Tuition assistance policy (Kansas): Free template

Tuition assistance policy (Kansas)

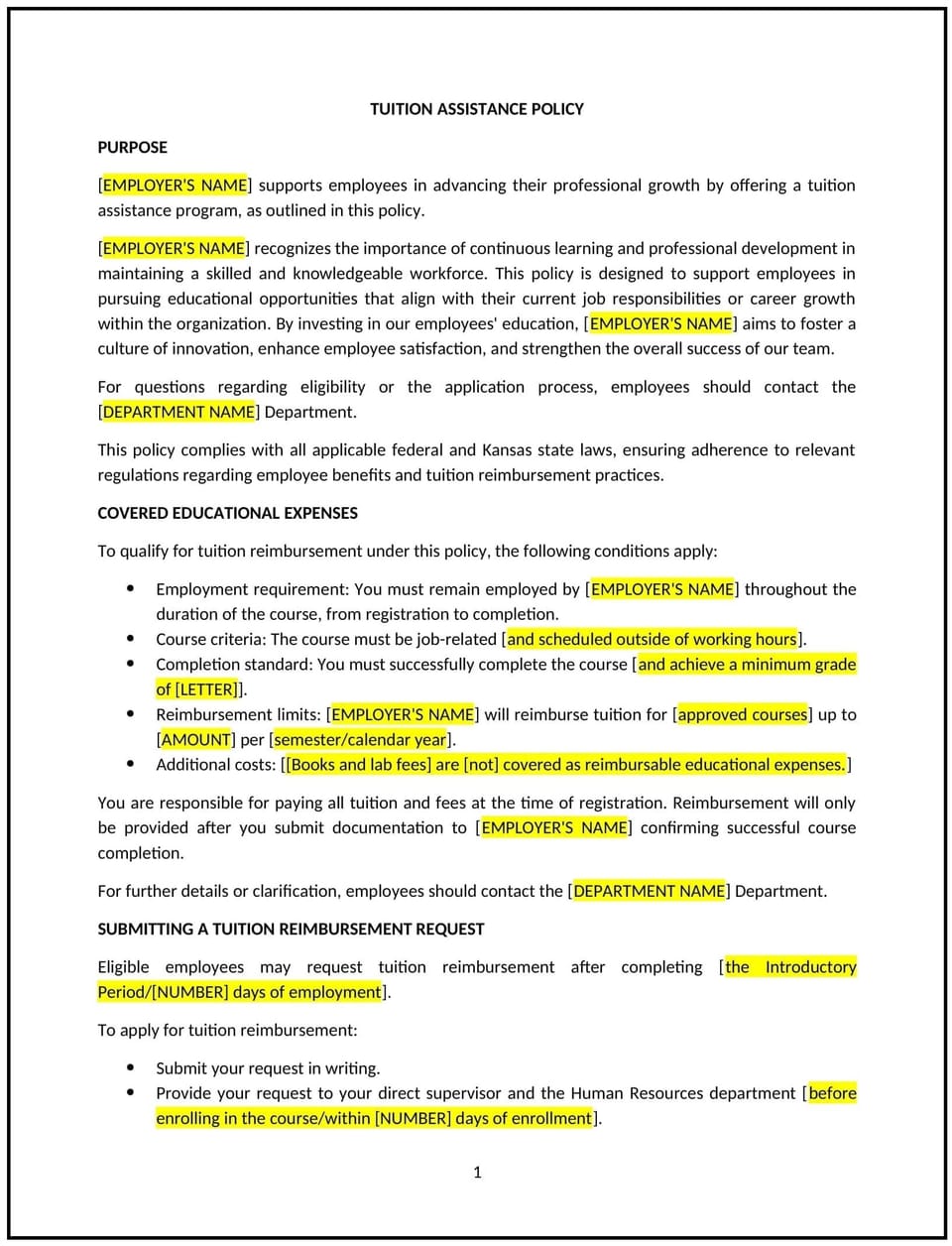

A tuition assistance policy helps Kansas businesses support employees who wish to further their education by providing financial assistance for tuition, fees, or other educational expenses. This policy outlines eligibility criteria, reimbursement processes, and the types of educational programs that qualify for assistance, with the goal of encouraging ongoing employee development and growth.

By implementing this policy, businesses can attract and retain talented employees, enhance their skills, and foster a culture of continuous learning.

How to use this tuition assistance policy (Kansas)

- Define eligibility: The policy should specify which employees are eligible for tuition assistance, including requirements such as employment tenure, full-time status, or performance criteria.

- Outline reimbursable expenses: The policy should clarify which expenses are covered, such as tuition fees, textbooks, or certification exam fees, and specify any maximum reimbursement limits.

