Tuition assistance policy (Iowa): Free template

Tuition assistance policy (Iowa)

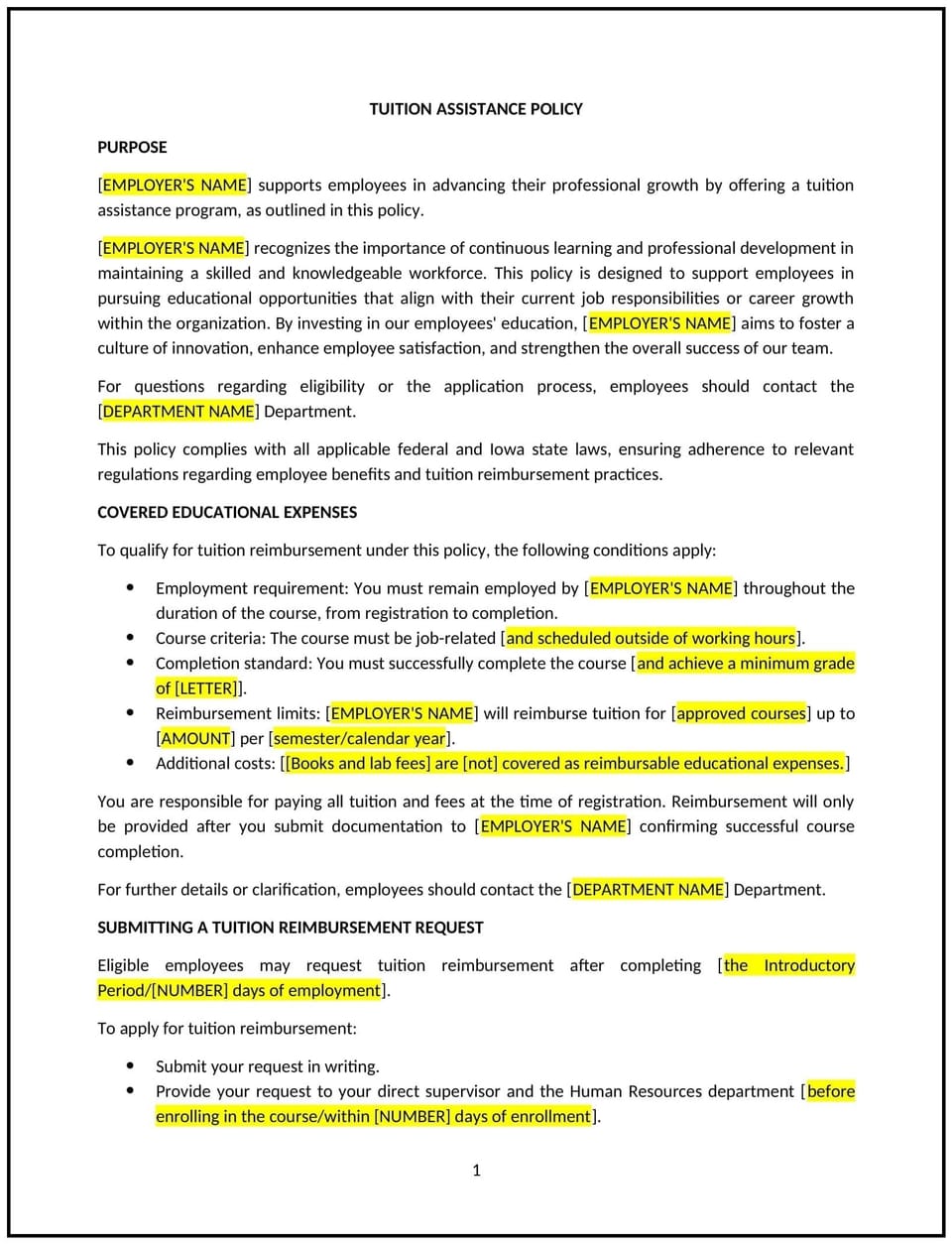

A tuition assistance policy helps Iowa businesses provide financial support for employees who wish to pursue further education and training relevant to their current job or career development. This policy outlines the eligibility criteria, application process, and reimbursement limits for employees seeking tuition assistance for courses, certifications, or degree programs that will enhance their skills and knowledge. It encourages continuous learning, career growth, and employee retention while benefiting the business through a more skilled workforce.

By implementing this policy, businesses can invest in the professional development of their employees, increase job satisfaction, and create a more knowledgeable and capable workforce.

How to use this tuition assistance policy (Iowa)

- Define eligibility: Clearly outline the eligibility criteria for employees to qualify for tuition assistance, such as a minimum length of employment, job performance standards, and whether the coursework is related to their current role or career development.

- Set application guidelines: Establish a process for employees to apply for tuition assistance, including submission of course details, proof of enrollment, and a clear timeline for approval. Specify whether employees must submit applications before enrolling or after completing the course.

- Outline reimbursement limits: Set clear limits for how much tuition assistance will be provided, such as a maximum reimbursement amount per course, semester, or year. Include details on any caps for textbooks, fees, or other related expenses.

