Third-party agents policy (Mississippi): Free template

Third-party agents policy (Mississippi)

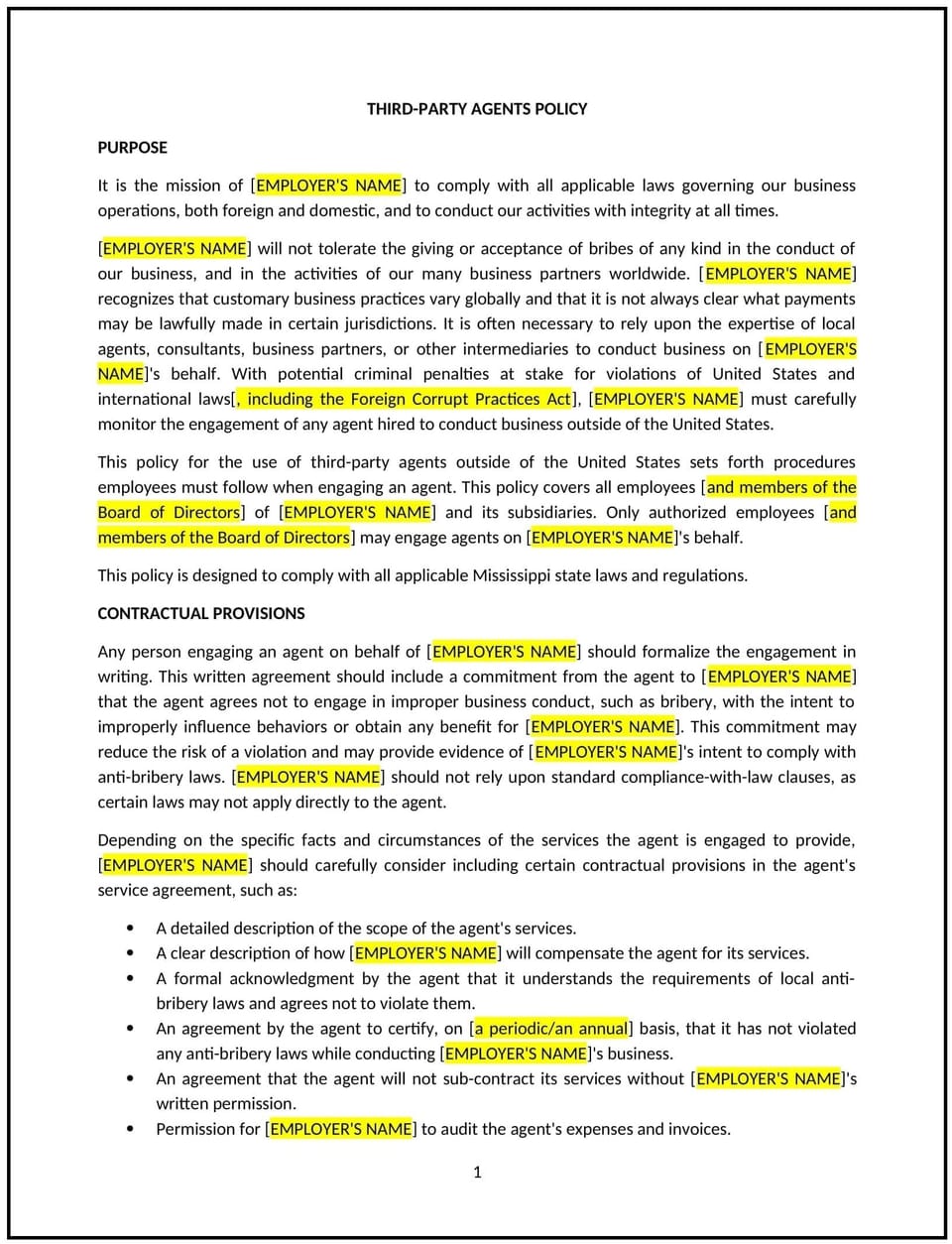

A third-party agents policy helps Mississippi businesses manage relationships with external agents, consultants, and representatives who act on behalf of the company. This policy establishes guidelines for selecting, monitoring, and working with third-party agents to ensure ethical and professional business practices.

By implementing this policy, businesses can minimize risks, improve accountability, and maintain strong partnerships with third-party agents.

How to use this third-party agents policy (Mississippi)

- Define third-party agents: Clarify which individuals or entities qualify as third-party agents, including consultants, contractors, and sales representatives.

- Establish selection criteria: Outline the standards for selecting third-party agents, including qualifications, industry experience, and reputation.

- Require formal agreements: Ensure all third-party agents sign contracts that define their responsibilities, scope of work, and ethical expectations.

- Monitor performance: Implement regular evaluations to assess third-party agents' effectiveness and adherence to company policies.

- Maintain compliance records: Require third-party agents to provide necessary documentation, such as business licenses and certifications.

- Set reporting expectations: Establish guidelines for communication, reporting structures, and documentation of activities.

- Address conflicts of interest: Require third-party agents to disclose any potential conflicts that could impact their objectivity.

- Review and update the policy regularly: Adapt the policy to reflect changing business needs and industry standards.

Benefits of using this third-party agents policy (Mississippi)

This policy offers several benefits for Mississippi businesses:

- Strengthens accountability: Ensures third-party agents adhere to company policies and ethical guidelines.

- Reduces business risks: Helps prevent fraud, misconduct, and contractual disputes.

- Improves operational efficiency: Establishes clear roles and expectations for external agents.

- Enhances reputation: Promotes professional and responsible business partnerships.

- Supports regulatory alignment: Helps businesses manage third-party relationships effectively.

Tips for using this third-party agents policy (Mississippi)

- Conduct due diligence: Research third-party agents' backgrounds, experience, and track records before entering agreements.

- Require transparency: Ensure agents provide full disclosure regarding business practices and financial transactions.

- Set performance benchmarks: Define measurable goals and expectations for third-party agents.

- Keep records of interactions: Document agreements, communications, and performance evaluations to maintain accountability.

- Provide training: Educate third-party agents on company policies, industry regulations, and ethical standards.

Q: Why should Mississippi businesses have a third-party agents policy?

A: A third-party agents policy helps businesses establish clear guidelines for working with external representatives while minimizing risks.

Q: What criteria should businesses use when selecting third-party agents?

A: Businesses should evaluate agents based on industry experience, reputation, compliance history, and ability to meet business needs.

Q: How should businesses monitor third-party agent performance?

A: Businesses should implement regular check-ins, performance reviews, and reporting requirements to ensure accountability.

Q: What should be included in agreements with third-party agents?

A: Contracts should outline roles, responsibilities, ethical expectations, reporting requirements, and termination clauses.

Q: How should businesses handle conflicts of interest with third-party agents?

A: Businesses should require agents to disclose potential conflicts and assess whether they impact business integrity.

Q: Can businesses terminate agreements with third-party agents?

A: Yes, businesses should include termination clauses in contracts to allow for disengagement if performance or ethical concerns arise.

Q: How often should this policy be reviewed?

A: Businesses should review the policy annually to ensure it reflects current business needs and industry practices.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.