Tuition assistance policy (Hawaiʻi): Free template

Tuition assistance policy (Hawaiʻi)

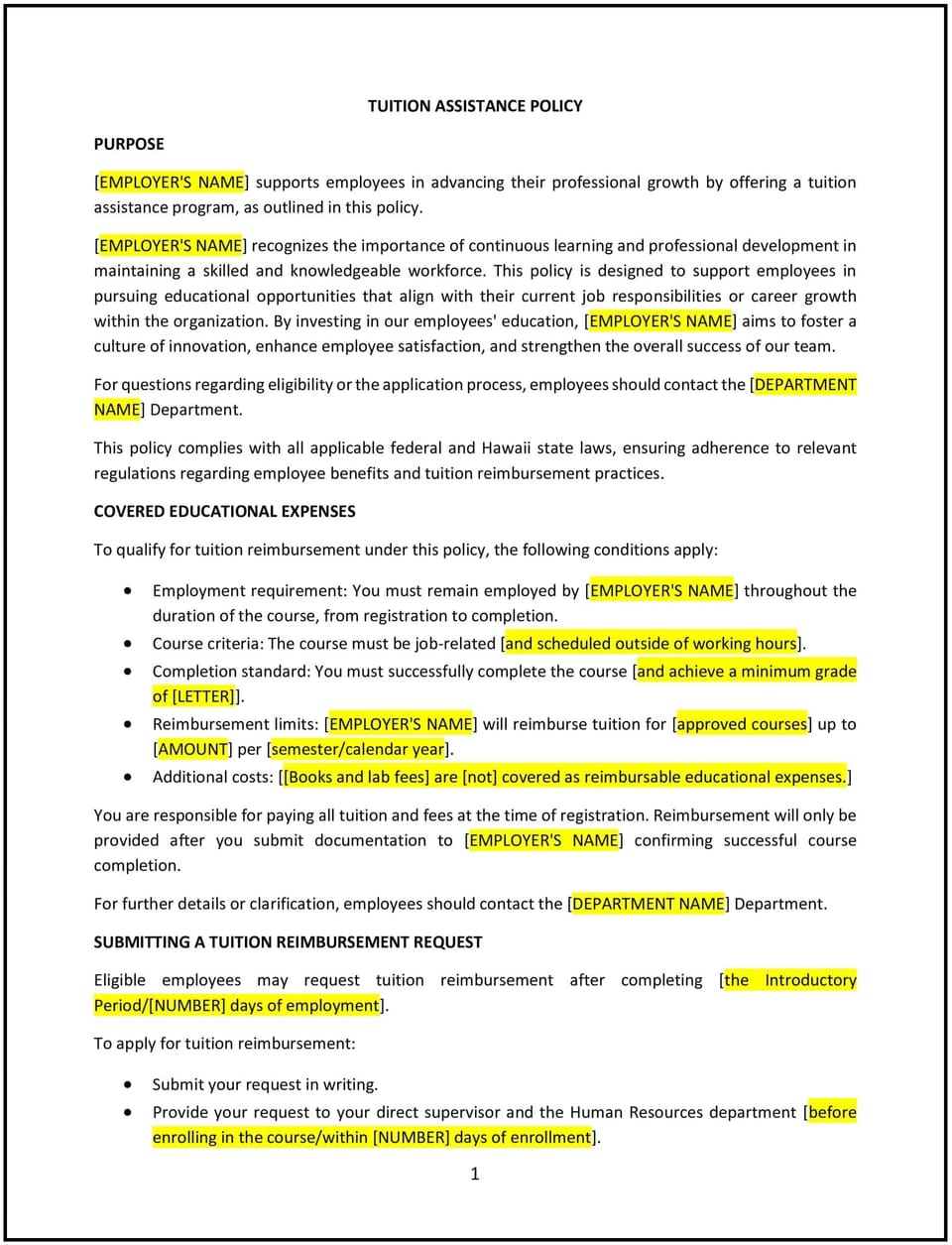

A tuition assistance policy helps Hawaiʻi businesses support employees in pursuing further education and professional development. This policy outlines guidelines for providing financial assistance for courses, certifications, or degree programs, while considering Hawaiʻi’s unique workforce needs and cultural values. It is designed to promote employee growth, enhance skills, and contribute to the business’s long-term success.