- Define repayment obligations: Specify whether employees must repay the tuition assistance if they leave the company within a certain period of time after completing the course, such as within one or two years.

- Clarify grade requirements: Define the minimum grade or performance required for reimbursement, such as passing grades or certain academic achievements.

- Provide deadlines and timelines: Establish deadlines for submitting applications and reimbursements, as well as how long after course completion employees can submit their reimbursement requests.

- Review and update regularly: Periodically review the policy to ensure it aligns with changing business needs, industry standards, and employee feedback. Update the policy as necessary to remain competitive and effective.

Benefits of using this tuition assistance policy (Iowa)

This policy offers several key benefits for Iowa businesses:

- Fosters employee growth: Offering tuition assistance promotes the development of employees’ skills, enhancing their capabilities and preparing them for future roles within the company.

- Increases employee retention: Employees are more likely to stay with a company that invests in their education and career development, reducing turnover and associated recruitment costs.

- Enhances productivity: A more educated workforce is better equipped to handle challenges, improve job performance, and drive innovation within the company.

- Attracts top talent: Tuition assistance is an attractive benefit that can help businesses stand out in competitive job markets, making them more appealing to skilled candidates.

- Strengthens company culture: By supporting employee education, businesses show that they value continuous learning and employee development, which can boost morale and engagement.

- Builds a skilled workforce: Tuition assistance ensures that employees have the skills and knowledge necessary to contribute to the business's success, particularly in a fast-changing work environment.

Tips for using this tuition assistance policy (Iowa)

- Communicate the policy clearly: Ensure that all employees are aware of the tuition assistance policy, including eligibility, application processes, and reimbursement limits. Regularly remind employees about this benefit during performance reviews or company meetings.

- Align education with business goals: Encourage employees to pursue courses or certifications that are directly relevant to their job responsibilities or the company’s objectives to ensure a return on investment.

- Monitor the application process: Keep track of the number of requests and the types of courses being pursued to ensure that the tuition assistance program is being utilized effectively and efficiently.

- Offer flexible reimbursement options: Consider providing flexible reimbursement options, such as partial reimbursements for courses or covering different types of educational expenses (e.g., textbooks, fees, online courses).

- Be consistent with approval and reimbursement: Apply the same rules and processes consistently for all employees to ensure fairness and transparency in how tuition assistance requests are handled.

- Evaluate the policy regularly: Periodically assess the tuition assistance policy to ensure it is meeting both the company’s needs and employees’ expectations. Gather feedback from employees to refine the policy and make improvements as necessary.

Q: Why should Iowa businesses implement a tuition assistance policy?

A: Businesses should implement a tuition assistance policy to invest in employee development, increase retention, improve job performance, and attract top talent. It fosters a skilled workforce and strengthens the company's competitiveness in the market.

Q: Who is eligible for tuition assistance?

A: Employees are typically eligible for tuition assistance after meeting certain criteria, such as a minimum length of employment, job performance standards, and enrollment in job-related courses or degree programs. Specific eligibility requirements should be outlined in the policy.

Q: How do employees apply for tuition assistance?

A: Employees should submit a formal application that includes course details, proof of enrollment, and other necessary documentation. The application should be submitted for approval before the course begins or shortly after enrollment, depending on the company’s policy.

Q: What types of education or training qualify for tuition assistance?

A: Tuition assistance typically covers job-related courses, certifications, or degree programs that will improve the employee's skills and enhance their current role or career development. The policy should specify any exclusions, such as unrelated personal education or courses not aligned with the company's needs.

Q: Will employees be reimbursed for other expenses related to education, such as textbooks or fees?

A: The policy may allow reimbursement for other education-related expenses, such as textbooks, registration fees, or materials. The maximum reimbursement amount and eligible expenses should be clearly defined in the policy.

Q: What happens if an employee doesn’t pass the course?

A: The policy should specify whether the employee is required to repay tuition assistance if they do not achieve a certain grade or pass the course. Businesses may choose to require reimbursement only if the employee fails to meet the minimum grade requirement.

Q: Are there limits to the amount of tuition assistance employees can receive?

A: Yes, businesses should set clear limits on how much tuition assistance is available per employee, such as per course, semester, or year. These limits should be detailed in the policy to prevent excessive claims and ensure fair distribution of funds.

Q: Do employees have to repay tuition assistance if they leave the company?

A: The policy should specify whether employees must repay tuition assistance if they leave the company within a certain period after receiving reimbursement, such as one or two years. This helps protect the company’s investment in employee education.

Q: Can employees use tuition assistance for courses taken outside of work hours?

A: Yes, tuition assistance is typically available for courses taken outside of regular work hours, as long as the courses are job-related and approved under the company’s guidelines. The policy should clarify whether in-person or online courses are eligible.

Q: How often should businesses review their tuition assistance policy?

A: Businesses should review the policy regularly, at least annually, to ensure it remains competitive, relevant to employee needs, and aligned with the company’s objectives and budget. Employee feedback can help guide these reviews.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.