Tuition assistance policy (California): Free template

Tuition assistance policy (California)

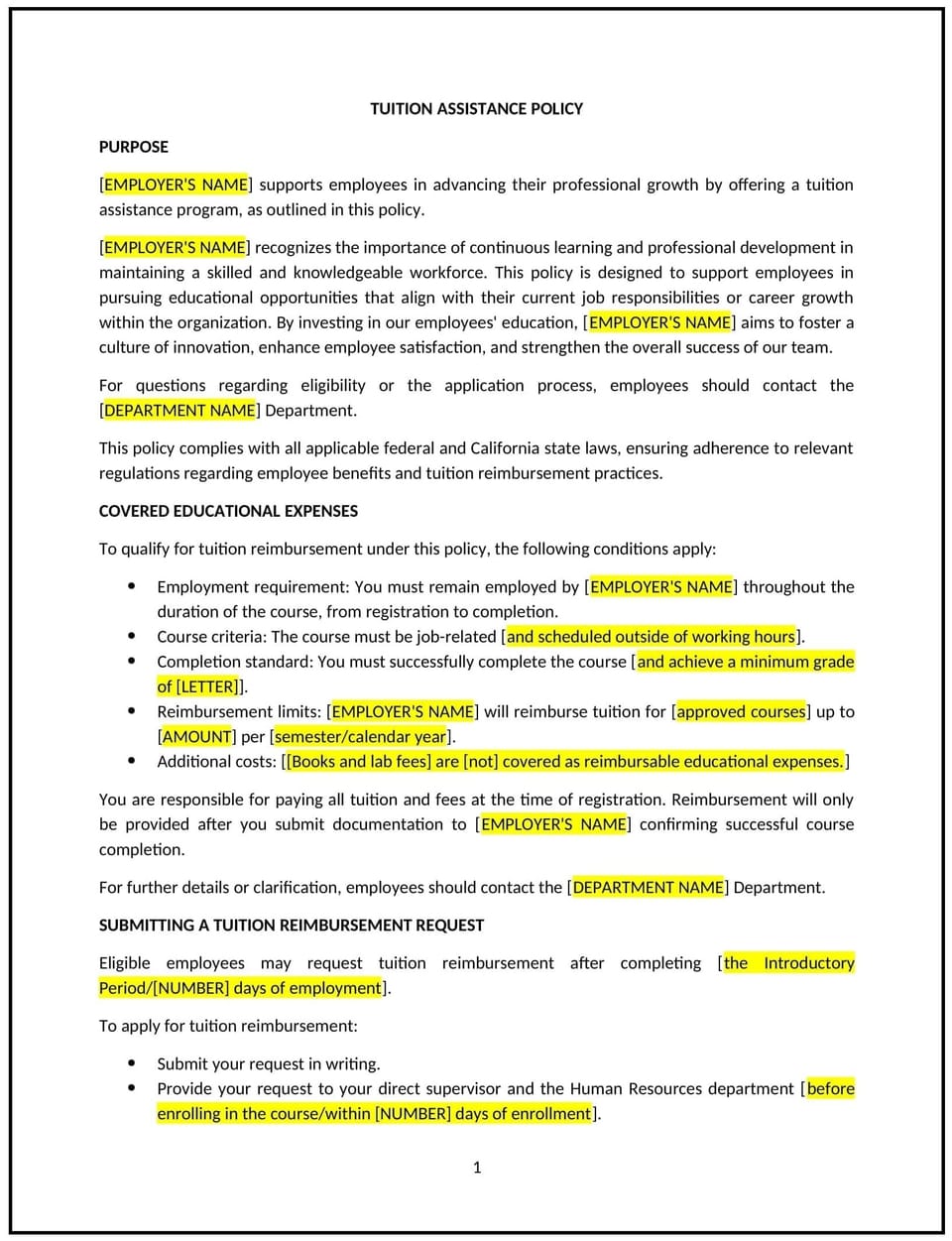

In California, a tuition assistance policy provides businesses with guidelines for supporting employees in pursuing educational opportunities that enhance their skills and align with the business’s goals. This policy helps businesses attract and retain talent, foster professional growth, and maintain compliance with California labor laws, including wage and hour regulations.

This policy outlines eligibility criteria, the process for requesting tuition assistance, and the business’s expectations for employees who participate in the program. By implementing this policy, California businesses can invest in workforce development while promoting employee satisfaction.

How to use this tuition assistance policy (California)

- Define eligibility: Specify the criteria employees must meet to qualify for tuition assistance, such as tenure, job performance, and relevance of the course to their role.

- Outline covered expenses: Clearly state what is covered, such as tuition, fees, or books, and set limits on reimbursement amounts or percentages.

- Communicate the application process: Provide steps for employees to request assistance, including deadlines and required documentation, such as proof of enrollment or course descriptions.

- Address repayment obligations: Include provisions for repayment if the employee leaves the business within a specified period after receiving assistance.

- Monitor progress: Require employees to provide proof of course completion and maintain satisfactory grades to continue receiving support.

Benefits of using this tuition assistance policy (California)

This policy offers several advantages for California businesses:

- Supports compliance: Reflects California labor laws by ensuring lawful handling of wage deductions and reimbursement processes.

- Promotes professional growth: Encourages employees to gain new skills that enhance job performance and align with business objectives.

- Improves retention: Demonstrates the business’s commitment to employee development, fostering loyalty and satisfaction.

- Enhances reputation: Positions the business as an employer that invests in workforce education and development.

- Provides clarity: Ensures employees understand the terms and conditions of the program, minimizing misunderstandings.

Tips for using this tuition assistance policy (California)

- Reflect California-specific laws: Ensure compliance with state wage and hour regulations, including repayment agreements for tuition assistance.

- Communicate effectively: Share details about the program during onboarding or employee training sessions.

- Use clear agreements: Require signed agreements outlining the terms of tuition assistance and repayment obligations, if applicable.

- Monitor expenses: Set annual or program-specific limits to manage the business’s budget for tuition assistance.

- Review regularly: Update the policy to reflect changes in California laws, educational trends, or business needs.

Q: How does this policy benefit the business?

A: This policy supports compliance with California laws, fosters employee development, and enhances workforce skills aligned with the business’s objectives.

Q: What types of educational programs are eligible under this policy?

A: Eligible programs may include job-related courses, certifications, or degree programs that enhance the employee’s role or career development.

Q: How does this policy support compliance with California laws?

A: The policy reflects state labor regulations, ensuring lawful reimbursement processes and handling of repayment agreements.

Q: What steps should employees take to apply for tuition assistance?

A: Employees should submit an application to HR, provide details of the program, and include any required documentation, such as proof of enrollment.

Q: How can the business manage its tuition assistance budget?

A: The business can set annual caps, prioritize programs aligned with business goals, and regularly evaluate the program’s impact on workforce development.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.