US export and trade compliance policy (California): Free template

US export and trade compliance policy (California)

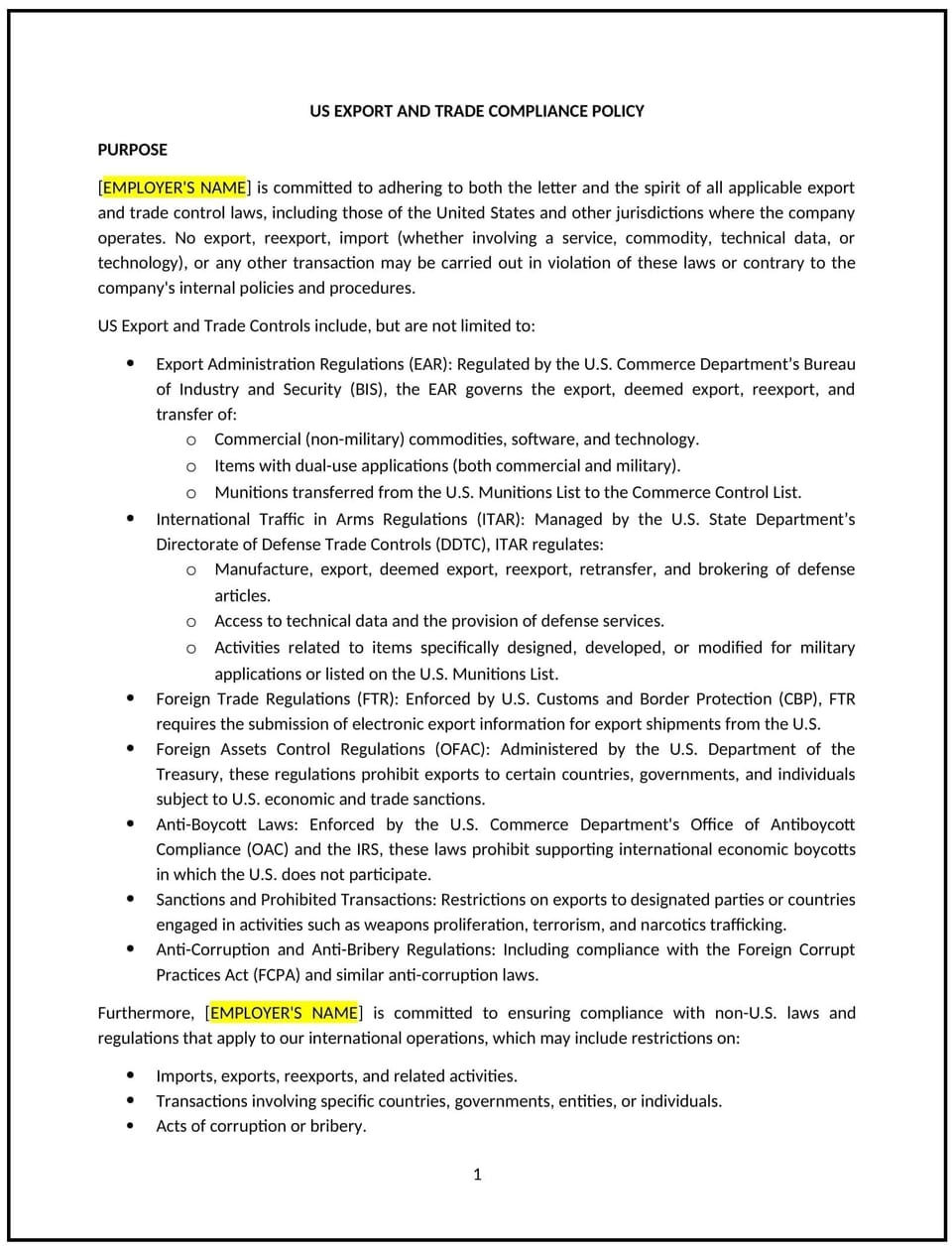

In California, a US export and trade compliance policy provides businesses with guidelines for adhering to federal and state regulations governing the export of goods, services, and technology. This policy ensures compliance with laws such as the Export Administration Regulations (EAR), International Traffic in Arms Regulations (ITAR), and sanctions administered by the Office of Foreign Assets Control (OFAC).

This policy outlines the business’s obligations, procedures for export activities, and responsibilities for maintaining compliance. By implementing this policy, California businesses can mitigate legal risks, safeguard intellectual property, and ensure smooth international operations.

How to use this US export and trade compliance policy (California)

- Define scope: Specify the types of goods, services, and technology covered under export regulations and how they apply to the business.

- Assign responsibilities: Identify individuals or teams responsible for overseeing export compliance and managing trade-related activities.

- Outline procedures: Provide detailed steps for screening transactions, verifying licenses, and ensuring compliance with relevant regulations.

- Address recordkeeping: Establish guidelines for maintaining records of export activities, including licenses, documentation, and transaction histories.

- Communicate reporting obligations: Specify procedures for reporting suspected violations to appropriate authorities or internal compliance teams.

Benefits of using this US export and trade compliance policy (California)

This policy offers several advantages for California businesses:

- Supports compliance: Reflects federal and state regulations, minimizing legal and financial risks related to export activities.

- Protects intellectual property: Safeguards sensitive technology and information from unauthorized export or misuse.

- Enhances transparency: Provides clear procedures for managing export transactions and addressing compliance concerns.

- Mitigates risks: Reduces the likelihood of penalties or sanctions resulting from non-compliance.

- Improves efficiency: Streamlines export operations through standardized processes and clear responsibilities.

Tips for using this US export and trade compliance policy (California)

- Reflect California-specific considerations: Address any state-specific requirements or industry-specific nuances affecting export activities.

- Train employees: Provide regular training on export regulations, documentation, and compliance procedures for relevant teams.

- Use compliance tools: Implement software to automate screening and documentation for export transactions.

- Conduct audits: Regularly review export processes and records to ensure compliance and identify areas for improvement.

- Update regularly: Revise the policy to reflect changes in federal or state export regulations or business operations.

Q: How does this policy benefit the business?

A: This policy supports compliance with federal and state export regulations, protects intellectual property, and mitigates risks associated with trade violations.

Q: What types of exports are covered under this policy?

A: The policy applies to goods, services, and technology subject to US export controls, including those regulated under EAR, ITAR, or OFAC sanctions.

Q: How does this policy support compliance with California laws?

A: The policy aligns with state-specific business practices and federal regulations, ensuring lawful export activities.

Q: What steps should employees take to ensure compliance with export regulations?

A: Employees should verify licenses, screen transactions, and follow the procedures outlined in the policy for documentation and reporting.

Q: How can the business manage export compliance efficiently?

A: The business can implement compliance software, provide training, and designate a compliance officer to oversee export-related activities.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.