Travel and expense reimbursement policy (Indiana): Free template

Travel and expense reimbursement policy (Indiana): Free template

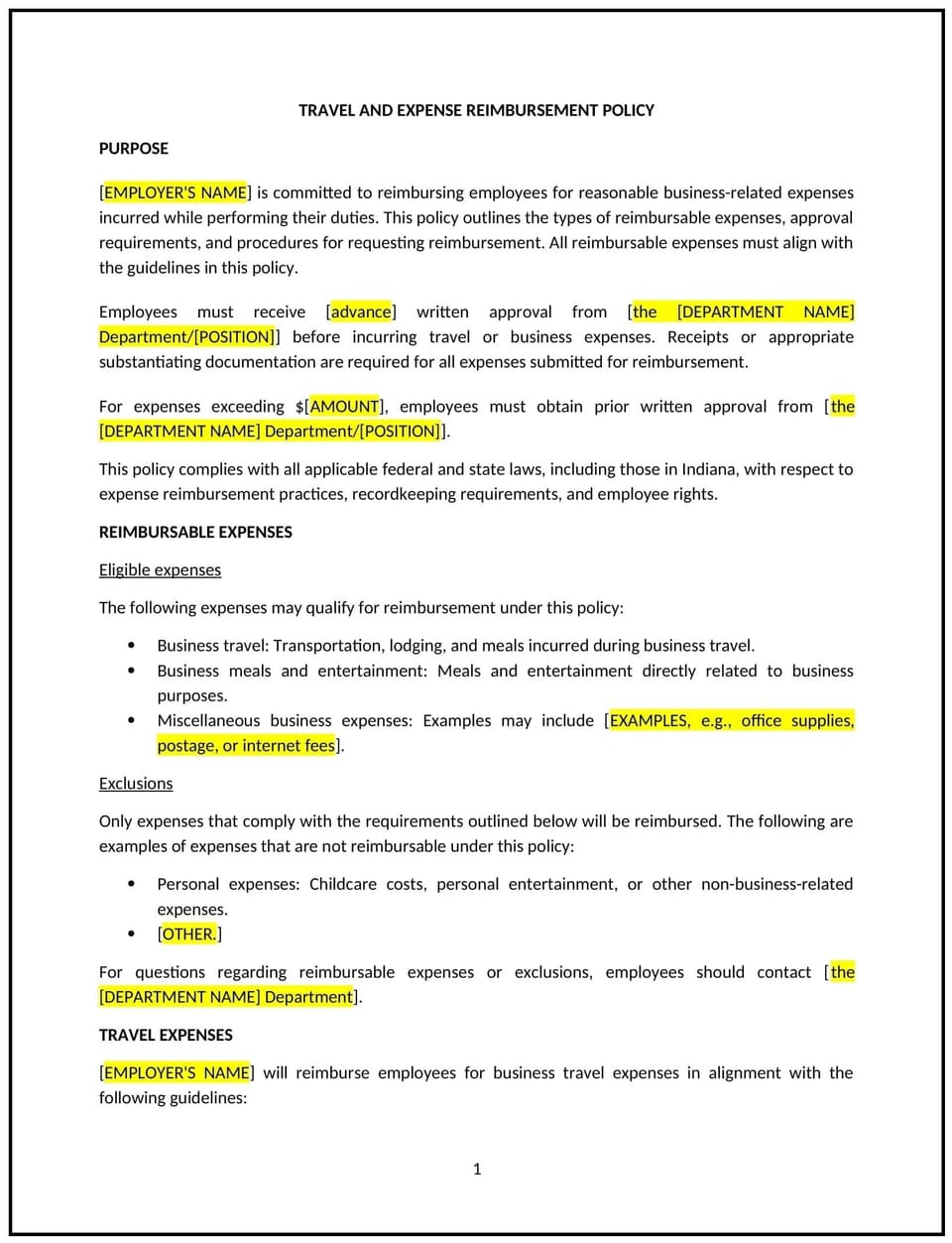

This travel and expense reimbursement policy helps Indiana businesses provide clear guidelines for reimbursing employees for business-related travel and expenses. It outlines eligible expenses, reimbursement procedures, and documentation requirements to ensure accuracy and transparency. By implementing this policy, businesses can streamline reimbursement processes, maintain budget control, and support employees conducting work-related travel.

