality requirements, and any other relevant provisions.

- Ensure confidentiality: Outline expectations for maintaining the confidentiality of company data, proprietary information, and any other sensitive materials that third-party agents may access or handle.

- Manage risk: Establish procedures for assessing and managing risks associated with third-party agents, including conducting background checks, assessing financial stability, and evaluating the agent’s ability to meet compliance and regulatory requirements.

- Monitor performance: Define how third-party agents’ performance will be monitored, including regular reporting, audits, and performance reviews to ensure they meet contractual obligations and company standards.

- Address disputes: Provide a framework for resolving disputes or conflicts with third-party agents, including escalation procedures, mediation, or legal action when necessary.

- Review and update regularly: Periodically review and update the policy to ensure that it reflects changes in legal requirements, business operations, and industry practices.

Benefits of using this third-party agents policy (Iowa)

This policy offers several key benefits for Iowa businesses:

- Mitigates risk: By setting clear guidelines for selecting, managing, and monitoring third-party agents, businesses can reduce risks related to non-compliance, fraud, and reputational damage.

- Protects confidential information: The policy ensures that third-party agents understand their obligations regarding confidentiality, protecting sensitive company data and proprietary information.

- Improves accountability: Clear expectations for performance, monitoring, and dispute resolution ensure that third-party agents are held accountable for their work and actions on behalf of the business.

- Enhances business operations: By establishing structured and consistent relationships with third-party agents, businesses can streamline processes, improve efficiency, and maintain control over the quality of external work.

- Reduces legal exposure: A formalized process for managing third-party relationships helps ensure compliance with relevant laws and regulations, reducing the risk of legal challenges.

- Strengthens company reputation: Working with reputable, well-managed third-party agents enhances the business's credibility and helps maintain strong relationships with clients and customers.

Tips for using this third-party agents policy (Iowa)

- Communicate expectations clearly: Ensure that all third-party agents understand the terms of the policy, including their responsibilities and obligations regarding confidentiality, compliance, and performance standards.

- Conduct thorough due diligence: Before entering into an agreement with a third-party agent, conduct background checks and evaluations to ensure they meet the company’s selection criteria and can deliver the required services.

- Monitor ongoing performance: Regularly assess the performance of third-party agents through audits, reviews, and feedback from relevant departments to ensure they are meeting contractual obligations and quality standards.

- Address issues proactively: If performance issues or breaches of the agreement occur, address them promptly by following the dispute resolution procedures outlined in the policy, including mediation or legal action when necessary.

- Stay updated on legal requirements: Keep track of any changes in laws and regulations that may impact third-party relationships and update the policy accordingly to remain compliant.

- Set clear contractual terms: Ensure that all third-party agreements include clear terms about scope of work, deadlines, payments, and performance expectations, and are signed before work begins.

Q: Why should Iowa businesses implement a third-party agents policy?

A: Businesses should implement a third-party agents policy to manage relationships with external vendors, ensure compliance with legal requirements, protect sensitive information, and mitigate risks associated with third-party operations.

Q: What types of third-party agents does this policy cover?

A: This policy covers a wide range of third-party agents, including vendors, contractors, consultants, service providers, and other external parties who perform work or provide services on behalf of the business.

Q: How should businesses select third-party agents?

A: Businesses should establish clear selection criteria based on the third-party agent's qualifications, reputation, compliance with industry standards, and ability to meet the company’s business needs. A formal vetting process, including background checks and due diligence, should be part of the selection process.

Q: What should be included in third-party contracts or agreements?

A: Contracts should outline the scope of work, deliverables, performance expectations, payment terms, confidentiality clauses, and any legal or regulatory requirements that apply to the third-party agent’s work. Clear dispute resolution procedures should also be included.

Q: How can businesses protect sensitive information when working with third-party agents?

A: Businesses should include confidentiality clauses in all third-party contracts, outlining the agent's responsibilities regarding the protection of sensitive information. Regular monitoring and audits can help ensure that third-party agents adhere to these requirements.

Q: What should businesses do if a third-party agent is not meeting performance expectations?

A: Businesses should address performance issues promptly by reviewing the terms of the contract, providing feedback to the third-party agent, and working with them to resolve the issue. If necessary, the business may escalate the matter through dispute resolution procedures, such as mediation or legal action.

Q: How can businesses monitor third-party agent performance?

A: Businesses should establish monitoring procedures, including regular reports, audits, and performance reviews, to ensure that third-party agents are meeting their contractual obligations and adhering to company standards.

Q: Are businesses required to conduct background checks on third-party agents?

A: While not legally required, businesses should conduct background checks as part of their due diligence process to assess the qualifications, reputation, and reliability of third-party agents before entering into a contractual agreement.

Q: Can businesses terminate a third-party agent contract if there is a violation?

A: Yes, businesses should include termination clauses in their contracts that outline the conditions under which the agreement can be terminated, including breaches of contract or failure to meet performance expectations.

Q: How often should businesses review their third-party agents policy?

A: Businesses should review their third-party agents policy regularly, at least annually, or whenever there are changes in regulations, business needs, or industry practices to ensure it remains effective and up-to-date.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.