Tuition assistance policy (Alaska): Free template

Tuition assistance policy (Alaska)

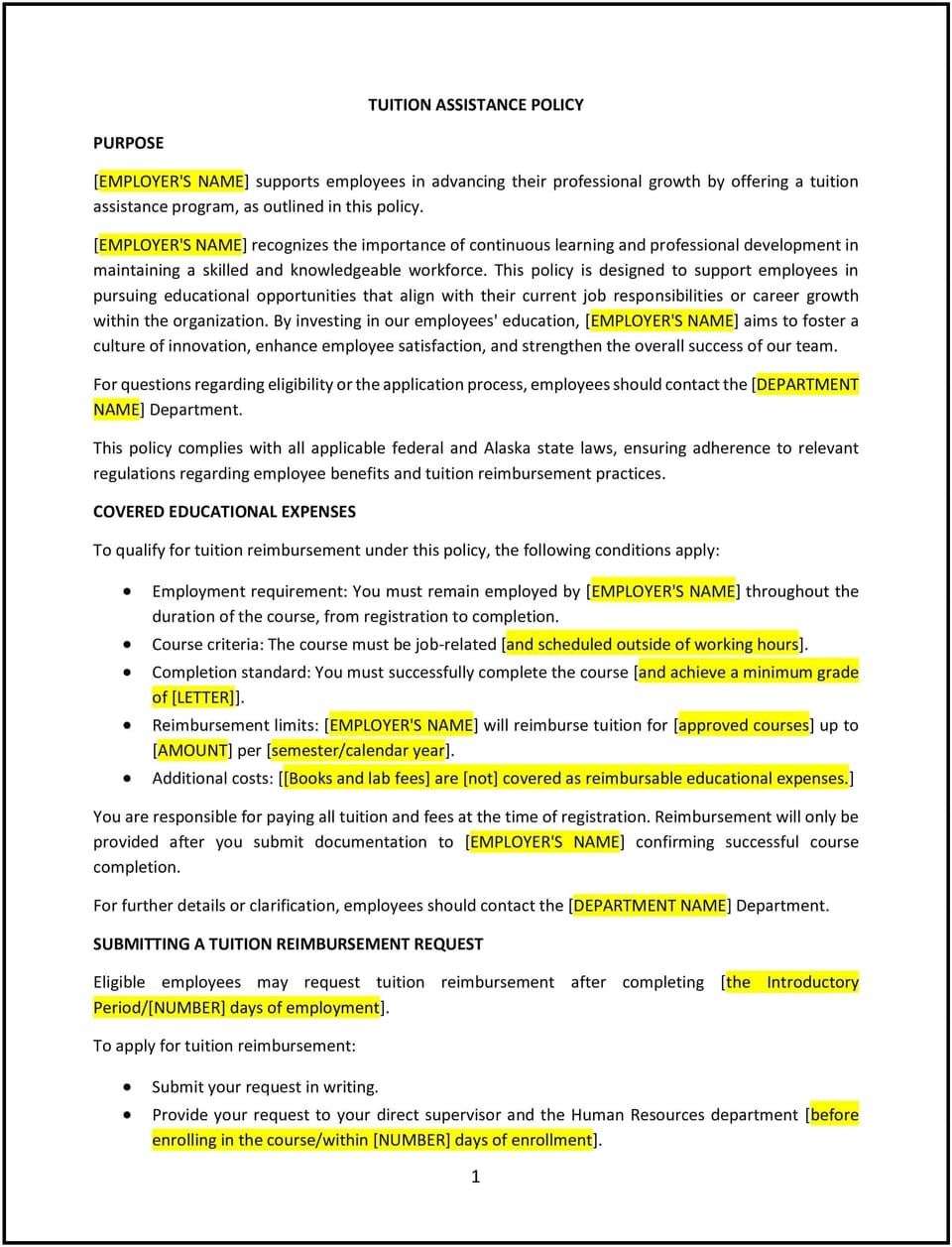

In Alaska, a tuition assistance policy provides guidelines for supporting employees seeking to enhance their education through job-related courses, certifications, or degree programs. This policy outlines eligibility, covered expenses, and reimbursement procedures, helping businesses foster professional development while maintaining accountability for resources.

By implementing this policy, businesses can invest in workforce skills while promoting employee loyalty and satisfaction.

How to use this tuition assistance policy (Alaska)

- Define eligibility: Clearly outline which employees qualify for tuition assistance, such as full-time or long-tenured staff, and specify any performance requirements.

- Specify covered expenses: Detail which costs are eligible for reimbursement, such as tuition, textbooks, and required fees, and establish annual reimbursement limits.

- Include approval procedures: Require employees to obtain pre-approval for courses or programs, demonstrating alignment with company goals or job relevance.

- Address reimbursement criteria: Specify conditions for reimbursement, such as achieving a minimum grade or completing the course successfully.

- Clarify repayment obligations: Include provisions requiring employees to repay tuition assistance if they leave the company within a certain timeframe after completing the program.

Benefits of using a tuition assistance policy (Alaska)

A tuition assistance policy provides several advantages for businesses in Alaska. Here’s how it helps:

- Encourages professional growth: Supports employees in gaining knowledge and skills that directly benefit their roles and the company.

- Boosts employee retention: Demonstrates a commitment to employee development, fostering loyalty and reducing turnover.

- Enhances competitiveness: Prepares employees to address industry-specific challenges and contribute to the company’s success.

- Promotes accountability: Ensures tuition assistance is used effectively by establishing clear eligibility and reimbursement criteria.

- Builds reputation: Positions the company as an attractive employer for talent seeking career advancement opportunities.

Tips for using a tuition assistance policy (Alaska)

- Tailor to workforce needs: Focus assistance on programs relevant to Alaska’s industries, such as natural resources, healthcare, or education.

- Use tax benefits: Ensure the policy complies with IRS guidelines to allow tax-free reimbursement for eligible educational expenses.

- Encourage internal growth: Prioritize programs that prepare employees for future leadership roles within the company.

- Monitor program effectiveness: Track employee participation and post-training contributions to evaluate the policy’s impact.

- Update regularly: Revise the policy to reflect changes in workforce priorities, educational offerings, or budget considerations.

Q: What types of education programs are eligible for tuition assistance?

A: Eligible programs typically include job-related courses, certifications, or degree programs that align with the company’s goals or the employee’s role.

Q: How much financial assistance is provided under this policy?

A: Reimbursement limits depend on the company’s budget and policy, often capped annually or per program.

Q: What documentation is required for reimbursement?

A: Employees must submit proof of enrollment, itemized receipts, and transcripts or certificates showing successful completion of the course.

Q: What happens if an employee leaves the company after receiving tuition assistance?

A: Employees may be required to repay some or all of the assistance if they leave within a specified timeframe, as outlined in the policy.

Q: How often should this policy be reviewed?

A: Review the policy annually or whenever changes occur in educational needs, company goals, or budget allocations.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.