Travel and expense reimbursement policy (Iowa): Free template

Travel and expense reimbursement policy (Iowa)

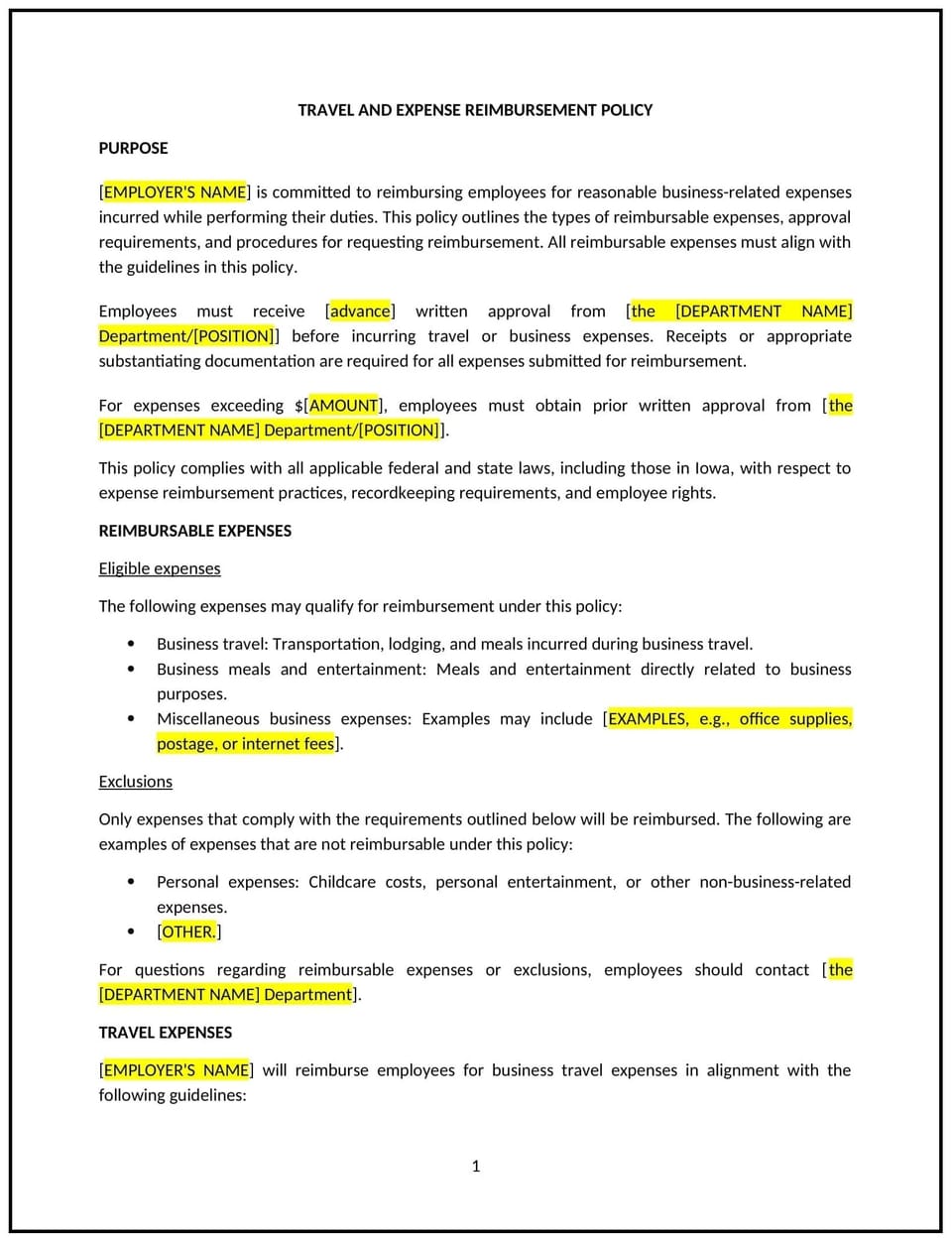

A travel and expense reimbursement policy helps Iowa businesses manage and control employee spending when traveling for work or engaging in business-related activities. This policy defines the types of expenses that are eligible for reimbursement, establishes limits and guidelines for allowable expenses, and outlines the process for submitting and approving reimbursement claims.

By implementing this policy, businesses can ensure consistency in how travel and expenses are handled, maintain control over company spending, and provide clear expectations for employees when traveling on behalf of the company.

How to use this travel and expense reimbursement policy (Iowa)

- Define eligible expenses: Clearly specify the types of expenses that are eligible for reimbursement, such as airfare, lodging, meals, transportation, and any other costs directly related to business travel.

- Set spending limits: Establish maximum allowable amounts for different categories of expenses, such as per diem limits for meals, hotel stay allowances, and transportation costs. Provide clear guidelines to prevent excessive or unnecessary spending.

- Define the reimbursement process: Outline the steps employees must follow to request reimbursement, including submitting receipts, completing reimbursement forms, and obtaining necessary approvals before incurring expenses.

