Travel and expense reimbursement policy (Connecticut): Free template

Travel and expense reimbursement policy (Connecticut)

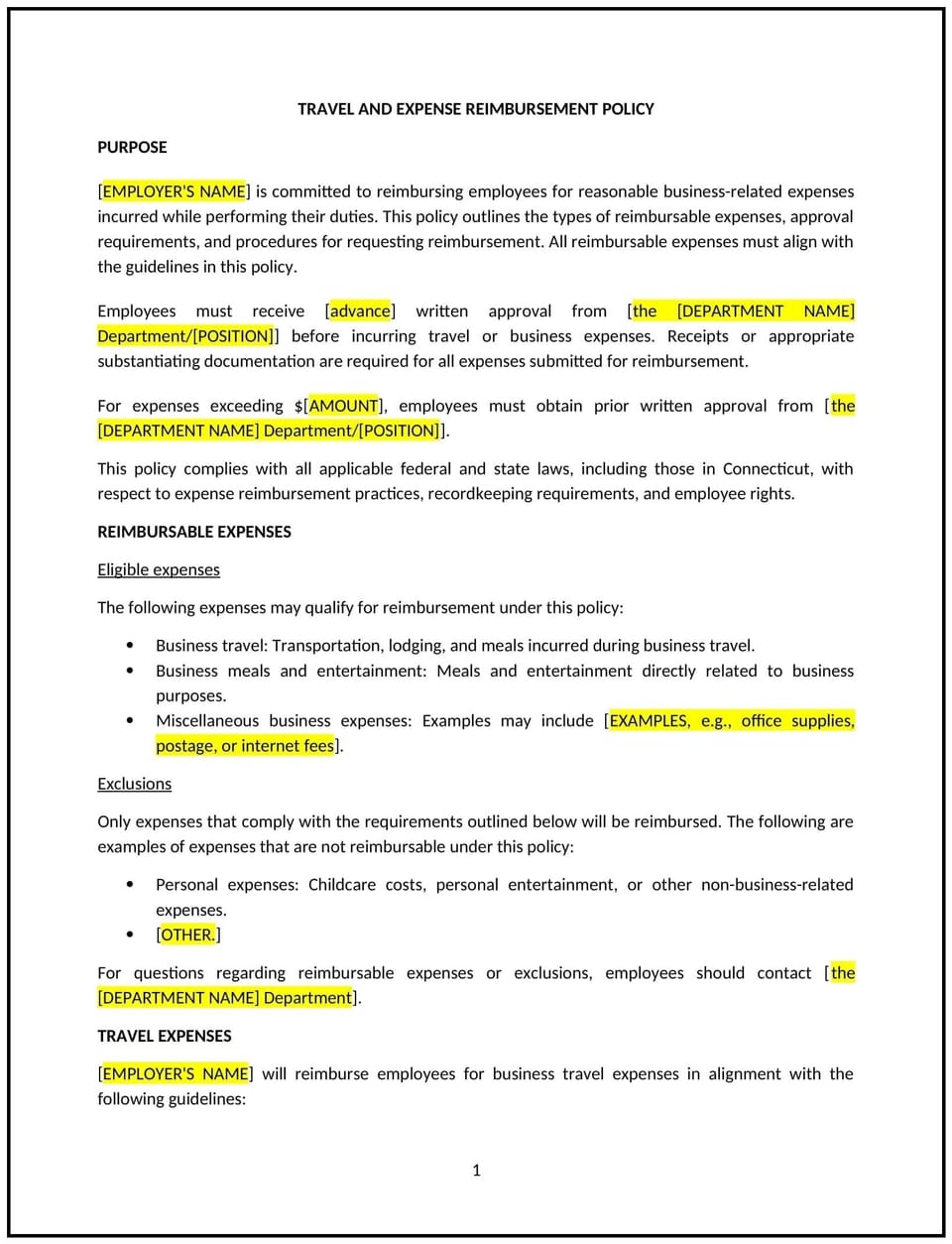

A travel and expense reimbursement policy helps Connecticut businesses establish clear guidelines for reimbursing employees for expenses incurred while traveling for work-related purposes. This policy outlines which expenses are eligible for reimbursement, the process for submitting expense reports, and the documentation required to ensure transparency and consistency in reimbursement practices.