- Set approval procedures: Employees should submit requests for tuition assistance before enrolling in a program. The policy should outline the approval process, including the necessary documentation and any deadlines for submission.

- Specify reimbursement terms: The policy should define how reimbursement will be handled, including the timing of payments (e.g., after the course is completed), the required grades or performance benchmarks (e.g., minimum grade requirement), and how employees can submit proof of completion.

- Address course and program qualifications: The policy should outline which types of courses or programs qualify for tuition assistance, such as those directly related to the employee’s current role, career advancement within the company, or industry-recognized certifications.

- Define repayment conditions: If employees leave the company within a certain time frame after receiving tuition assistance, the policy should specify repayment terms to protect the company’s investment in their education.

- Review and update regularly: The policy should be reviewed periodically to ensure it aligns with evolving business needs, employee development strategies, and industry best practices.

Benefits of using a tuition assistance policy (Kansas)

- Enhances employee skills: By offering financial support for education, businesses enable employees to enhance their skills and knowledge, improving their overall performance and contributing to company success.

- Increases employee satisfaction and retention: Tuition assistance demonstrates that a business is invested in employees’ personal and professional growth, leading to higher job satisfaction and improved employee retention.

- Supports career development: The policy encourages employees to pursue further education, which helps them advance in their careers and contribute to the company in more meaningful ways.

- Strengthens the company’s talent pool: By providing tuition assistance, businesses can attract skilled employees who value professional development and are motivated to contribute to the organization’s growth.

- Provides a competitive advantage: Companies with tuition assistance policies stand out as employers of choice, especially in competitive job markets, by offering attractive benefits that support employee learning and growth.

- Maximizes business potential: Educated and skilled employees help businesses stay innovative and competitive in the market, supporting long-term growth and success.

Tips for using this tuition assistance policy (Kansas)

- Communicate the policy clearly: Ensure all employees understand the eligibility requirements, the types of programs covered, and the reimbursement process so they can take full advantage of the benefit.

- Track educational investments: Keep accurate records of tuition assistance claims, reimbursements, and program participation to manage the budget and track the effectiveness of the policy.

- Offer guidance on course selection: While the policy should specify which types of programs are eligible, businesses may also offer guidance or recommendations to help employees choose courses or certifications that align with their career growth and company objectives.

- Set clear performance expectations: If the policy includes a minimum grade requirement, ensure employees are aware of the standards they must meet to qualify for reimbursement.

- Encourage ongoing education: Businesses should actively promote the tuition assistance policy to encourage employees to take advantage of the benefit and continue learning and growing in their careers.

- Periodically review the policy: Businesses should assess the effectiveness of the tuition assistance policy and update it regularly to reflect changing business needs, educational trends, or shifts in employee development goals.

Q: Why should Kansas businesses implement a tuition assistance policy?

A: Businesses should implement a tuition assistance policy to support employee development, increase employee satisfaction and retention, and ensure that employees are continuously learning and growing in alignment with the company’s needs.

Q: Who is eligible for tuition assistance?

A: Eligibility typically depends on factors such as employment status (e.g., full-time employees), tenure with the company, and performance. The policy should clearly define these criteria to ensure fair access to the benefit.

Q: What expenses are covered under the tuition assistance policy?

A: The policy should specify which expenses are reimbursed, such as tuition fees, textbooks, exam fees, or other educational costs. The policy should also establish any spending limits for different categories of expenses.

Q: How do employees apply for tuition assistance?

A: Employees should submit a formal request for tuition assistance, including documentation of the course or program details, associated costs, and how the course will contribute to their professional development. The approval process should be outlined clearly in the policy.

Q: Is there a minimum grade requirement to receive reimbursement?

A: The policy should specify whether a minimum grade or performance standard (e.g., a grade of “B” or higher) is required for reimbursement. If so, employees should be made aware of these expectations before enrolling in programs.

Q: What happens if an employee leaves the company after receiving tuition assistance?

A: The policy should outline repayment conditions if an employee leaves the company within a certain time frame after receiving tuition assistance. For example, employees may be required to repay the assistance if they leave within a year of completing the course.

Q: How often should businesses review and update their tuition assistance policy?

A: Businesses should review the policy at least annually to ensure that it meets employee needs, reflects changes in the business environment, and aligns with educational trends and industry standards.

Q: Can employees use tuition assistance for self-improvement or non-job-related courses?

A: The policy should specify whether courses unrelated to the employee’s current role or career path are eligible for reimbursement. Many businesses limit assistance to job-related courses or programs that support company goals.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.