Tuition assistance policy (Illinois): Free template

Tuition assistance policy (Illinois)

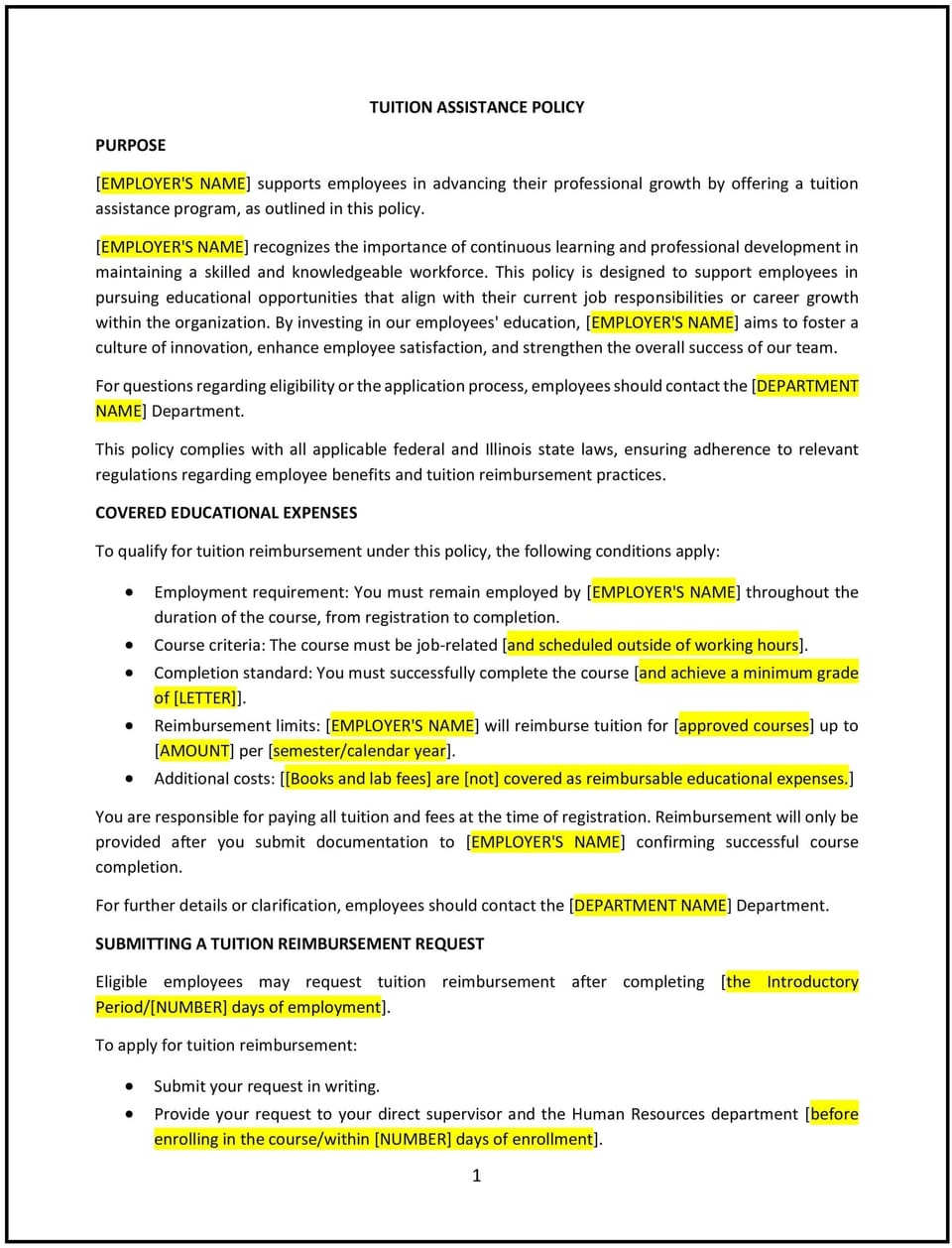

This tuition assistance policy is designed to help Illinois businesses support employees in pursuing educational and professional development opportunities. It outlines eligibility, application procedures, and reimbursement guidelines for tuition-related expenses, promoting employee growth and aligning with company objectives.

By adopting this policy, businesses can enhance employee skills, foster retention, and support lifelong learning.

How to use this tuition assistance policy (Illinois)

- Define eligibility: Specify the criteria for employees to qualify for tuition assistance, such as full-time status, tenure, or relevance of the coursework to their role.

- Outline covered expenses: Clarify which expenses are eligible for reimbursement, such as tuition, books, and required fees, while excluding optional or non-academic costs.

- Provide application procedures: Require employees to submit a written request, including details about the program, institution, and estimated costs, for approval before enrollment.

- Establish reimbursement terms: Detail the percentage of costs reimbursed, payment caps, and whether assistance is contingent on course completion or grades.

- Include repayment obligations: Specify conditions under which employees must repay tuition assistance, such as leaving the company within a certain timeframe.

- Promote approved institutions: Encourage employees to enroll in accredited programs or institutions that align with company standards.

- Monitor compliance: Regularly review the policy to ensure alignment with Illinois laws and business goals.

Benefits of using this tuition assistance policy (Illinois)

This policy provides several benefits for Illinois businesses:

- Encourages professional growth: Supports employees in enhancing their skills and qualifications.

- Improves retention: Demonstrates the company’s investment in employee development, fostering loyalty and reducing turnover.

- Aligns with business goals: Helps employees acquire knowledge and expertise that benefit the company.

- Provides transparency: Establishes clear guidelines for tuition reimbursement and eligibility.

- Enhances compliance: Helps the policy adhere to Illinois labor laws and tax regulations.

Tips for using this tuition assistance policy (Illinois)

- Communicate the policy: Share the policy with employees during onboarding and include it in the employee handbook.

- Set clear expectations: Define approval processes, eligible programs, and reimbursement terms to avoid confusion.

- Track employee progress: Monitor employees’ course completion and grades to ensure compliance with reimbursement requirements.

- Encourage feedback: Solicit employee input to refine the policy and better align it with professional development needs.

- Update regularly: Revise the policy to reflect changes in Illinois laws, education trends, or company goals.

Q: Who is eligible for tuition assistance under this policy?

A: Eligibility depends on criteria such as full-time status, tenure, and the relevance of the coursework to the employee’s role.

Q: What expenses are covered by this policy?

A: Covered expenses may include tuition, required books, and mandatory fees, while excluding optional or non-academic costs.

Q: How can employees apply for tuition assistance?

A: Employees must submit a written request, including program details, estimated costs, and how the education aligns with their role, for pre-approval.

Q: What are the reimbursement terms?

A: Reimbursement may cover a percentage of costs or a fixed cap, contingent on course completion and achieving a minimum grade.

Q: Are employees required to repay tuition assistance if they leave the company?

A: Yes, employees may be required to repay assistance if they leave the company within a specified period, as outlined in the policy.

Q: Are online courses eligible for tuition assistance?

A: Yes, online courses are eligible if they are accredited and align with the company’s standards and the employee’s role.

Q: How often is this policy reviewed?

A: This policy is reviewed annually or whenever significant changes occur in Illinois laws, education trends, or business practices.

Q: Does this policy apply to part-time employees?

A: Eligibility for part-time employees depends on company-specific criteria and should be clarified in the policy.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.