Travel and expense reimbursement policy (Arkansas): Free template

Travel and expense reimbursement policy (Arkansas)

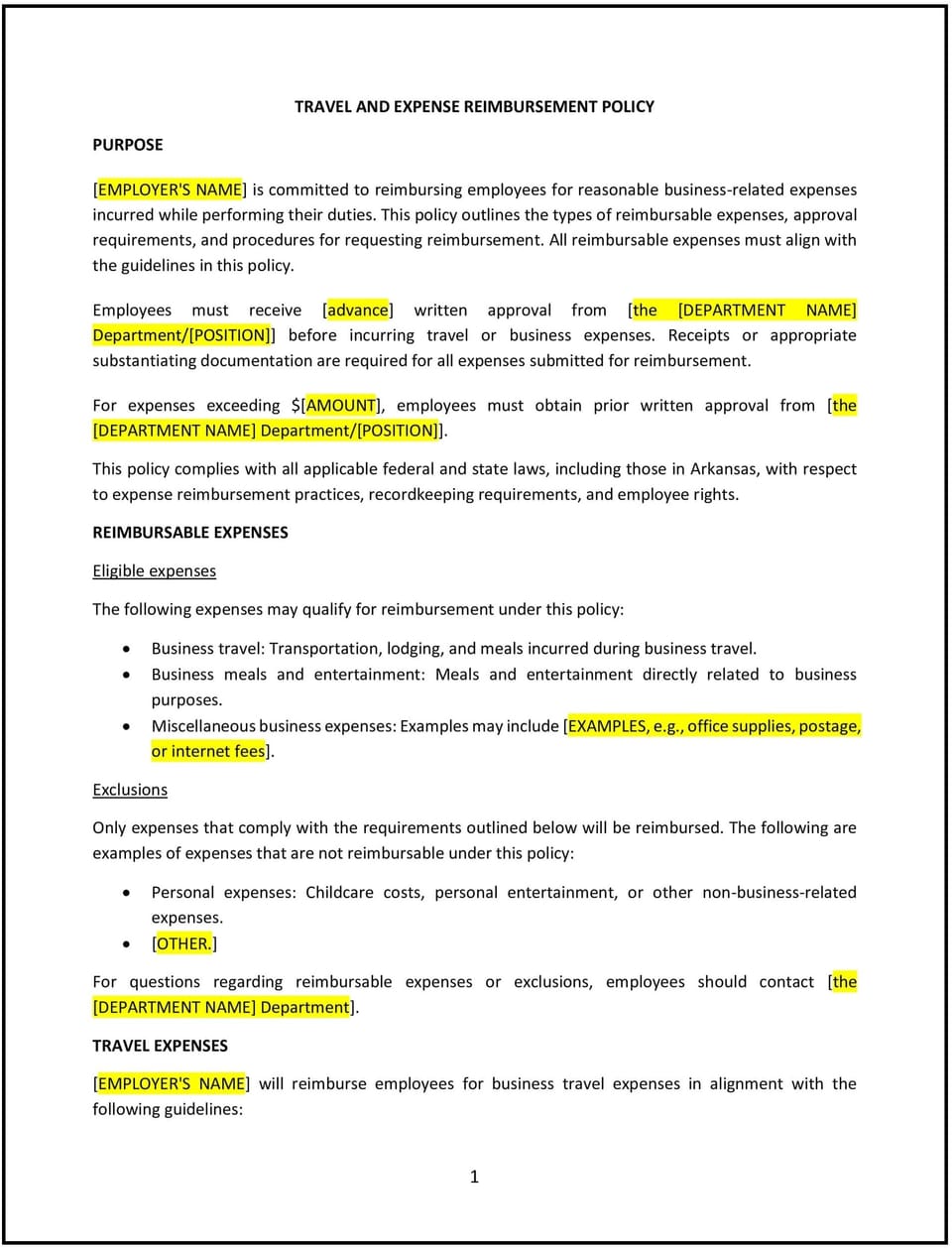

In Arkansas, a travel and expense reimbursement policy provides businesses with guidelines for reimbursing employees for work-related travel and associated expenses. This policy ensures consistency, transparency, and compliance with applicable state and federal tax laws.

This policy outlines reimbursable expenses, submission procedures, and documentation requirements, helping Arkansas businesses manage travel costs effectively while supporting employee accountability.

How to use this travel and expense reimbursement policy (Arkansas)

- Define reimbursable expenses: Specify which expenses qualify for reimbursement, such as transportation, lodging, meals, and business-related supplies.

- Establish submission procedures: Provide instructions for submitting reimbursement claims, including timelines and required forms.

- Set documentation requirements: Require employees to provide receipts or other supporting evidence for all claimed expenses.

- Communicate approval processes: Outline the process for reviewing and approving reimbursement requests to ensure consistency and fairness.

- Monitor compliance: Conduct periodic reviews of expense claims to ensure adherence to the policy and prevent misuse.

Benefits of using this travel and expense reimbursement policy (Arkansas)

This policy offers several advantages for Arkansas businesses:

- Promotes transparency: Clearly defines reimbursable expenses and submission requirements, reducing misunderstandings.

- Enhances accountability: Ensures employees provide proper documentation for claims, minimizing the risk of improper reimbursements.

- Supports compliance: Aligns with Arkansas tax regulations and federal requirements, ensuring accurate reporting and recordkeeping.

- Improves employee satisfaction: Provides a structured process for reimbursing legitimate business expenses, fostering trust and fairness.

- Controls costs: Helps the business manage travel and expense budgets effectively.

Tips for using this travel and expense reimbursement policy (Arkansas)

- Address Arkansas-specific considerations: Ensure the policy aligns with state tax regulations and travel norms.

- Train employees: Provide guidance on how to identify eligible expenses and complete reimbursement submissions correctly.

- Use standardized forms: Develop templates for expense reports to streamline the submission and approval process.

- Encourage cost-conscious decisions: Include guidelines for selecting economical travel options, such as booking flights in advance or using preferred vendors.

- Review regularly: Update the policy to reflect changes in tax laws, business practices, or travel requirements.

Q: How does this policy benefit the business?

A: This policy ensures consistent handling of travel expenses, supports compliance with tax laws, and fosters transparency and accountability in managing business costs.

Q: What types of expenses are reimbursable under this policy?

A: Reimbursable expenses include transportation, lodging, meals, and other business-related costs, as outlined in the policy.

Q: How does this policy support compliance with Arkansas tax laws?

A: The policy includes best practices for documenting and reporting expenses, ensuring compliance with state and federal tax regulations.

Q: What documentation should employees provide for reimbursement?

A: Employees should submit receipts or other proof of payment for all claimed expenses, along with completed expense reports.

Q: How can the business manage travel expenses effectively?

A: The business can set clear spending limits, encourage cost-saving practices, and regularly review expense reports to ensure budget control.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.