Travel and expense reimbursement policy (Idaho): Free template

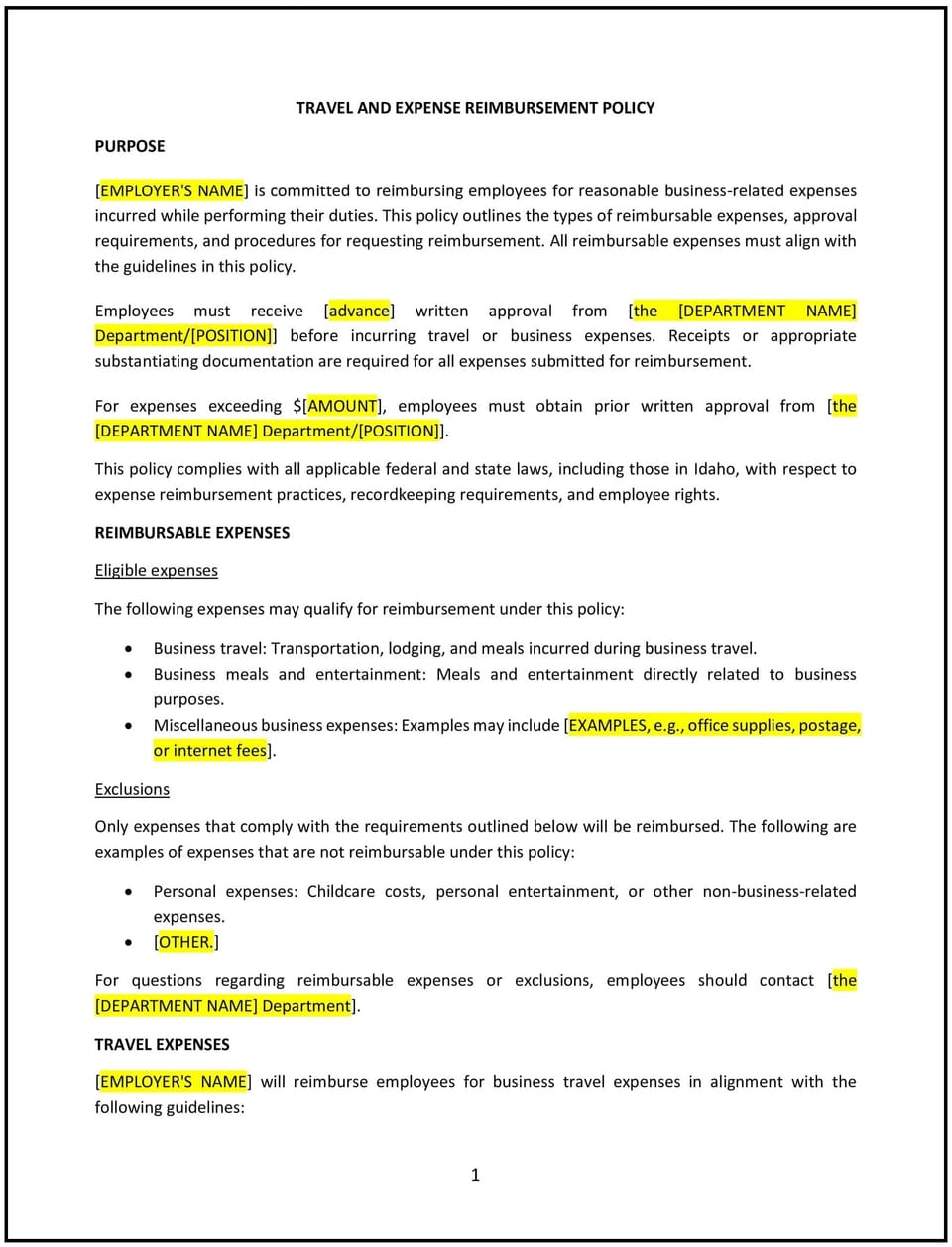

Travel and expense reimbursement policy (Idaho)

A travel and expense reimbursement policy helps Idaho businesses establish guidelines for employees who incur expenses while traveling for work or conducting business-related activities. This policy outlines the types of expenses covered, reimbursement procedures, and documentation requirements. It also emphasizes the importance of accountability, transparency, and responsible spending.