By implementing this policy, Indiana businesses can ensure fair, consistent, and efficient reimbursement practices while fostering accountability.

How to use this travel and expense reimbursement policy (Indiana)

- Define eligible expenses: Specify which expenses are reimbursable, such as transportation, lodging, meals, and incidentals incurred during business-related travel. Include any restrictions, such as daily limits or excluded items.

- Outline approval procedures: Require employees to obtain pre-approval for travel and significant expenses, providing clear steps for requesting approval and documenting the purpose of the travel or expense.

- Detail documentation requirements: Specify the documentation needed for reimbursement, such as receipts, invoices, or mileage logs, and set a deadline for submitting reimbursement claims.

- Establish reimbursement limits: Include per diem rates or maximum reimbursement amounts for specific expenses, such as hotel stays or meal allowances, to control costs.

- Address payment methods: Clarify whether employees are expected to use personal funds, company credit cards, or travel advances for business-related expenses.

- Provide submission procedures: Include instructions for submitting reimbursement claims, such as using an expense management system or completing a specific form.

- Define timelines: State the timeframe for processing reimbursement requests and issuing payments to employees.

- Review and update regularly: Periodically assess the policy to ensure it reflects changes in business practices, travel needs, or Indiana regulations.

Benefits of using this travel and expense reimbursement policy (Indiana)

Implementing this policy provides several key benefits for Indiana businesses:

- Promotes transparency: Clearly defines reimbursable expenses and processes, reducing confusion or disputes.

- Enhances employee satisfaction: Ensures employees are promptly reimbursed for legitimate business expenses, supporting their financial well-being.

- Supports budget control: Establishes clear limits and guidelines for reimbursable expenses, helping businesses manage costs effectively.

- Improves efficiency: Streamlines the reimbursement process with clear instructions and timelines, saving time for both employees and administrators.

- Reduces compliance risks: Aligns with Indiana laws and tax regulations regarding expense reporting and reimbursement.

- Encourages accountability: Requires employees to provide proper documentation, ensuring expenses are valid and necessary.

Tips for using this travel and expense reimbursement policy (Indiana)

- Communicate the policy: Share the policy during onboarding and ensure it is included in the employee handbook for easy access.

- Train employees: Provide training on the reimbursement process and tools, such as expense management software, to ensure compliance and efficiency.

- Monitor expenses: Regularly review expense reports to identify trends or areas where cost control measures may be needed.

- Provide clear examples: Include examples of reimbursable and non-reimbursable expenses to help employees understand the policy.

- Encourage timely submissions: Remind employees to submit reimbursement requests promptly to avoid delays or missed deadlines.

- Keep records: Maintain accurate records of all reimbursements for auditing and tax purposes.

Q: What expenses are covered under this policy?

A: Reimbursable expenses typically include transportation, lodging, meals, and business-related incidentals. The policy should specify any limits or exclusions.

Q: Are there limits on reimbursable expenses?

A: Yes, businesses can set limits on reimbursable expenses, such as per diem rates for meals or maximum amounts for lodging, to maintain budget control.

Q: How can employees request pre-approval for travel expenses?

A: Employees should submit a travel request form or email outlining the purpose, estimated costs, and duration of the trip for management approval before incurring expenses.

Q: What documentation is required for reimbursement?

A: Employees must provide original receipts, invoices, or other supporting documents for all reimbursable expenses. Mileage claims should include a log of distances traveled.

Q: How long do employees have to submit reimbursement claims?

A: Employees should submit claims within a specified timeframe, such as 30 days from the date the expense was incurred, as outlined in the policy.

Q: How long does it take to process reimbursement requests?

A: Reimbursement requests are typically processed within a specific timeframe, such as 7-14 business days, depending on the company’s internal procedures.

Q: Can employees use company credit cards for travel expenses?

A: Yes, if company credit cards are provided, employees should use them for eligible travel expenses and follow guidelines for submitting receipts and reconciliation.

Q: How often should the policy be reviewed?

A: The policy should be reviewed annually or whenever there are significant changes to business practices or Indiana regulations.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.