Tuition assistance policy (Florida): Free template

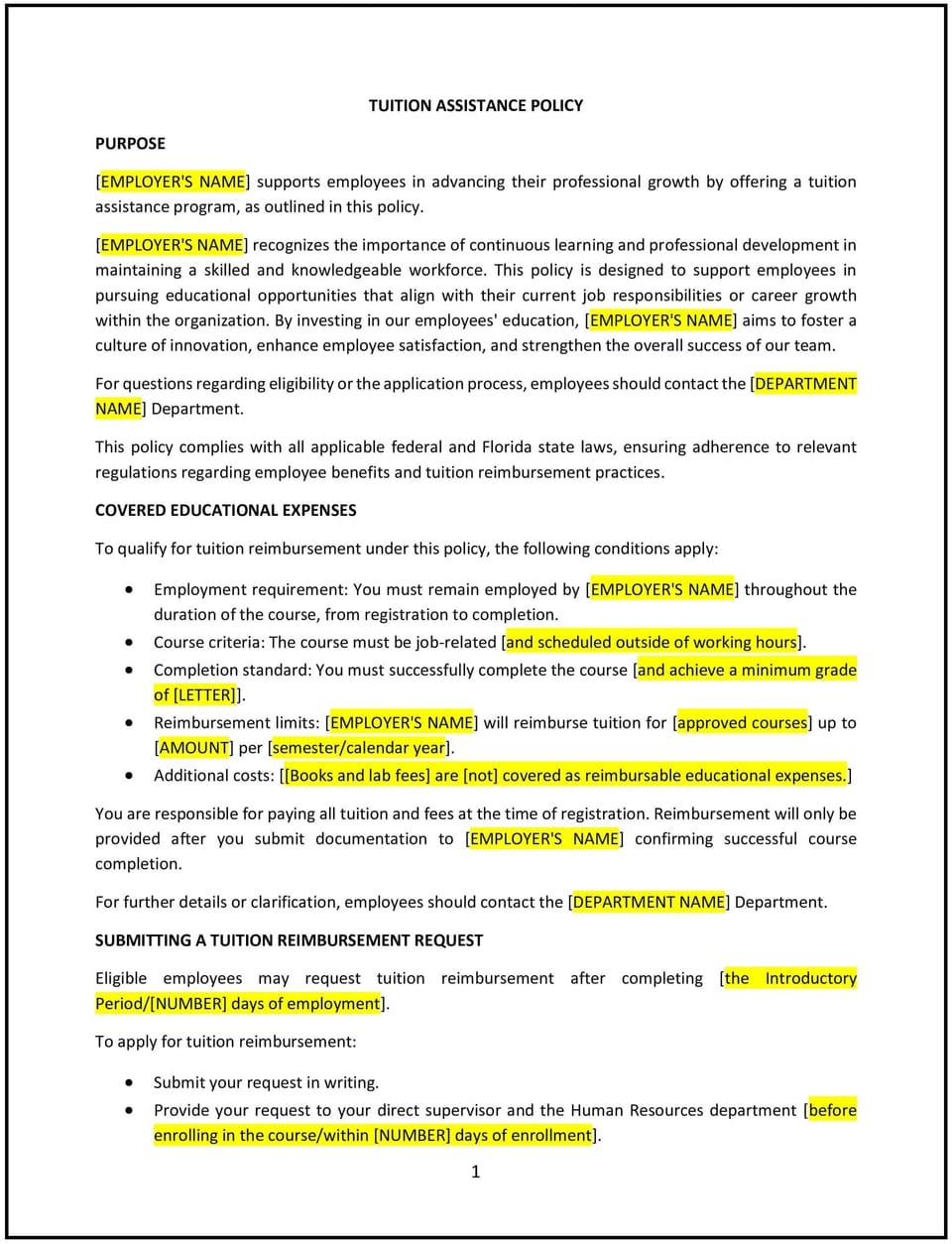

Tuition assistance policy (Florida)

A tuition assistance policy helps Florida businesses support employees who pursue further education to enhance their skills and contribute to the organization’s success. This policy outlines procedures for providing financial assistance, eligibility criteria, and expectations for employees who participate in the program. It is designed to promote professional development, reduce turnover, and align with the state’s focus on workforce development and education.