By implementing this policy, businesses can streamline expense management, reduce administrative burdens, and maintain accurate financial records.

How to use this travel and expense reimbursement policy (Idaho)

- Define eligible expenses: Specify the types of expenses that are reimbursable, such as airfare, lodging, meals, transportation, and business-related supplies, to ensure clarity and consistency in applying the policy.

- Set spending limits: Establish maximum amounts for specific expenses, such as daily meal allowances or hotel rates, to control costs and minimize risks.

- Outline reimbursement procedures: Provide clear instructions for employees to submit expense reports, including required documentation, approval processes, and timelines.

- Address advance payments: Explain the process for requesting and approving travel advances, including repayment terms and documentation requirements.

- Set documentation requirements: Require receipts or invoices for all reimbursable expenses to ensure accountability and accurate record-keeping.

- Develop approval processes: Establish procedures for reviewing and approving expense reports, including designated approvers and escalation processes for disputed expenses.

- Train employees: Provide training for employees on how to follow the policy’s procedures, submit expense reports, and maintain proper documentation.

- Review and update the policy: Periodically assess the policy’s effectiveness and make adjustments based on changes in business needs, financial practices, or Idaho laws.

Benefits of using this travel and expense reimbursement policy (Idaho)

This policy offers several advantages for Idaho businesses:

- Streamlines expense management: Clear guidelines help employees understand what expenses are reimbursable and how to submit claims, reducing administrative burdens.

- Enhances accountability: Documentation requirements and approval processes ensure expenses are legitimate and properly accounted for.

- Reduces costs: Spending limits and clear guidelines help control travel and business-related expenses, minimizing unnecessary spending.

- Improves financial controls: The policy helps businesses maintain proper financial controls and reduce the risk of misuse or errors.

- Supports transparency: Regular review and documentation of expenses foster trust and transparency in financial practices.

- Encourages responsible spending: Setting limits and requiring approvals helps control expenditures and prevent overspending.

Tips for using this travel and expense reimbursement policy (Idaho)

- Communicate the policy clearly: Share the policy with employees through onboarding materials, training sessions, or internal communication platforms to ensure awareness and understanding.

- Train employees: Provide training on how to submit expense reports, follow the policy’s procedures, and maintain proper documentation.

- Monitor compliance: Regularly review expense reports to ensure adherence to the policy and identify any potential issues.

- Stay informed about legal updates: Keep up-to-date with changes to Idaho laws or financial regulations that may impact travel and expense reimbursement.

- Encourage transparency: Foster a culture where employees feel comfortable reporting discrepancies or concerns related to expenses.

- Document everything: Maintain detailed records of expense reports, receipts, and approvals to ensure accountability and transparency.

Q: Why should Idaho businesses have a travel and expense reimbursement policy?

A: A travel and expense reimbursement policy provides clear guidelines for managing work-related expenses, ensuring accountability, transparency, and responsible spending.

Q: What types of expenses should businesses reimburse?

A: Businesses should reimburse expenses such as airfare, lodging, meals, transportation, and business-related supplies, as long as they are incurred for legitimate business purposes.

Q: How should businesses set spending limits for travel and expenses?

A: Businesses should establish maximum amounts for specific expenses, such as daily meal allowances or hotel rates, to control costs and minimize risks.

Q: What documentation is required for expense reimbursement?

A: Businesses should require receipts or invoices for all reimbursable expenses to ensure accountability and accurate record-keeping.

Q: How should businesses handle travel advances?

A: Businesses should outline the process for requesting and approving travel advances, including repayment terms and documentation requirements.

Q: How can businesses ensure fairness in approving expense reports?

A: Businesses should apply the policy consistently, provide clear communication, and document all approvals and disputes to ensure fairness and transparency.

Q: How often should businesses review their travel and expense reimbursement policy?

A: Businesses should review the policy annually or as needed to ensure it aligns with current business needs, financial practices, and Idaho laws.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.