Tuition assistance policy (Alabama): Free template

Tuition assistance policy (Alabama)

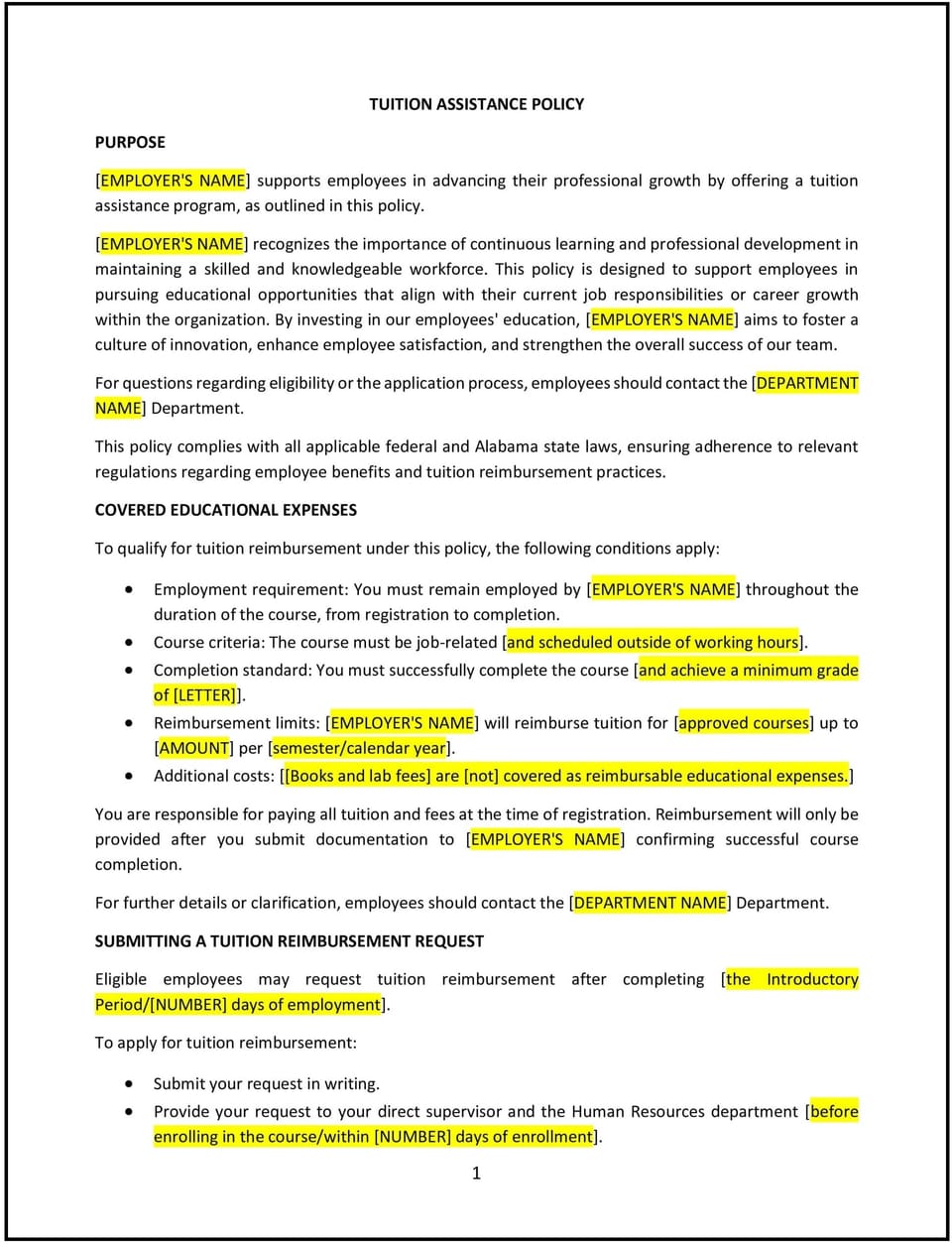

A tuition assistance policy provides a structured framework for companies to support employees pursuing education and professional development opportunities. For SMBs in Alabama, this policy can help enhance workforce skills, improve employee retention, and align development efforts with business objectives.

This policy establishes clear guidelines on eligibility, approved expenses, and reimbursement terms, helping companies implement a consistent and transparent approach to educational assistance.

How to use this tuition assistance policy (Alabama)

- Define qualifying programs: Specify the types of educational courses or certifications eligible for assistance, focusing on those that provide measurable value to the company.

- Establish eligibility requirements: Include criteria for employees, such as minimum tenure or performance standards, ensuring the policy is applied fairly.

- Clarify reimbursement terms: Set clear rules on covered expenses (e.g., tuition, books) and maximum annual limits for assistance.

- Streamline the application process: Provide a template or step-by-step guidance for employees to request tuition support, including approvals from leadership or HR.

- Include return-on-investment terms: Outline how the company will benefit, such as requiring a commitment to stay for a certain period after program completion.

Benefits of using a tuition assistance policy (Alabama)

A well-crafted tuition assistance policy can provide measurable benefits for SMBs:

- Enhances skills: Helps employees acquire knowledge and credentials that directly contribute to business goals.

- Improves retention: Demonstrates the company’s commitment to employee growth, reducing turnover rates.

- Increases engagement: Motivates employees by investing in their professional development, leading to higher morale and productivity.

- Controls costs: Provides a clear structure for educational expenses, helping manage budgets effectively.

- Attracts talent: Positions the company as an employer of choice by offering competitive benefits.

Tips for using a tuition assistance policy (Alabama)

- Tie education to business needs: Focus assistance on programs that align with the company’s strategic goals, such as leadership training or industry certifications.

- Use agreements: Require employees to sign agreements detailing terms for repayment if they leave the company shortly after receiving tuition support.

- Track outcomes: Monitor how supported education translates into measurable benefits, such as improved performance or expanded business capabilities.

- Leverage tax benefits: Research potential tax deductions or credits for offering tuition assistance to employees.

- Keep policies flexible: Allow adjustments to annual limits or covered expenses based on the company’s financial health or changing needs.

Q: What types of programs should companies consider funding?

A: SMBs typically fund programs that directly support their business, such as leadership development, certifications in relevant industries, or technical skills training.

Q: How can SMBs manage costs for tuition assistance?

A: Set annual caps or per-employee limits, and focus on funding courses that align with immediate business needs. Monitor results to ensure ROI.

Q: Are there tax benefits for SMBs offering tuition assistance?

A: Yes, companies may be eligible for tax deductions or credits for educational assistance programs, subject to federal and Alabama-specific guidelines.

Q: What safeguards should companies put in place for reimbursement?

A: Require employees to meet performance standards in their coursework and stay with the company for a set period post-completion. Agreements can include repayment clauses for early departures.

Q: How does this policy benefit the company directly?

A: Employees gain skills that enhance business operations, reduce reliance on external training, and build loyalty within the workforce.

Q: Should companies revisit the policy regularly?

A: Yes, review the policy annually to adjust reimbursement limits, update eligible programs, and align with evolving business goals or budget considerations.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.