Travel and expense reimbursement policy (Kansas): Free template

Travel and expense reimbursement policy (Kansas)

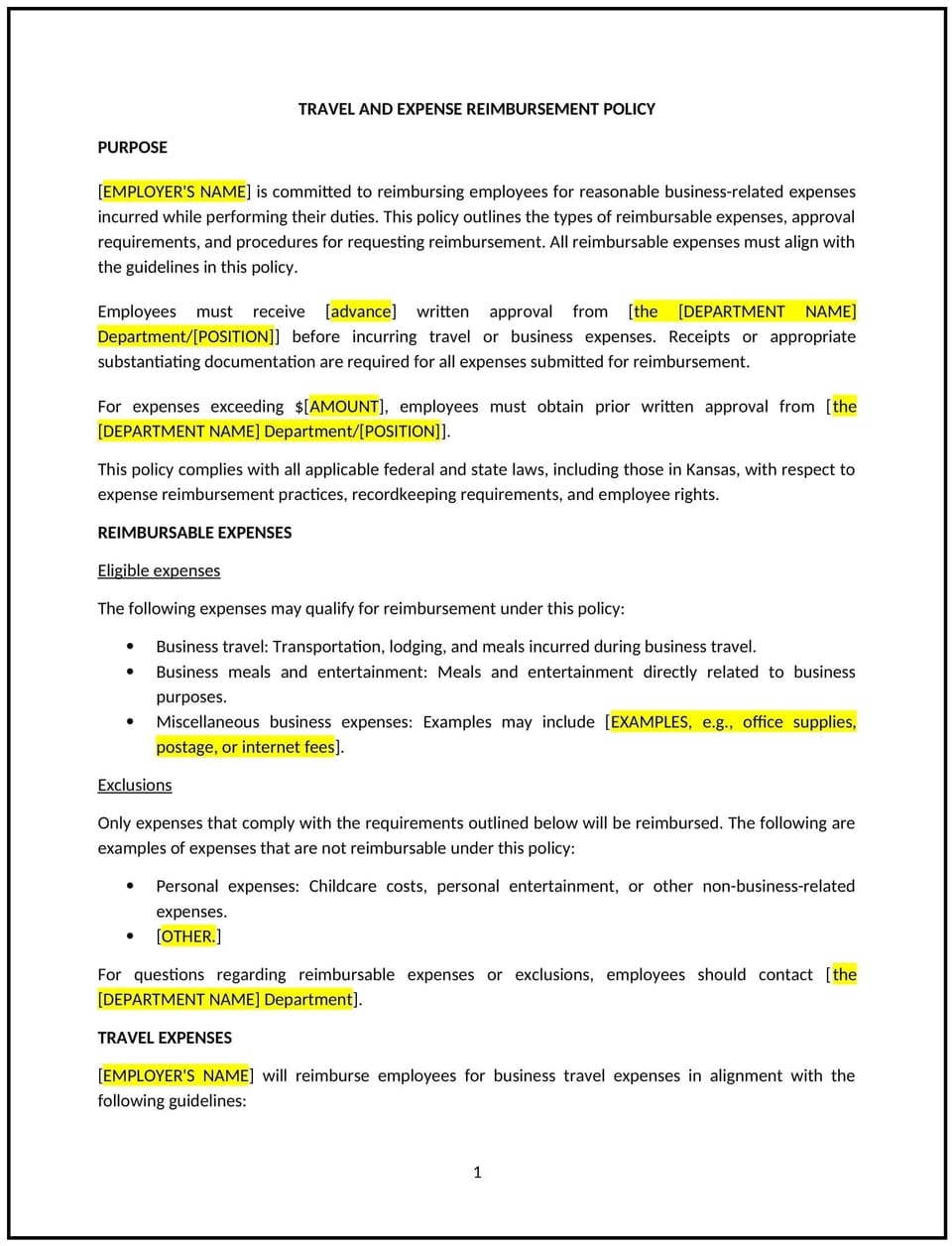

A travel and expense reimbursement policy helps Kansas businesses manage and control expenses incurred by employees while traveling for work or during business-related activities. This policy outlines the types of expenses that are eligible for reimbursement, the process for submitting claims, and the documentation required to ensure that all reimbursements are accurate and aligned with company guidelines.

By implementing this policy, businesses can ensure that employees are reimbursed fairly for legitimate work-related expenses while maintaining budget control and ensuring transparency in financial operations.

How to use this travel and expense reimbursement policy (Kansas)

- Define reimbursable expenses: The policy should clearly define which types of expenses are eligible for reimbursement, such as transportation, lodging, meals, and other necessary travel-related costs. It should specify any limits or caps on certain expenses.

