Travel and expense reimbursement policy (Maine): Free template

Travel and expense reimbursement policy (Maine): Free template

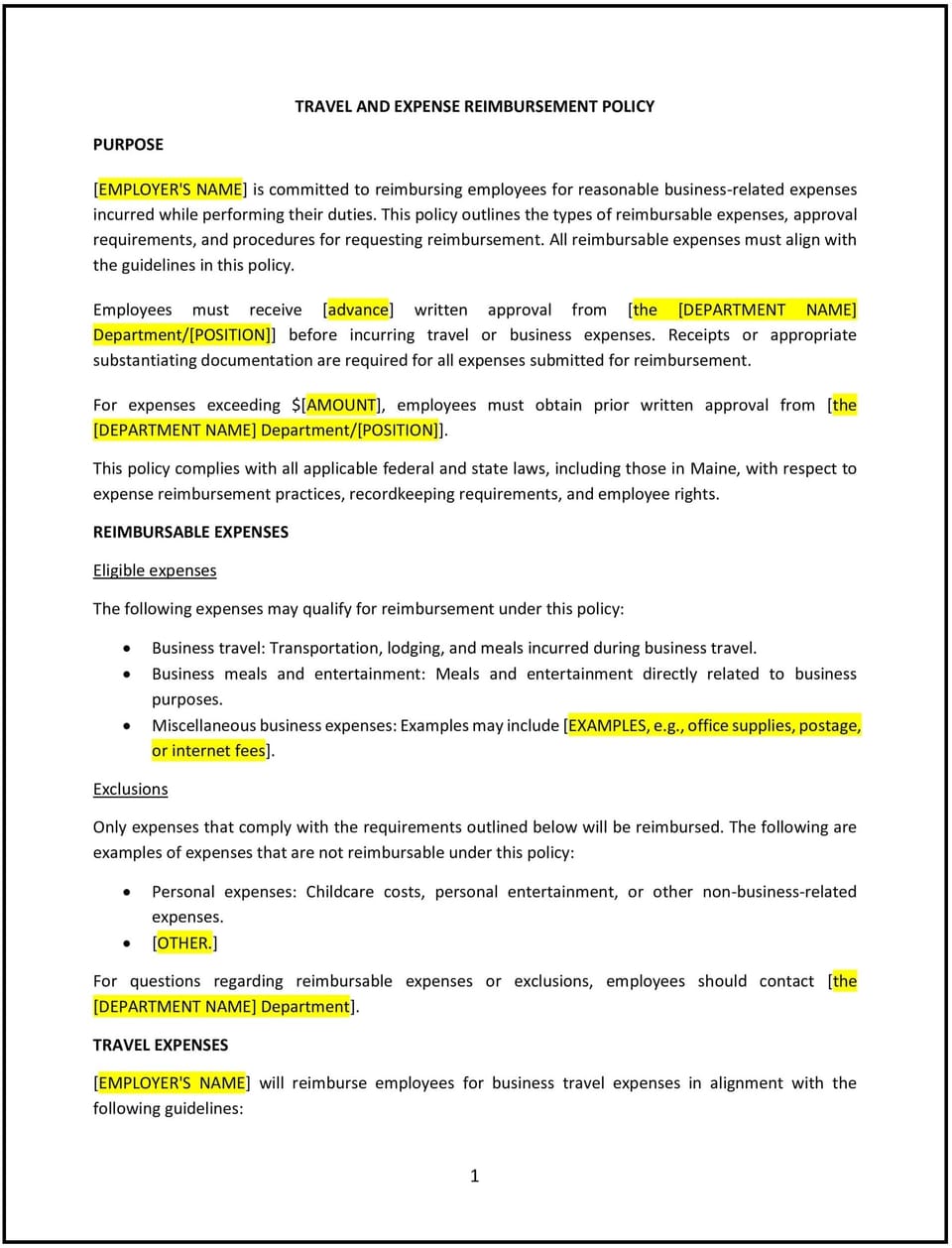

This travel and expense reimbursement policy is designed to help Maine businesses manage employee expenses related to travel and other business-related activities. It outlines the guidelines for reimbursing employees for travel expenses, such as transportation, lodging, meals, and other incidental costs incurred while performing job-related duties.