By implementing this policy, businesses can manage travel and expenses efficiently, comply with tax regulations, and ensure that employees are fairly reimbursed for legitimate work-related expenses.

How to use this travel and expense reimbursement policy (Connecticut)

- Define eligible expenses: Clearly outline the types of expenses that are eligible for reimbursement, such as transportation, lodging, meals, and other business-related costs incurred during travel. Specify any limits or caps for each category of expenses.

- Set approval procedures: Establish a clear process for employees to request travel and expense reimbursement, including obtaining pre-approval for certain expenses (e.g., travel, accommodations) before incurring the costs.

- Reimbursement submission process: Specify the procedure for submitting expense reports, including the timeline for submission, the format for reports (e.g., itemized receipts, expense forms), and the required documentation (e.g., receipts, invoices).

- Set reimbursement timelines: Define the time frame in which employees can expect reimbursement once their expense reports are submitted, ensuring prompt payment to employees.

- Address non-reimbursable expenses: Clearly specify any expenses that will not be reimbursed, such as personal expenses or costs that do not align with company guidelines.

- Promote cost-effectiveness: Encourage employees to use cost-effective options for travel, accommodations, and meals, while balancing the need for comfort and productivity.

- Comply with tax and legal requirements: Ensure that the policy complies with Connecticut and federal tax laws, ensuring that reimbursements are processed properly and any tax implications are addressed.

Benefits of using this travel and expense reimbursement policy (Connecticut)

This policy offers several benefits for Connecticut businesses:

- Ensures fairness and consistency: By establishing clear guidelines for reimbursement, the policy ensures that all employees are reimbursed fairly and consistently for their legitimate travel and work-related expenses.

- Reduces administrative burden: A streamlined reimbursement process helps reduce the time spent on managing expenses, allowing HR or accounting teams to process reimbursements more efficiently.

- Promotes compliance: Helps ensure compliance with tax regulations and minimizes the risk of discrepancies in expense reporting.

- Supports cost control: The policy encourages employees to use cost-effective travel options, reducing unnecessary spending and improving the company’s overall travel budget management.

- Enhances employee satisfaction: Offering fair and timely reimbursement for work-related expenses helps maintain employee trust and satisfaction, particularly for employees who travel frequently for work.

Tips for using this travel and expense reimbursement policy (Connecticut)

- Communicate the policy clearly: Ensure that all employees understand the reimbursement process, including the types of expenses that are eligible for reimbursement, the required documentation, and the timeline for submitting expense reports.

- Set clear guidelines for reasonable expenses: Ensure employees understand what qualifies as reasonable and necessary expenses, and establish guidelines to help employees make cost-effective choices when traveling.

- Monitor compliance: Regularly review expense reports to ensure compliance with the policy and look for areas where expenses can be reduced or streamlined.

- Provide training on the process: Offer training or guidance to employees on how to submit expense reports, what documentation is required, and how to follow the company’s reimbursement procedures.

- Review periodically: Update the policy regularly to reflect changes in travel practices, company budget, or tax regulations, ensuring the policy remains effective and compliant.

Q: How does this policy benefit my business?

A: The policy ensures consistency and fairness in reimbursing employees for travel-related expenses, reduces administrative burden, and helps control travel costs. It also ensures compliance with tax regulations and promotes timely reimbursement for employees.

Q: What types of expenses are eligible for reimbursement?

A: Eligible expenses may include transportation (e.g., flights, car rental), lodging, meals, and other work-related costs incurred during travel. The policy should specify any limits or caps for each type of expense.

Q: How do employees submit expense reports?

A: Employees should submit detailed expense reports with itemized receipts for each eligible expense. The policy should specify the required format for the report and the timeline for submission, along with any approval steps.

Q: How soon will employees be reimbursed for expenses?

A: The policy should specify the reimbursement timeline, outlining when employees can expect to receive reimbursement after submitting their expense reports. Typically, reimbursements should be processed within a specified number of days following submission.

Q: Are there any expenses that are not reimbursed?

A: The policy should clearly define non-reimbursable expenses, such as personal expenses or costs that do not align with company guidelines, to avoid confusion and ensure transparency in the reimbursement process.

Q: How often should this policy be reviewed?

A: The policy should be reviewed annually or whenever there are changes to Connecticut laws, federal regulations, or company practices to ensure it remains compliant, effective, and relevant.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.