- Set approval procedures: Employees should obtain approval from their manager or a designated person before incurring certain expenses. The policy should outline the process for obtaining pre-approval for large or unusual expenses.

- Provide submission guidelines: The policy should specify how employees should submit expense claims, including the format, required documentation (e.g., receipts, invoices), and deadlines for submission.

- Set reimbursement timelines: The policy should clarify how quickly employees can expect to be reimbursed for their expenses once claims are submitted, and whether reimbursements will be made through payroll or other means.

- Establish payment limits: The policy should set guidelines on what constitutes reasonable and necessary expenses, providing limits for meals, lodging, and other categories of expenses.

- Encourage cost-effective practices: The policy should encourage employees to be mindful of costs when traveling and to select economical options where possible without compromising on the quality or necessity of the service.

- Review and update regularly: The policy should be periodically reviewed to ensure it remains up-to-date with changing business needs, industry standards, and any changes in relevant laws or tax regulations.

Benefits of using a travel and expense reimbursement policy (Kansas)

- Controls business spending: A clear travel and expense policy helps businesses manage and control travel-related costs, ensuring that expenses remain within budget and that only legitimate, necessary expenses are reimbursed.

- Promotes fairness and transparency: By providing clear guidelines, businesses ensure that all employees are reimbursed fairly and consistently, reducing confusion or disputes regarding expense claims.

- Simplifies expense management: A well-structured policy streamlines the expense submission and reimbursement process, making it easier for both employees and finance departments to manage claims efficiently.

- Reduces errors and fraud: Requiring receipts and documentation for all expenses helps prevent fraudulent claims and ensures that reimbursements are legitimate.

- Enhances employee satisfaction: Clear guidelines and timely reimbursement can improve employee morale, as employees are assured that they will be compensated for valid business expenses without delay or confusion.

- Supports tax compliance: A formal policy helps ensure that the company complies with tax regulations related to business expenses and that reimbursements are properly documented for tax reporting purposes.

Tips for using this travel and expense reimbursement policy (Kansas)

- Communicate the policy clearly: Ensure all employees understand the travel and expense reimbursement policy, including what types of expenses are covered, how to submit claims, and the approval process.

- Require timely submission of claims: Encourage employees to submit their expense reports promptly after travel to avoid delays in processing and to ensure expenses are accurately accounted for within the correct fiscal period.

- Keep accurate records: Both employees and the finance department should maintain accurate and organized records of all receipts and documentation associated with travel expenses.

- Monitor expenses regularly: Businesses should regularly review travel expenses to identify trends, ensure compliance with policy, and make adjustments where necessary to control costs.

- Encourage cost-conscious behavior: Businesses should promote cost-effective travel choices, such as using discounted fares, booking in advance, and limiting unnecessary expenses.

- Review and update the policy periodically: The policy should be reviewed annually or when necessary to reflect changes in the company’s travel practices, budget, or any changes in applicable laws or tax regulations.

Q: Why should Kansas businesses implement a travel and expense reimbursement policy?

A: Businesses should implement a travel and expense reimbursement policy to manage and control travel-related costs, ensure fairness in reimbursements, streamline the claims process, and maintain compliance with legal and tax requirements.

Q: What types of expenses are eligible for reimbursement?

A: Eligible expenses typically include transportation (flights, trains, taxis), lodging, meals, parking, and other necessary travel-related costs. The policy should define specific guidelines for each category, including any spending limits.

Q: How do employees request reimbursement for travel expenses?

A: Employees should submit an expense report with detailed information about the expenses incurred, including receipts, the purpose of the trip, and any other required documentation. The policy should specify how and when these reports should be submitted.

Q: How soon can employees expect to be reimbursed?

A: The policy should outline the expected timeframe for reimbursement after submission, such as within one or two payroll cycles, depending on the company’s internal processing procedures.

Q: Are there limits on how much employees can spend on meals or lodging?

A: The policy should set reasonable limits on expenses for meals, lodging, and other categories to ensure costs are controlled. These limits may vary depending on the location of the trip, the duration, and the level of the employee’s position.

Q: Do employees need to get approval before booking travel?

A: The policy should require that employees obtain approval from a manager or supervisor before booking significant travel expenses to ensure that the travel is necessary and aligns with company objectives.

Q: What happens if an employee submits an expense that is not covered by the policy?

A: The policy should specify the process for handling non-reimbursable expenses, such as notifying the employee and outlining what steps will be taken to address the situation.

Q: How often should businesses review and update their travel and expense reimbursement policy?

A: Businesses should review the policy at least annually to ensure it aligns with current company practices, industry standards, and any changes in laws or regulations that may impact the reimbursement process.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.