Tuition assistance policy (Maine): Free template

Tuition assistance policy (Maine): Free template

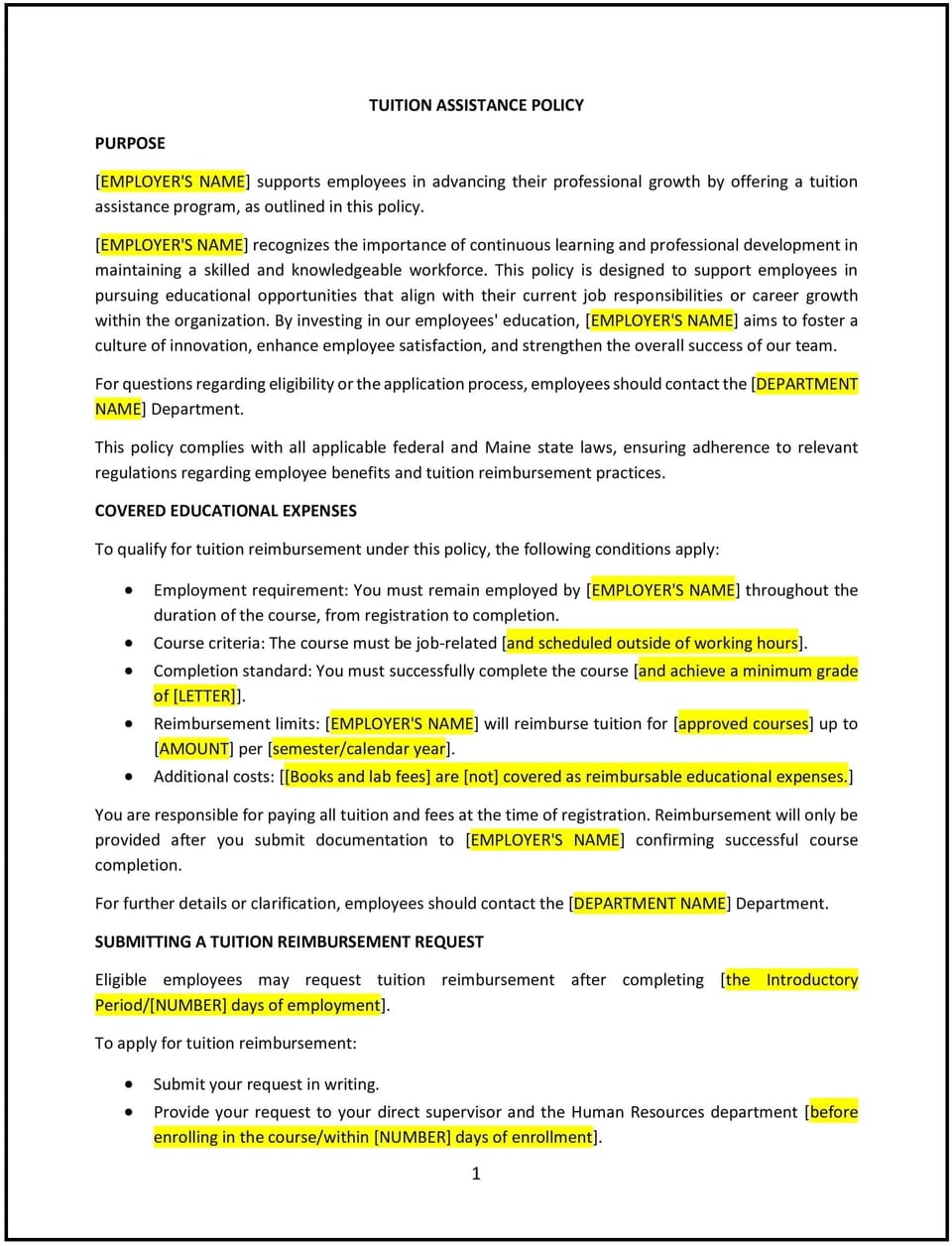

This tuition assistance policy is designed to help Maine businesses support employees in their pursuit of education and professional development. It outlines the criteria, process, and guidelines for providing financial assistance to employees who wish to pursue relevant courses, certifications, or degree programs that will enhance their skills and contribute to the company's success.

