Travel and expense reimbursement policy (Hawaii): Free template

Travel and expense reimbursement policy (Hawaiʻi)

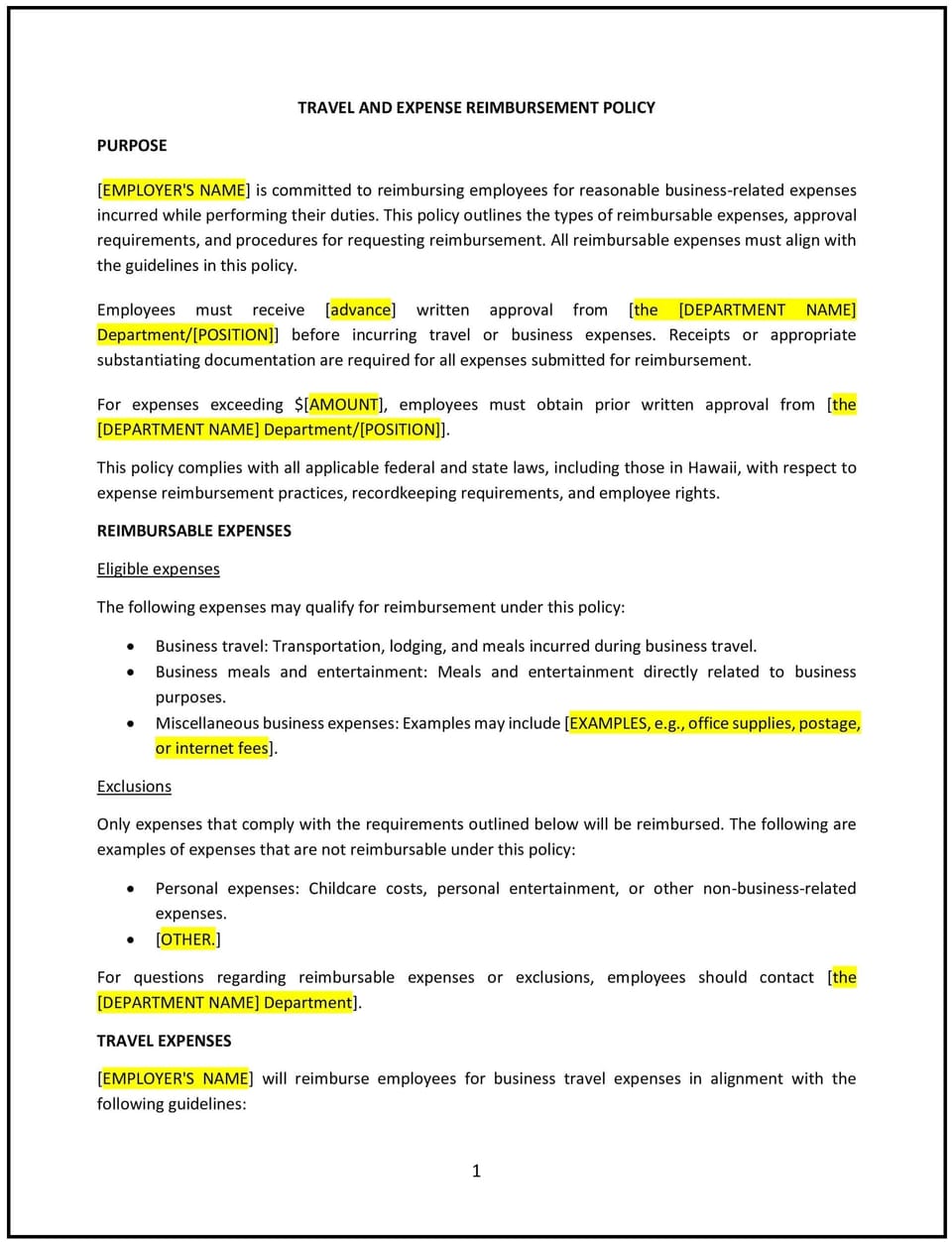

A travel and expense reimbursement policy helps Hawaiʻi businesses establish clear guidelines for managing employee travel and related expenses. This policy outlines procedures for submitting, approving, and reimbursing expenses, while addressing Hawaiʻi’s unique business environment and cultural values. It is designed to promote transparency, accountability, and efficient financial management.

