Tuition assistance policy (Louisiana): Free template

Tuition assistance policy (Louisiana)

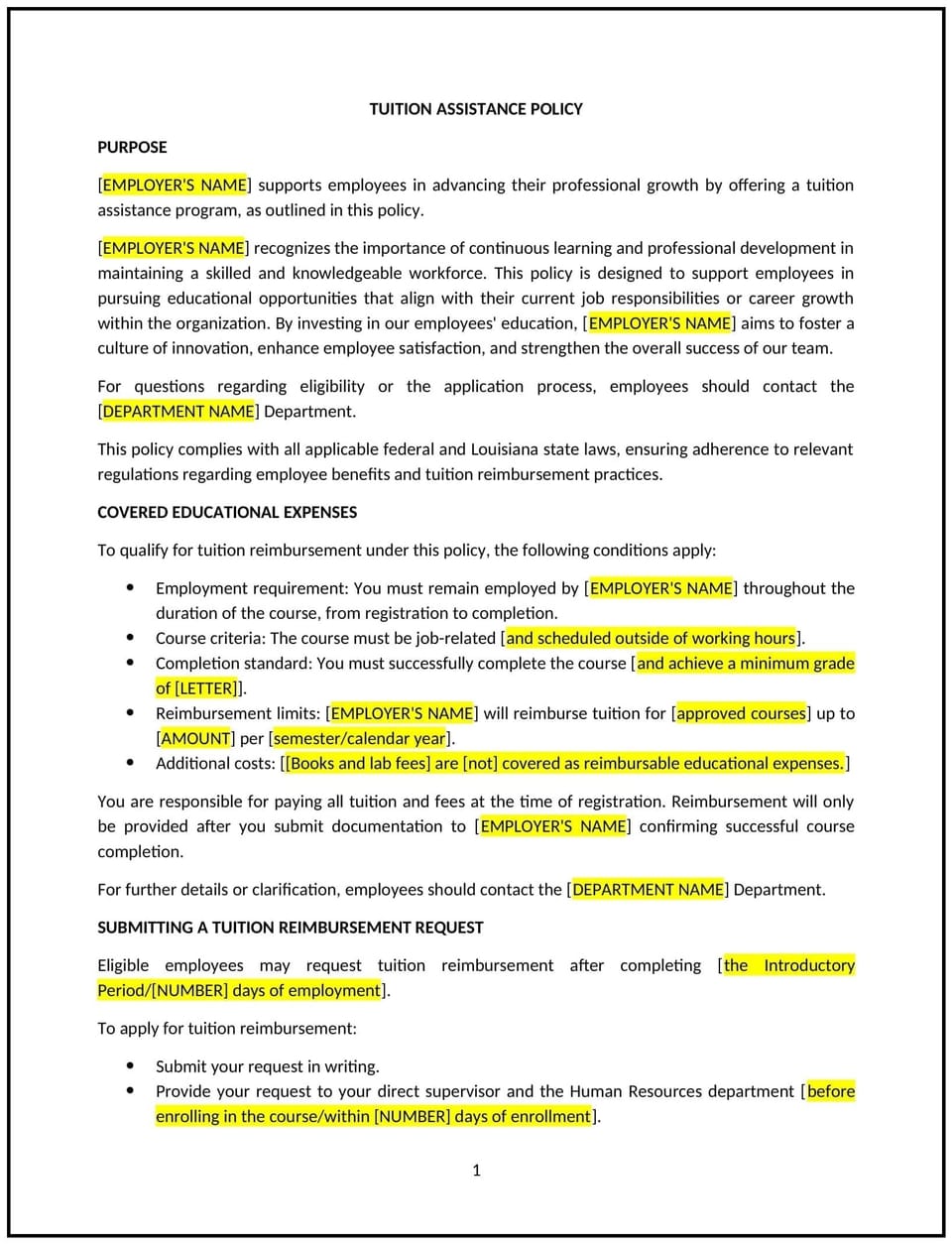

This tuition assistance policy is designed to help Louisiana businesses support employees in furthering their education and professional development. It outlines eligibility criteria, application procedures, and reimbursement guidelines to ensure a structured approach to educational support.

By implementing this policy, businesses can encourage continuous learning, enhance employee skills, and boost workplace morale.

How to use this tuition assistance policy (Louisiana)

- Define eligibility: Specify which employees qualify for tuition assistance, such as full-time or part-time staff and those with a minimum tenure.

- Outline covered programs: Detail the types of courses or degrees eligible for assistance, such as job-related certifications, undergraduate, or graduate programs.

- Provide application procedures: Include steps for applying, such as submitting a written request, course details, and cost estimates.

- Address reimbursement guidelines: Clarify the percentage or amount of tuition costs covered, any grade requirements, and timelines for reimbursement.

- Communicate employment conditions: Specify any retention agreements or payback clauses if employees leave the company within a set period after receiving assistance.

- Include documentation requirements: Require proof of enrollment, completion, and grades for reimbursement processing.

Benefits of using a tuition assistance policy (Louisiana)

Implementing this policy provides several advantages for Louisiana businesses:

- Enhances skills: Supports employees in acquiring knowledge that benefits their roles and the organization.

- Improves retention: Encourages loyalty by investing in employees’ education and professional growth.

- Boosts morale: Demonstrates the company’s commitment to supporting career advancement.

- Promotes fairness: Establishes consistent guidelines for educational support.

- Reflects Louisiana-specific needs: Adapts to regional educational institutions and workforce requirements.

Tips for using this tuition assistance policy (Louisiana)

- Communicate clearly: Ensure employees are aware of the policy during onboarding and provide reminders when relevant.

- Set budget limits: Define an annual or per-semester cap on assistance to manage company expenses.

- Align with goals: Prioritize funding for programs that directly enhance skills needed for current or future roles within the company.

- Monitor outcomes: Track the impact of funded education on employee performance and organizational goals.

- Update regularly: Revise the policy to reflect changes in educational opportunities or Louisiana-specific considerations.

Q: Who is eligible for tuition assistance under this policy?

A: Eligibility typically extends to full-time and part-time employees who have completed a minimum tenure, as outlined in the policy.

Q: What types of educational programs are covered?

A: Covered programs may include job-related certifications, undergraduate or graduate degrees, and continuing education courses relevant to the business.

Q: How much of the tuition cost will be reimbursed?

A: The reimbursement amount or percentage will be defined in the policy and may vary depending on the program or course type.

Q: What documentation is required for reimbursement?

A: Employees must provide proof of enrollment, receipts for tuition payment, and transcripts or certificates showing successful course completion.

Q: Are there grade requirements for reimbursement?

A: Yes, reimbursement may require achieving a specific grade or passing the course, as specified in the policy.

Q: What happens if an employee leaves the company after receiving assistance?

A: Employees may be required to repay tuition assistance if they leave within a specified period, as outlined in the retention agreement.

Q: How often should this policy be reviewed?

A: The policy should be reviewed annually or when changes occur in educational funding practices or Louisiana-specific needs.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.