Tuition assistance policy (Delaware): Free template

Tuition assistance policy (Delaware)

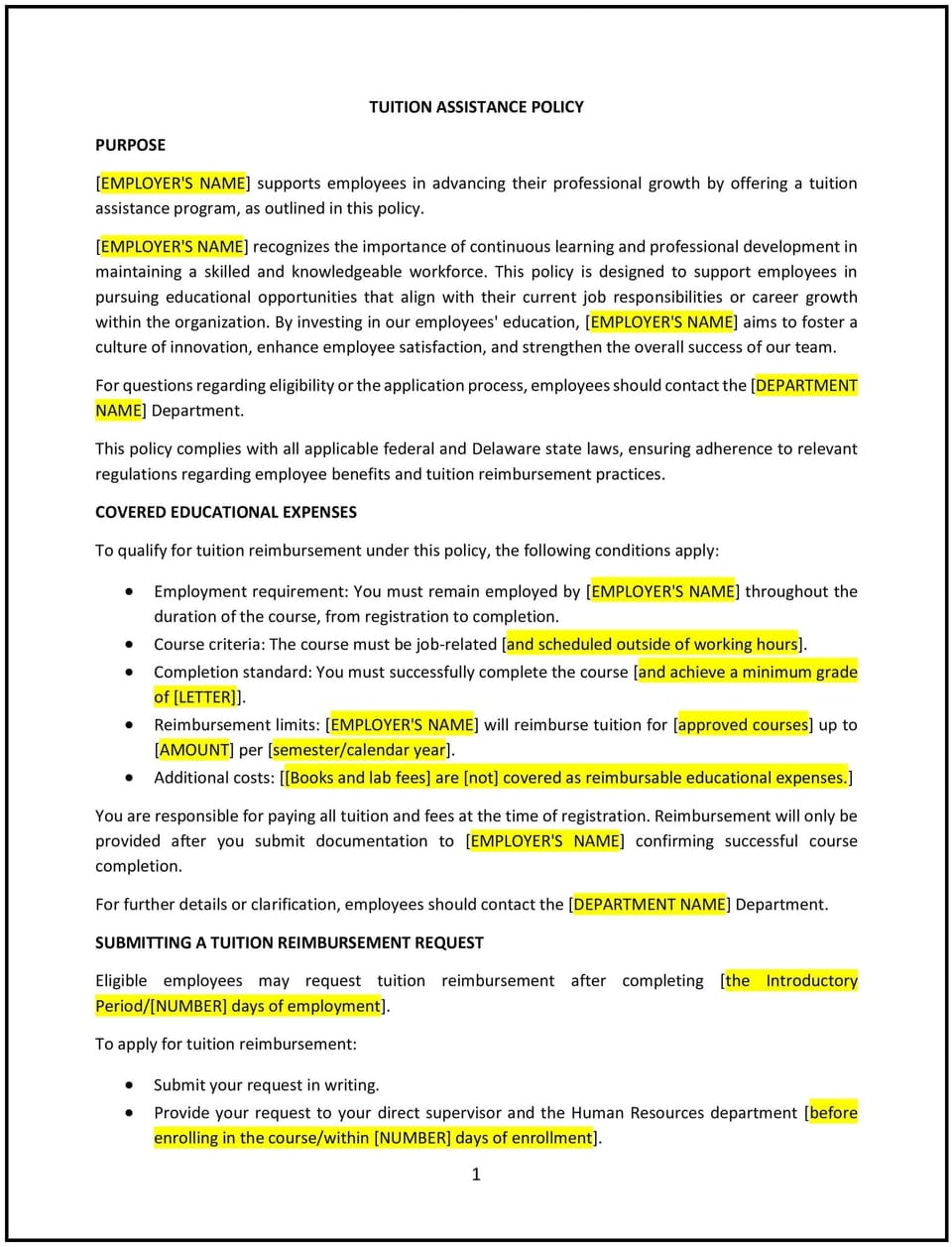

A tuition assistance policy helps Delaware businesses support employees’ professional development by providing financial assistance for job-related coursework, certifications, or degree programs. This policy outlines eligibility, covered expenses, application procedures, and reimbursement terms, ensuring clarity and alignment with business goals.

By implementing this policy, businesses can encourage skill development, improve employee retention, and foster a culture of continuous learning.

How to use this tuition assistance policy (Delaware)

- Define eligibility: Specify the criteria for employees to qualify for tuition assistance, such as employment duration, job performance, and relevance of the course or program to their role.

- Outline covered expenses: Detail which costs are eligible for reimbursement, such as tuition, textbooks, and required fees, and set limits on reimbursement amounts.

- Establish application procedures: Provide a clear process for submitting tuition assistance requests, including timelines, required documentation, and approval steps.

- Clarify reimbursement terms: Specify conditions for reimbursement, such as achieving a minimum grade, completing the course, or providing proof of payment.

- Address repayment obligations: Include provisions for repayment if the employee leaves the company within a certain period after receiving assistance.

- Promote employee development: Encourage employees to pursue educational opportunities that align with their career goals and the company’s objectives.

Benefits of using this tuition assistance policy (Delaware)

This policy offers several benefits for Delaware businesses:

- Enhances employee skills: Encourages employees to develop new skills that directly benefit their roles and the organization’s success.

- Boosts retention: Demonstrates the company’s commitment to employee growth, improving morale and reducing turnover.

- Promotes competitiveness: Helps employees stay updated on industry trends and innovations, keeping the business competitive.

- Strengthens loyalty: Fosters long-term employee engagement by supporting professional development.

- Ensures financial accountability: Provides clear guidelines for managing tuition assistance expenses and aligning them with business goals.

Tips for using this tuition assistance policy (Delaware)

- Communicate the policy clearly: Ensure employees and managers understand the eligibility criteria, application process, and reimbursement terms.

- Track participation: Maintain records of approved courses, reimbursement amounts, and employee outcomes to assess the policy’s impact.

- Align with business goals: Encourage employees to choose programs that enhance their skills and contribute to the company’s objectives.

- Monitor compliance: Regularly review tuition assistance requests and ensure adherence to the policy’s guidelines.

- Update regularly: Revise the policy to reflect changes in Delaware laws, educational trends, or business needs.

Q: Why is a tuition assistance policy important for my business?

A: This policy supports employee development, improves retention, and ensures that educational investments align with business goals.

Q: Who is eligible for tuition assistance under this policy?

A: Eligibility typically includes employees who meet specific criteria, such as a minimum employment duration, satisfactory job performance, and the course’s relevance to their role.

Q: What expenses are covered under this policy?

A: Covered expenses may include tuition, textbooks, required fees, and other costs directly related to the approved program, as outlined in the policy.

Q: What happens if an employee leaves the company after receiving tuition assistance?

A: The policy may require employees to repay tuition assistance if they leave within a specified period, such as one or two years, after receiving reimbursement.

Q: How often should this policy be reviewed?

A: This policy should be reviewed annually or whenever Delaware laws, company budgets, or educational trends change to ensure continued relevance and compliance.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.