By implementing this policy, businesses in Hawaiʻi can streamline expense tracking, reduce administrative burdens, and ensure fair and consistent reimbursement practices.

How to use this travel and expense reimbursement policy (Hawaiʻi)

- Define eligible expenses: Clearly outline what types of expenses are reimbursable, such as airfare, lodging, meals, transportation, and other travel-related costs.

- Set spending limits: Specify maximum allowable amounts for different expense categories, such as daily meal allowances or hotel rates.

- Establish approval processes: Describe the steps employees must follow to obtain pre-approval for travel and expenses, including required documentation.

- Provide submission guidelines: Explain how employees should submit expense reports, including deadlines, required receipts, and supporting documentation.

- Outline reimbursement timelines: Specify how long employees can expect to wait for reimbursement after submitting an expense report.

- Address non-reimbursable expenses: List expenses that are not eligible for reimbursement, such as personal purchases or non-business-related activities.

- Communicate the policy: Share the policy with employees during onboarding and through internal communications to ensure awareness and understanding.

- Train employees and managers: Educate staff on the policy’s guidelines, including how to submit expense reports and managers’ responsibilities for approval.

- Monitor and enforce the policy: Regularly review expense reports and reimbursement practices to ensure adherence to the policy.

- Review and update the policy: Periodically assess the policy’s effectiveness and make adjustments as needed to reflect changes in business needs or financial practices.

Benefits of using this travel and expense reimbursement policy (Hawaiʻi)

This policy offers several advantages for Hawaiʻi businesses:

- Promotes transparency: Clear guidelines help employees understand what expenses are reimbursable and how to submit claims, reducing confusion and disputes.

- Enhances accountability: Structured procedures for submitting and approving expenses ensure accurate record-keeping and reduce the risk of misuse.

- Streamlines processes: A standardized policy simplifies expense tracking, reimbursement, and financial reporting, saving time and resources.

- Supports budgeting: Spending limits and pre-approval processes help businesses control costs and manage travel budgets effectively.

- Builds trust: A fair and consistent reimbursement policy demonstrates the business’s commitment to treating employees equitably.

- Reduces administrative burdens: Clear guidelines and automated tools (if applicable) minimize the time spent processing expense reports.

- Aligns with business values: The policy reflects the business’s commitment to responsible financial management and employee support.

Tips for using this travel and expense reimbursement policy (Hawaiʻi)

- Communicate the policy effectively: Share the policy with employees during onboarding and through regular reminders, such as emails or training sessions.

- Use technology: Implement expense management software or tools to streamline the submission, approval, and reimbursement process.

- Provide training: Educate employees and managers on the policy’s guidelines, including how to submit expense reports and handle approvals.

- Be consistent: Apply the policy consistently to all employees to ensure fairness and transparency.

- Monitor compliance: Regularly review expense reports and reimbursement practices to ensure adherence to the policy.

- Review the policy periodically: Update the policy as needed to reflect changes in business needs, financial practices, or travel trends.

Q: Why should Hawaiʻi businesses adopt a travel and expense reimbursement policy?

A: Businesses should adopt this policy to promote transparency, streamline expense tracking, and ensure fair and consistent reimbursement practices.

Q: What types of expenses are typically reimbursable?

A: Reimbursable expenses may include airfare, lodging, meals, transportation, and other travel-related costs incurred for business purposes.

Q: How should employees submit expense reports?

A: Employees should submit expense reports with receipts and supporting documentation by the specified deadline, following the policy’s guidelines.

Q: What spending limits should businesses set for travel expenses?

A: Businesses should set reasonable limits for categories like meals, lodging, and transportation, based on industry standards and budget considerations.

Q: How long should businesses take to reimburse employees?

A: Businesses should aim to reimburse employees within a specified timeframe, such as 14 or 30 days after submitting an expense report.

Q: What expenses are typically non-reimbursable?

A: Non-reimbursable expenses may include personal purchases, entertainment, or activities not related to business purposes.

Q: How can businesses simplify the expense reimbursement process?

A: Businesses can use expense management software, provide clear guidelines, and train employees to streamline the submission and approval process.

Q: How often should businesses review the policy?

A: Businesses should review the policy annually or as needed to reflect changes in business needs, financial practices, or travel trends.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.