By implementing this policy, businesses in Hawaiʻi can attract and retain talent, improve employee satisfaction, and build a more skilled and motivated workforce.

How to use this tuition assistance policy (Hawaiʻi)

- Define eligibility: Clearly outline which employees are eligible for tuition assistance, such as full-time staff or those with a minimum tenure.

- Specify covered programs: Identify the types of programs eligible for assistance, such as degree programs, certifications, or job-related courses.

- Set funding limits: Establish the maximum amount of financial assistance available per employee, per course, or per year.

- Outline approval processes: Describe the steps employees must follow to request tuition assistance, including required documentation and manager approval.

- Address repayment agreements: Specify whether employees are required to repay assistance if they leave the business within a certain timeframe after completing their program.

- Communicate the policy: Share the policy with employees during onboarding and through internal communications to ensure awareness and understanding.

- Train managers: Educate managers on the policy’s guidelines, including how to evaluate requests and support employees’ educational goals.

- Monitor and update the policy: Regularly review the policy’s effectiveness and make adjustments as needed to reflect changes in business needs or workforce trends.

Benefits of using this tuition assistance policy (Hawaiʻi)

This policy offers several advantages for Hawaiʻi businesses:

- Attracts and retains talent: Offering tuition assistance makes the business more competitive in attracting and retaining skilled employees.

- Enhances employee skills: Supporting further education helps employees develop new skills and knowledge that benefit the business.

- Boosts morale: Employees appreciate the opportunity for professional growth, which can improve job satisfaction and loyalty.

- Supports career development: Tuition assistance helps employees advance their careers, contributing to a more motivated and engaged workforce.

- Aligns with workforce needs: The policy ensures employees gain skills that align with the business’s goals and Hawaiʻi’s evolving job market.

- Demonstrates investment in employees: Providing tuition assistance shows the business’s commitment to employee development and long-term success.

- Builds a skilled workforce: A more educated and skilled workforce enhances the business’s ability to innovate and compete.

Tips for using this tuition assistance policy (Hawaiʻi)

- Communicate the policy effectively: Share the policy with employees during onboarding and through regular reminders, such as emails or training sessions.

- Provide clear guidelines: Ensure employees understand eligibility requirements, covered programs, and the application process.

- Train managers: Educate managers on how to evaluate tuition assistance requests and support employees’ educational goals.

- Monitor usage: Track how employees use tuition assistance and assess its impact on their performance and career development.

- Review the policy periodically: Update the policy as needed to reflect changes in business needs, workforce trends, or educational opportunities.

Q: Why should Hawaiʻi businesses adopt a tuition assistance policy?

A: Businesses should adopt this policy to attract and retain talent, enhance employee skills, and support long-term workforce development.

Q: Which employees are eligible for tuition assistance?

A: Eligibility should be based on factors such as employment status (e.g., full-time) and tenure, as outlined in the policy.

Q: What types of programs are covered under the policy?

A: The policy should cover degree programs, certifications, and job-related courses that align with the business’s goals and the employee’s role.

Q: How much financial assistance can employees receive?

A: Businesses should set funding limits, such as a maximum amount per employee, per course, or per year, based on their budget and goals.

Q: What is the process for requesting tuition assistance?

A: Employees should submit a request with required documentation, such as course details and costs, and obtain manager approval.

Q: Are employees required to repay tuition assistance if they leave the business?

A: Businesses should specify whether repayment is required if employees leave within a certain timeframe after completing their program.

Q: How can businesses measure the impact of tuition assistance?

A: Businesses should track employee performance, career progression, and retention rates to assess the policy’s effectiveness.

Q: How often should businesses review the policy?

A: Businesses should review the policy annually or as needed to reflect changes in business needs, workforce trends, or educational opportunities.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.