By implementing this policy, businesses in Florida can attract and retain talented employees, foster a culture of learning, and demonstrate their commitment to employee growth and community progress.

How to use this tuition assistance policy (Florida)

- Define eligibility requirements: Clearly specify who qualifies for tuition assistance, such as full-time employees, specific tenure requirements, or performance benchmarks.

- Outline covered expenses: Explain which educational costs are eligible for reimbursement, such as tuition, fees, books, or exam fees.

- Set limits and conditions: Provide guidelines on maximum reimbursement amounts, grade requirements, and any service commitments after completing the program.

- Establish application procedures: Outline how employees should apply for tuition assistance, including required documentation and deadlines.

- Address tax implications: Explain any potential tax considerations for employees receiving tuition assistance.

- Communicate the policy: Share the policy with employees through handbooks, emails, or training sessions to ensure awareness and understanding.

- Monitor participation: Regularly review applications and track employee progress to ensure the program’s effectiveness.

- Update the policy: Periodically assess the policy to reflect changes in business needs, educational trends, or workforce development goals.

Benefits of using this tuition assistance policy (Florida)

This policy offers several advantages for Florida businesses:

- Promotes professional development: Supporting education helps employees grow their skills and advance their careers.

- Reduces turnover: Offering tuition assistance fosters loyalty and encourages employees to stay with the business.

- Enhances workforce quality: A more educated workforce contributes to improved performance and innovation.

- Builds goodwill: Demonstrates the business’s commitment to employee growth and community progress.

- Aligns with local values: Reflects Florida’s emphasis on education and workforce development.

- Improves recruitment: A tuition assistance program can make the business more attractive to top talent.

- Strengthens employer-employee relationships: Investing in employees’ futures fosters trust and mutual respect.

Tips for using this tuition assistance policy (Florida)

- Communicate clearly: Ensure employees understand the policy by providing written materials and discussing it during meetings or training sessions.

- Train managers: Educate supervisors on how to guide employees through the application process and manage expectations.

- Be flexible: Consider offering tiered benefits based on employee roles, tenure, or performance to maximize program impact.

- Track outcomes: Monitor employee participation and measure the program’s impact on retention, productivity, and skill development.

- Stay informed: Keep up with changes in educational trends, workforce needs, or tax regulations that may affect the program.

- Encourage feedback: Solicit input from participants to identify areas for improvement and ensure the program meets employee needs.

- Review periodically: Assess the policy’s effectiveness and make updates as needed to reflect changes in business goals or workforce dynamics.

Q: Why should Florida businesses adopt a tuition assistance policy?

A: Businesses should adopt this policy to promote professional development, reduce turnover, and demonstrate their commitment to employee growth and community progress.

Q: What types of expenses should be covered under the policy?

A: Businesses should consider covering tuition, fees, books, and exam fees, while setting clear limits on reimbursement amounts.

Q: Should businesses require employees to stay after completing the program?

A: Businesses should consider requiring a service commitment, such as remaining with the company for a specified period, to ensure a return on investment.

Q: How can businesses determine eligibility for tuition assistance?

A: Businesses should define eligibility based on factors such as employment status, tenure, performance, or alignment with business goals.

Q: What should businesses do if an employee fails to meet grade requirements?

A: Businesses should outline consequences, such as withholding reimbursement, and communicate these expectations clearly in the policy.

Q: How can businesses promote the program effectively?

A: Businesses should share the policy through multiple channels, such as emails, meetings, and employee handbooks, and highlight success stories to encourage participation.

Q: How often should businesses review the policy?

A: Businesses should review the policy annually or whenever there are significant changes in workforce needs, educational trends, or business goals.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.