By implementing this policy, Maine businesses can foster a culture of continuous learning, increase employee engagement, and help employees grow professionally while contributing to the company’s long-term goals.

How to use this tuition assistance policy (Maine)

- Define eligibility: Specify which employees are eligible for tuition assistance, such as full-time employees who have been with the company for a certain period, and the types of programs that qualify for assistance (e.g., degree programs, certifications, or job-related courses).

- Outline the approval process: Establish a process for employees to request tuition assistance, including the submission of a formal application, approval from managers or HR, and any required documentation such as course descriptions and enrollment details.

- Specify the amount of assistance: Detail the maximum amount of tuition assistance available to employees per year, whether it’s a flat amount or a percentage of tuition costs, and any limitations on the amount for each program or course.

- Set reimbursement criteria: Clarify how and when employees will be reimbursed for tuition expenses, including the requirement for passing grades and submission of receipts or invoices.

- Explain the repayment policy: If applicable, outline conditions under which employees may need to repay the tuition assistance, such as if they leave the company within a certain period after receiving assistance.

- Address related expenses: Specify whether other education-related expenses, such as textbooks, materials, or exam fees, are eligible for reimbursement.

- Review regularly: Update the policy periodically to reflect changes in the business’s financial capabilities, industry trends, or employee needs.

Benefits of using this tuition assistance policy (Maine)

Implementing this policy provides several benefits for Maine businesses:

- Enhances employee skills: Supports employees in obtaining relevant education and certifications, contributing to a more knowledgeable and capable workforce.

- Increases employee engagement and retention: Offering tuition assistance demonstrates a commitment to employee development and fosters loyalty, reducing turnover and boosting morale.

- Supports company growth: By investing in employees' education, businesses benefit from a more skilled and competent workforce that can contribute to improved productivity and innovation.

- Attracts top talent: A robust tuition assistance program can be an attractive benefit to prospective employees, making the company more competitive in the job market.

- Encourages professional growth: Employees are empowered to take control of their career development, enhancing job satisfaction and career progression.

Tips for using this tuition assistance policy (Maine)

- Communicate the policy clearly: Ensure that all employees are aware of the tuition assistance policy and its benefits by including it in the employee handbook and discussing it during onboarding.

- Set clear expectations: Make sure employees understand the criteria for eligibility, the process for requesting assistance, and the requirements for receiving reimbursement.

- Monitor program usage: Regularly track and review the number of employees utilizing the program, the types of programs they are pursuing, and the success rates to ensure the program is being used effectively.

- Provide support: Offer guidance to employees on selecting relevant courses or programs and how they align with career development goals and business needs.

- Stay flexible: Periodically assess the business’s budget and adjust the tuition assistance program accordingly, ensuring it remains a viable benefit for both the company and employees.

Q: Who is eligible for tuition assistance under this policy?

A: Typically, full-time employees who have been with the company for a set period (e.g., one year) are eligible for tuition assistance. Specific eligibility criteria will be outlined in the policy.

Q: How much tuition assistance can employees receive?

A: The policy should specify the maximum amount of tuition assistance available per employee per year, whether it is a set dollar amount or a percentage of tuition fees.

Q: What types of educational programs are eligible for assistance?

A: Eligible programs typically include degree programs, certifications, or job-related courses that enhance employees' skills and contribute to their professional development.

Q: Do employees need to pay for their courses upfront?

A: Yes, employees may need to pay for their courses upfront, and the company will reimburse them once they meet the necessary criteria, such as providing receipts and proof of passing grades.

Q: Is tuition assistance taxable?

A: Tuition assistance may be subject to tax depending on the amount provided and the specific tax laws. Businesses should consult with a tax advisor to determine the tax implications.

Q: Do employees need to repay tuition assistance if they leave the company?

A: The policy may include a repayment clause requiring employees to repay a portion or all of the tuition assistance if they leave the company within a specified period after receiving assistance (e.g., one year).

Q: How often should businesses review their tuition assistance policy?

A: The policy should be reviewed annually or whenever there are significant changes to the company’s financial situation, business priorities, or relevant industry trends.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.