Travel and expense reimbursement policy (Alabama): Free template

Travel and expense reimbursement policy (Alabama)

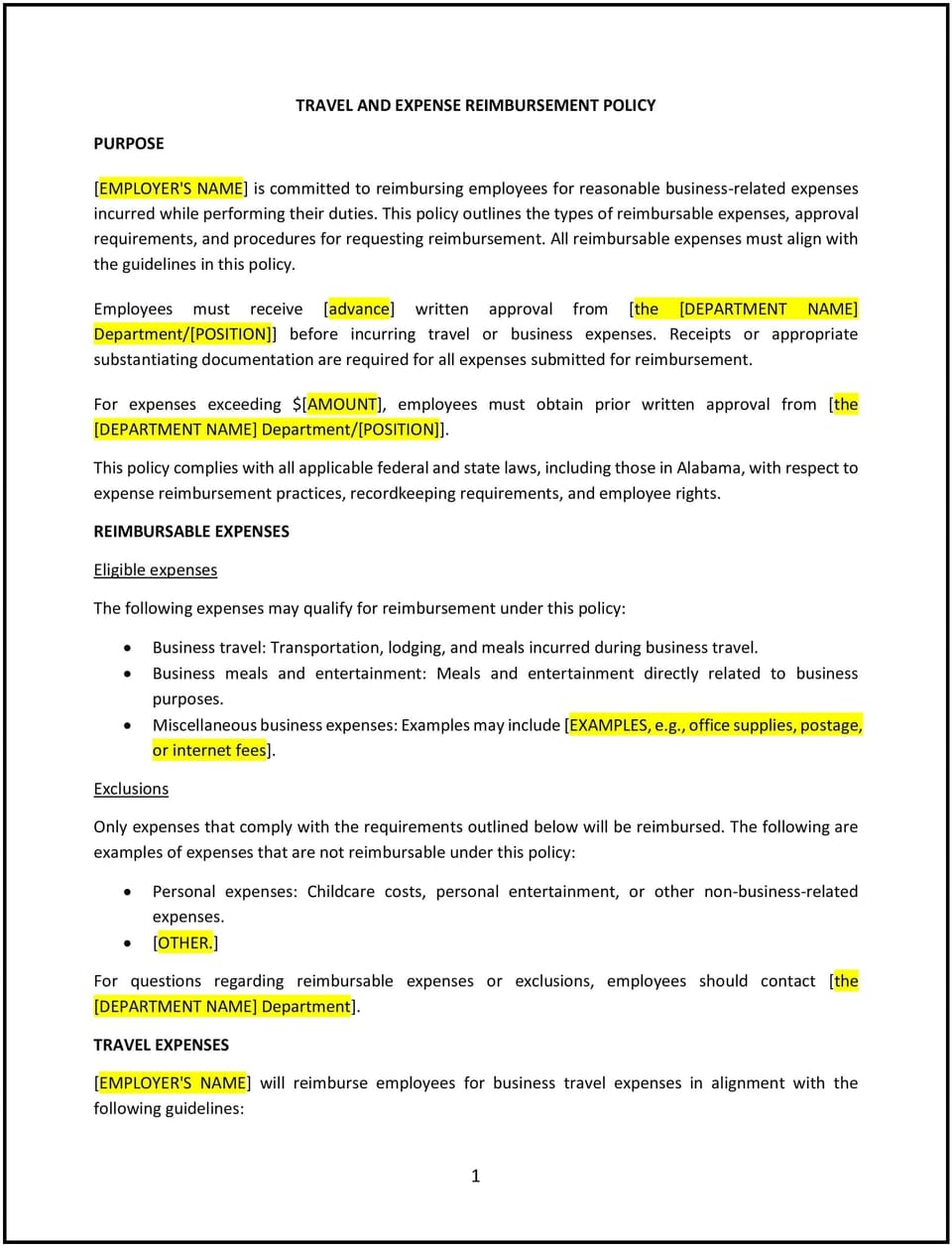

A travel and expense reimbursement policy provides guidelines for employees to claim reimbursement for business-related travel and associated expenses. For SMBs in Alabama, this policy ensures that reimbursements are handled fairly, transparently, and in compliance with applicable tax regulations.

This policy outlines the types of reimbursable expenses, approval procedures, and documentation requirements, helping businesses maintain accountability while supporting employees in fulfilling their duties.

How to use this travel and expense reimbursement policy (Alabama)

- Define reimbursable expenses: Clearly specify which expenses qualify for reimbursement, such as airfare, lodging, meals, transportation, and conference fees.

- Establish approval procedures: Require pre-approval for travel plans and major expenses to ensure alignment with company budgets and goals.

- Detail documentation requirements: Instruct employees to provide receipts, invoices, or other supporting documents for all reimbursement requests.

- Include submission deadlines: Specify the timeframe within which employees must submit reimbursement claims, typically within 30 days of incurring the expense.

- Address payment processing: Outline how reimbursements will be paid, such as through payroll or direct deposit, and the expected processing timeline.

Benefits of using a travel and expense reimbursement policy (Alabama)

A travel and expense reimbursement policy benefits both employees and the business by ensuring consistency and transparency. Here’s how it helps:

- Promotes accountability: Establishes clear rules for expense claims, reducing the risk of errors or misuse.

- Simplifies budgeting: Helps the company anticipate and control travel-related expenditures.

- Enhances employee trust: Demonstrates fairness by ensuring employees are reimbursed promptly and accurately for valid expenses.

- Streamlines processes: Provides a standardized approach to submitting and processing reimbursement requests.

- Supports compliance: Aligns expense management practices with Alabama and federal tax regulations, minimizing risks during audits.

Tips for implementing a travel and expense reimbursement policy (Alabama)

- Use standardized forms: Provide a uniform expense report template to ensure consistency in submissions.

- Communicate limits: Specify maximum allowances for categories such as meals, lodging, and transportation to manage costs effectively.

- Leverage technology: Implement expense management software to simplify submission, tracking, and approval processes.

- Monitor compliance: Conduct periodic reviews of reimbursement claims to ensure adherence to the policy and address discrepancies promptly.

- Provide clear instructions: Train employees and managers on how to use the policy and submit claims correctly to reduce errors.

Q: What types of expenses are eligible for reimbursement?

A: Eligible expenses include travel-related costs such as airfare, hotel accommodations, car rentals, meals, and conference fees that are directly related to business activities.

Q: Are there limits on reimbursable expenses?

A: Yes, the policy sets maximum allowances for categories such as meals and lodging. Employees should consult the policy or seek manager approval for clarity.

Q: How should employees submit reimbursement claims?

A: Employees must complete the company’s expense report form and attach all relevant receipts or supporting documents before submitting the claim to their manager or HR.

Q: What is the deadline for submitting expense claims?

A: Claims should typically be submitted within 30 days of incurring the expense to ensure timely processing and reimbursement.

Q: How long does it take to process reimbursement requests?

A: Reimbursements are usually processed within 10-15 business days after the claim is approved and verified.

Q: What happens if receipts are lost or unavailable?

A: Employees should provide a written explanation for missing receipts and seek manager approval for reimbursement, subject to company discretion.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.