By implementing this policy, Maine businesses can maintain control over travel expenditures, ensure consistent and fair reimbursement practices, and support compliance with financial and tax regulations.

How to use this travel and expense reimbursement policy (Maine)

- Define eligible expenses: Clearly outline the types of expenses that will be reimbursed, including transportation (airfare, car rentals, mileage), lodging, meals, and other business-related expenses like conference fees or tips.

- Set approval process: Specify how employees should request reimbursement, including the requirement for pre-approval from managers or HR for certain expenses (e.g., large or unusual expenses).

- Establish reimbursement limits: Set reasonable limits for various categories of expenses, such as daily meal allowances or hotel room rates, to prevent excessive spending.

- Provide documentation requirements: Require employees to submit receipts, invoices, or other documentation for all expenses being reimbursed, ensuring that only legitimate expenses are reimbursed.

- Outline reimbursement timing: Specify the timeline for submitting expenses and how soon employees can expect to receive reimbursements once expenses are approved.

- Set non-reimbursable expenses: Clearly state what types of expenses will not be reimbursed, such as personal expenses, alcohol, or expenses outside of the scope of business-related activities.

- Review regularly: Update the policy periodically to reflect changes in business practices, travel trends, or financial regulations.

Benefits of using this travel and expense reimbursement policy (Maine)

Implementing this policy provides several benefits for Maine businesses:

- Ensures financial control: Establishes clear limits and approval processes for travel expenses, helping businesses manage their travel budgets effectively.

- Promotes consistency: Ensures that all employees are treated fairly by applying the same reimbursement rules across the organization.

- Reduces confusion: Provides employees with clear guidelines on what is reimbursable and how to submit claims, reducing misunderstandings and disputes.

- Ensures compliance: Helps the business comply with state and federal tax regulations regarding employee reimbursements, ensuring that expenses are properly documented and reported.

- Enhances transparency: Establishes transparent procedures for employees to follow, promoting fairness and trust in how business expenses are managed.

Tips for using this travel and expense reimbursement policy (Maine)

- Communicate the policy: Ensure all employees are informed about the policy and understand the procedures for submitting and receiving reimbursement, ideally through the employee handbook or during onboarding.

- Require pre-approval for large expenses: For significant travel costs, such as flights or hotel stays, employees should seek approval from a manager or HR before booking to ensure compliance with the company’s reimbursement limits.

- Streamline the reimbursement process: Use digital tools or expense management software to track and approve expenses, ensuring a smooth and efficient reimbursement process.

- Monitor expense trends: Regularly review travel and expense reports to identify trends or areas where costs may be reduced or better controlled.

- Provide training: Ensure managers and employees are trained on the policy’s requirements, including which expenses are eligible for reimbursement and the documentation needed.

Q: What types of expenses are eligible for reimbursement?

A: Eligible expenses typically include transportation (airfare, car rentals, mileage), lodging, meals, and other business-related expenses, such as conference fees and parking.

Q: How should employees submit travel expenses for reimbursement?

A: Employees should submit itemized receipts, invoices, or other documentation for all expenses, along with a completed expense report form, to their manager or HR for approval.

Q: Are there any limits on reimbursement amounts?

A: Yes, the policy should specify limits for various categories of expenses, such as daily meal allowances or hotel rates, to ensure that expenses are reasonable and within budget.

Q: What is the process for getting approval for large expenses?

A: Employees should seek pre-approval from their manager or HR for large or unusual expenses, such as airfare or lodging, before booking to ensure they comply with the company’s reimbursement policy.

Q: How long do employees have to submit their expenses?

A: Employees should submit their expenses within a specified period (e.g., 30 days) after the trip or business-related activity to ensure timely processing of reimbursement.

Q: Are personal expenses reimbursed?

A: No, personal expenses, including personal travel, entertainment, and alcohol, are not reimbursed under this policy. Only business-related expenses are eligible for reimbursement.

Q: How often should businesses review their travel and expense reimbursement policy?

A: Businesses should review the policy annually or whenever there are changes to business practices, travel trends, or financial regulations to ensure it remains effective and compliant.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.