US export and trade compliance policy (Arizona): Free template

US export and trade compliance policy (Arizona)

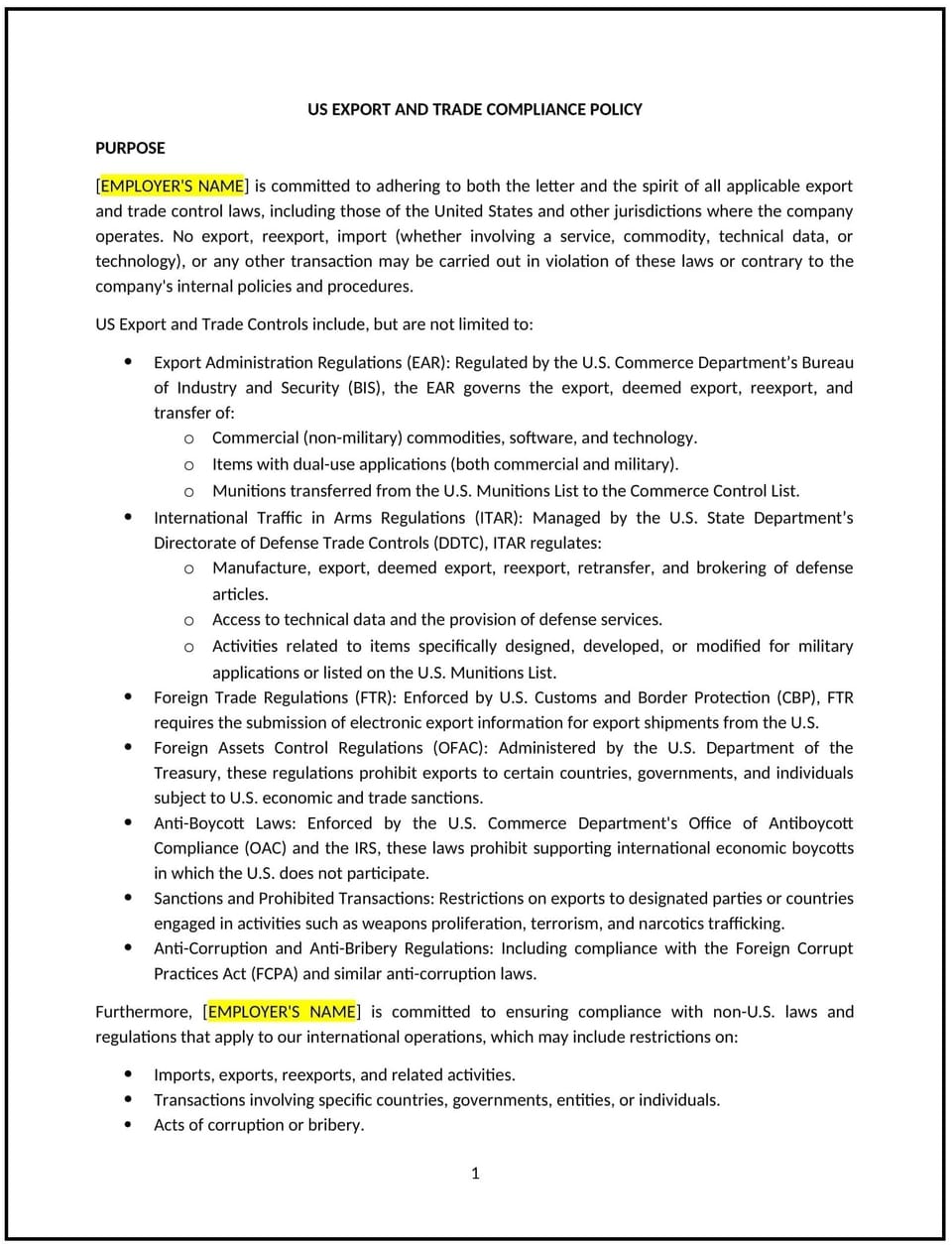

In Arizona, a US export and trade compliance policy provides businesses with guidelines to ensure they are fully compliant with federal regulations governing the export of goods, services, and technologies. This policy helps prevent violations of US export laws, such as those enforced by the Bureau of Industry and Security (BIS) and the Office of Foreign Assets Control (OFAC).

This policy outlines the requirements for handling export-controlled goods, services, and transactions with foreign entities.

By implementing this policy, Arizona businesses can protect themselves from legal penalties, reduce the risk of sanctions violations, and ensure that all international business activities are conducted in compliance with US law.

How to use this US export and trade compliance policy (Arizona)

- Define controlled goods and services: Identify which products, technologies, and services are subject to US export controls and outline which items require an export license before they can be exported.

- Establish compliance procedures: Implement processes for screening potential customers, suppliers, and transactions to ensure they comply with export control regulations.

- Conduct employee training: Ensure that employees involved in international trade or exports are trained on compliance requirements, including understanding export licensing, prohibited destinations, and restricted parties.

- Monitor and audit transactions: Set up systems for regularly monitoring and auditing export transactions to detect potential violations of export controls.

- Implement reporting mechanisms: Outline procedures for reporting potential violations or compliance issues to the appropriate regulatory authorities.

Benefits of using this US export and trade compliance policy (Arizona)

This policy offers several advantages for Arizona businesses:

- Reduces legal risks: Ensures that the business complies with US export laws, reducing the risk of fines, penalties, or other legal consequences.

- Protects business reputation: By adhering to export control regulations, the business safeguards its reputation and avoids involvement in illegal or unethical trade practices.

- Supports international operations: Helps the business manage global trade activities by ensuring compliance with the complex web of US export and trade laws.

- Improves risk management: Establishes processes for identifying and mitigating risks related to international trade, including transaction screening and employee training.

- Enhances business continuity: By ensuring compliance, the policy helps the business avoid disruptions in international trade caused by sanctions or violations.

Tips for using this US export and trade compliance policy (Arizona)

- Address Arizona-specific considerations: Incorporate any state-specific regulations or requirements that affect trade compliance in Arizona, especially for industries that deal with controlled technology.

- Collaborate with legal experts: Consult with legal professionals who specialize in export controls to ensure that the policy meets all regulatory requirements.

- Utilize technology: Use software tools that help track and screen transactions to ensure that exports are compliant with US laws.

- Regularly update the policy: As export regulations change, review and update the policy to stay compliant with new laws, sanctions lists, or trade restrictions.

- Conduct periodic audits: Regularly audit exports to ensure compliance with the policy and identify potential issues before they become violations.

Q: How does this policy benefit the business?

A: This policy helps the business avoid legal penalties and fines by ensuring compliance with US export regulations. It also mitigates the risk of involving the business in illegal trade practices, protecting its reputation and operations.

Q: How can the business monitor compliance with export regulations?

A: The business can monitor compliance by regularly auditing export transactions, screening customers and suppliers, and ensuring that employees are trained in export control laws and licensing requirements.

Q: What should the business do if a potential export violation is identified?

A: If a potential violation is identified, the business should promptly report the issue to the relevant authorities, conduct an internal investigation, and take corrective actions to ensure compliance with US laws.

Q: How does this policy help with international trade?

A: This policy ensures that the business can continue its international trade activities without risk of violating export control laws, enabling smooth operations in global markets while maintaining legal compliance.

Q: Can the business be penalized for inadvertently violating export controls?

A: Yes, violations of export control laws, even if unintentional, can result in significant fines and penalties. The policy helps reduce this risk by ensuring that all employees involved in international trade are aware of and adhere to compliance requirements.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.