Travel and expense reimbursement policy (Alaska): Free template

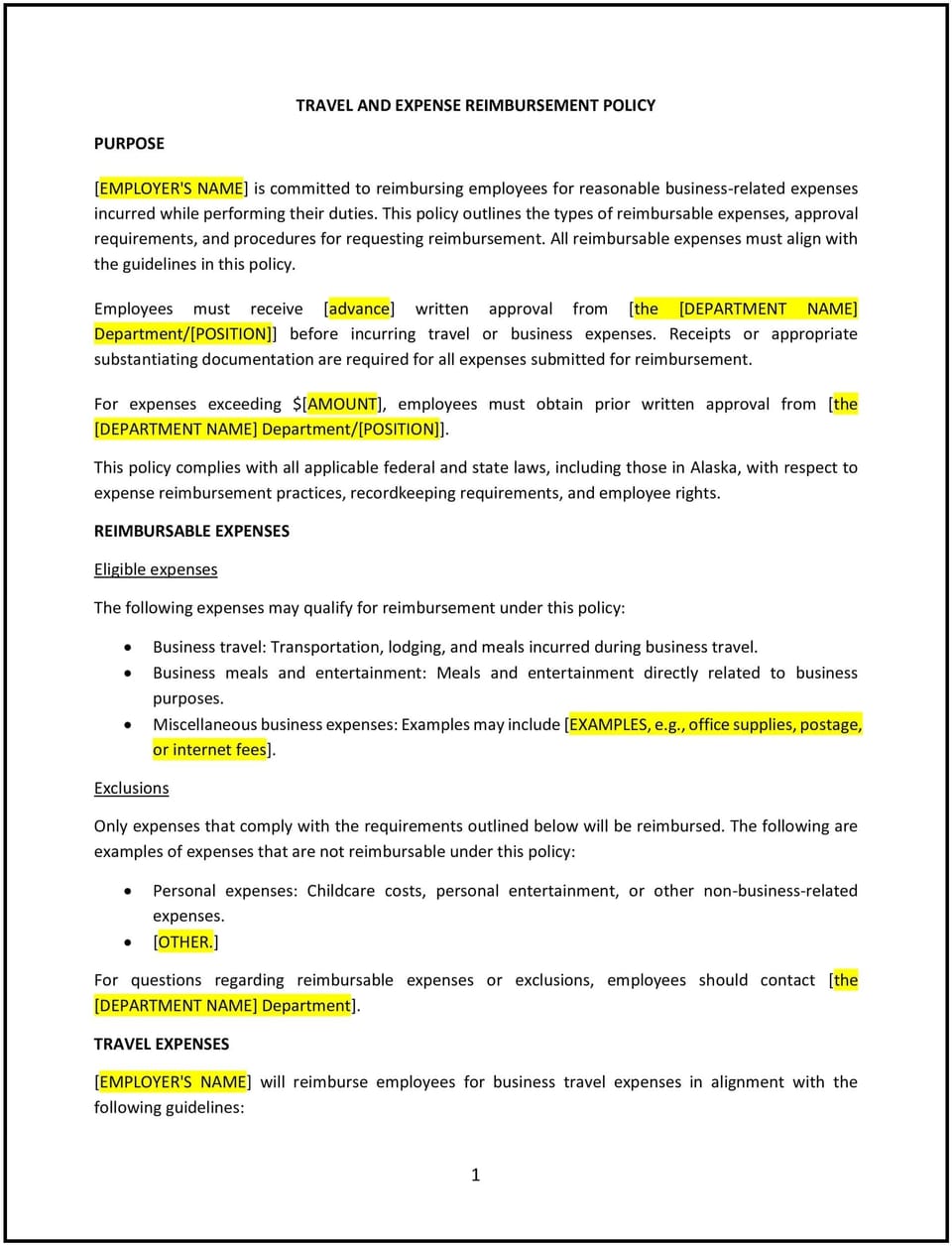

Travel and expense reimbursement policy (Alaska)

In Alaska, a travel and expense reimbursement policy provides guidelines for reimbursing employees for expenses incurred during business-related travel. This policy ensures clarity regarding eligible expenses, documentation requirements, and reimbursement processes. By implementing this policy, businesses can manage travel costs effectively while supporting employees’ needs.

How to use this travel and expense reimbursement policy (Alaska)

- Define eligible expenses: Specify which expenses are reimbursable, such as transportation, lodging, meals, and incidentals, as well as any limitations.

- Include pre-approval requirements: Require employees to obtain prior approval for business travel and related expenses from their manager or department head.

- Outline documentation standards: Provide clear instructions for submitting receipts and detailed expense reports to support reimbursement requests.

- Set reimbursement timelines: Specify how quickly employees will be reimbursed after submitting their expense reports and any deadlines for filing claims.

- Address non-reimbursable expenses: List expenses that will not be covered, such as personal entertainment, alcohol, or costs exceeding the policy limits.

Benefits of using a travel and expense reimbursement policy (Alaska)

A travel and expense reimbursement policy offers several advantages for businesses in Alaska. Here’s how it helps:

- Ensures consistency: Provides clear guidelines for employees, reducing misunderstandings about eligible expenses and reimbursement procedures.

- Controls costs: Establishes limits and approval processes to manage travel and expense budgets effectively.

- Enhances transparency: Promotes accountability by requiring detailed documentation for all reimbursement claims.

- Supports compliance: Aligns with tax regulations and record-keeping requirements for business expenses.

- Improves employee satisfaction: Offers employees clarity and confidence in recovering legitimate business expenses promptly.

Tips for using a travel and expense reimbursement policy (Alaska)

- Tailor to Alaska-specific travel: Address unique considerations such as costs associated with remote or rural travel, seasonal price fluctuations, and limited transportation options.

- Use per diem rates: Consider adopting standard per diem rates for meals and lodging to simplify expense tracking and reduce administrative burdens.

- Monitor compliance: Conduct periodic audits of expense reports to ensure adherence to the policy and identify opportunities for cost savings.

- Provide training: Educate employees on the policy, including how to submit accurate and complete expense reports.

- Update regularly: Revise the policy as needed to reflect changes in travel practices, company budgets, or tax regulations.

Q: What expenses are typically covered under this policy?

A: Eligible expenses may include transportation, lodging, meals, and other business-related costs approved in advance, such as conference fees.

Q: How can businesses control travel costs while supporting employees?

A: Set clear spending limits, require pre-approval for travel, and encourage employees to use cost-effective options like company-negotiated rates for lodging and transportation.

Q: What documentation is required for reimbursement?

A: Employees must provide itemized receipts, proof of payment, and a detailed expense report outlining the purpose of the travel and related costs.

Q: How quickly should businesses process reimbursements?

A: Reimbursements are typically processed within a set timeframe, such as 14 days, after receiving complete and accurate expense reports.

Q: How often should this policy be reviewed?

A: Review the policy annually or whenever significant changes occur in travel practices, tax regulations, or company budgets.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.