- Address travel booking: Specify whether the company will cover the cost of booking travel (e.g., flights, hotels, car rentals) or if employees should book their own travel and seek reimbursement afterward. Include preferred booking methods or services, if applicable.

- Clarify reimbursement for non-travel expenses: Define how non-travel-related business expenses, such as client meals, office supplies, or professional development costs, should be submitted for reimbursement and what is considered an appropriate expense.

- Implement an approval process: Set clear guidelines for who must approve travel and expenses before they are incurred, and specify the levels of approval required depending on the amount or type of expense.

- Review and update regularly: Periodically review and update the policy to ensure it aligns with changes in business practices, industry standards, and tax regulations.

Benefits of using this travel and expense reimbursement policy (Iowa)

This policy offers several key benefits for Iowa businesses:

- Promotes transparency: A clear and consistent policy helps employees understand what expenses are eligible for reimbursement and prevents misunderstandings or confusion.

- Controls business spending: By setting spending limits and approval processes, businesses can ensure that travel and business expenses are reasonable and within budget.

- Enhances accountability: Employees are held accountable for adhering to the policy guidelines when submitting reimbursement requests, helping to reduce fraudulent or excessive claims.

- Streamlines the reimbursement process: Establishing a formal process for submitting and approving expenses ensures that reimbursements are handled efficiently and in a timely manner.

- Reduces financial risk: Clear limits and guidelines help businesses avoid overpayment and ensure that reimbursements are in line with company budget and legal requirements.

- Increases employee satisfaction: A well-communicated reimbursement policy ensures employees are reimbursed fairly for business-related expenses, fostering goodwill and supporting their work-related travel needs.

Tips for using this travel and expense reimbursement policy (Iowa)

- Communicate the policy clearly: Ensure all employees understand the reimbursement policy, including the types of expenses covered, the approval process, and how to submit reimbursement requests.

- Set clear guidelines for allowable expenses: Specify any exclusions or non-reimbursable expenses (e.g., alcohol, personal expenses) to avoid confusion and ensure that only legitimate business expenses are covered.

- Encourage pre-approval for large expenses: Require employees to obtain approval for large or unusual expenses before incurring them, helping to prevent unexpected or excessive claims.

- Provide an easy reimbursement process: Streamline the process for submitting receipts and claims by offering online submission or expense management software, which can reduce delays and administrative workload.

- Ensure timely reimbursement: Process reimbursement claims in a timely manner to maintain employee satisfaction and ensure that employees are not financially burdened by out-of-pocket expenses.

- Review expenses regularly: Periodically assess the effectiveness of the policy by reviewing submitted claims to ensure they align with company objectives and budget constraints.

Q: Why should Iowa businesses implement a travel and expense reimbursement policy?

A: Businesses should implement this policy to manage travel-related expenses efficiently, set clear guidelines for employees, maintain control over spending, and ensure fair and timely reimbursement for employees who incur business-related costs.

Q: What types of expenses are eligible for reimbursement?

A: Eligible expenses typically include airfare, lodging, meals, ground transportation (e.g., taxis, car rentals), and any other expenses directly related to business travel or activities. Businesses should specify any non-eligible expenses, such as personal costs or alcohol.

Q: How can employees request reimbursement for travel and expenses?

A: Employees should submit a reimbursement request by completing an expense report, attaching receipts or proof of payment, and submitting the claim for approval. The policy should specify whether electronic submissions or physical paperwork are required.

Q: Are there limits on how much employees can spend on travel and expenses?

A: Yes, businesses should set reasonable limits for different types of expenses, such as per diem rates for meals, hotel stay caps, or car rental allowances. These limits should align with the company's budget and industry standards.

Q: What happens if an employee exceeds the spending limits for travel expenses?

A: Employees should be informed that exceeding spending limits may result in partial reimbursement or the employee being responsible for the additional cost. Businesses should outline how exceptions will be handled, such as requiring pre-approval for higher expenses.

Q: How does the reimbursement process work for employees who travel frequently for work?

A: Employees who travel frequently should follow the same process for submitting reimbursement requests as other employees, though businesses may allow for regular, recurring claims or set up automated systems for faster reimbursement.

Q: How can businesses manage the approval process for travel and expenses?

A: Businesses should establish a clear approval hierarchy for expenses, ensuring that each request is reviewed and approved by the appropriate manager or supervisor based on the amount of the claim. Managers should be responsible for verifying that the expenses are reasonable and within the budget.

Q: Can employees be reimbursed for non-travel-related business expenses?

A: Yes, employees may be reimbursed for non-travel-related expenses such as meals with clients, office supplies, or training costs. The policy should clearly define which non-travel expenses are eligible for reimbursement and provide a process for submitting these claims.

Q: How often should businesses review their travel and expense reimbursement policy?

A: Businesses should review the policy regularly, at least annually, to ensure it remains aligned with company objectives, changes in regulations, and industry best practices. Regular reviews help businesses adapt to evolving travel trends and employee needs.

Q: What should employees do if they have questions about a reimbursement claim?

A: Employees should reach out to their supervisor or the designated finance or HR team member responsible for handling reimbursements to clarify any questions or concerns about their claim. The policy should include contact details for assistance.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.