US export and trade compliance policy (Florida): Free template

US export and trade compliance policy (Florida)

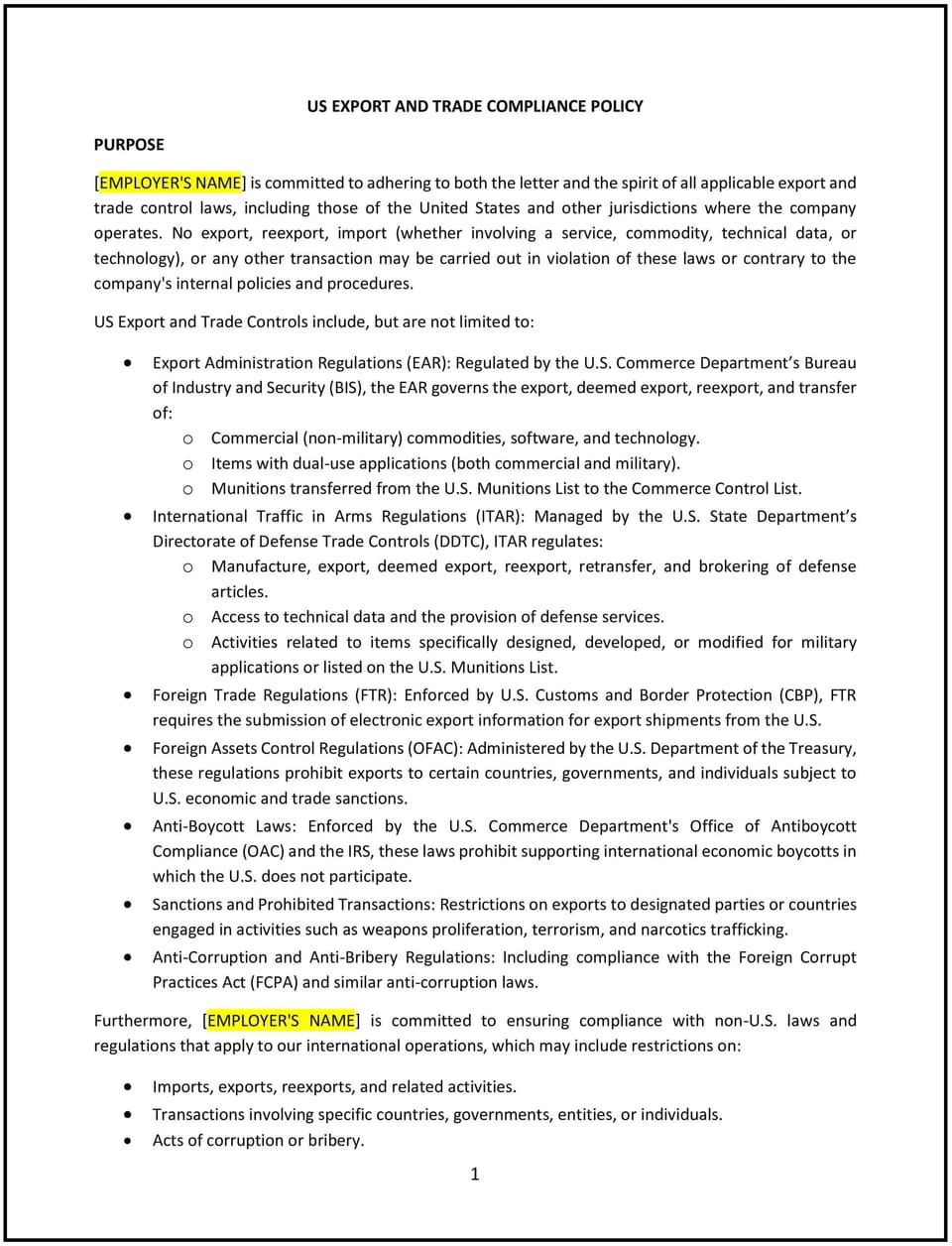

A US export and trade compliance policy helps Florida businesses establish a framework for managing international trade activities in alignment with federal regulations. This policy outlines procedures for identifying, assessing, and addressing export control requirements, sanctions, and trade restrictions. It is designed to promote responsible trade practices, reduce risks, and provide clear guidelines for handling cross-border transactions.

By implementing this policy, businesses in Florida can demonstrate their commitment to ethical trade practices, foster trust with partners, and align with the state’s focus on supporting global commerce while adhering to legal standards.

How to use this US export and trade compliance policy (Florida)

- Define export control requirements: Clearly specify which products, services, or technologies are subject to export controls under US laws, such as the Export Administration Regulations (EAR) or International Traffic in Arms Regulations (ITAR).

- Establish screening procedures: Outline how businesses should screen customers, partners, and transactions against restricted party lists and embargoed countries.

- Address licensing requirements: Explain when export licenses are needed and how to apply for them, including documentation and timelines.

- Provide training: Educate employees on recognizing red flags, understanding export classifications, and following compliance procedures.

- Develop recordkeeping practices: Specify how long records related to exports and trade activities should be retained and how they should be stored.

- Communicate the policy: Share the policy with employees through handbooks, emails, or training sessions to ensure awareness and understanding.

- Monitor adherence: Regularly review trade activities and address any concerns or discrepancies promptly.

- Update the policy: Periodically assess the policy to reflect changes in federal regulations, trade agreements, or business operations.

Benefits of using this US export and trade compliance policy (Florida)

This policy offers several advantages for Florida businesses:

- Promotes ethical conduct: Clear guidelines help prevent unethical behavior and foster a culture of integrity.

- Reduces risks: Defined procedures minimize the likelihood of legal issues, penalties, or reputational damage.

- Builds trust: Demonstrates the business’s commitment to transparency and accountability in all operations.

- Aligns with legal standards: Reflects Florida’s role in supporting businesses that operate within national and international legal frameworks.

- Enhances reputation: A robust policy showcases the business’s dedication to ethical practices and responsible global engagement.

- Improves planning: Helps businesses anticipate regulatory requirements and incorporate them into operational processes.

- Supports growth: Facilitates participation in global markets by providing a clear framework for navigating export controls.

Tips for using this US export and trade compliance policy (Florida)

- Communicate clearly: Ensure employees understand the policy by providing written materials and discussing it during meetings or training sessions.

- Train employees: Educate staff on recognizing export control requirements, red flags, and compliance procedures.

- Use technology: Leverage tools like compliance software to screen transactions, manage licenses, and track regulatory updates.

- Stay informed: Keep up with changes in federal regulations, trade agreements, or geopolitical developments that may affect export activities.

- Conduct audits: Regularly review trade activities and records to identify areas for improvement and ensure consistency.

- Encourage reporting: Create a process for employees to report potential compliance issues or seek guidance on complex situations.

- Review periodically: Assess the policy’s effectiveness and make updates as needed to reflect changes in regulations, business needs, or market conditions.

Q: Why should Florida businesses adopt a US export and trade compliance policy?

A: Businesses should adopt this policy to promote ethical conduct, reduce risks, and align with legal standards governing international trade.

Q: What types of activities are subject to export controls?

A: Businesses should consider whether their products, services, or technologies fall under categories such as dual-use items, defense articles, or encryption software, as defined by federal regulations.

Q: How should businesses conduct due diligence on third parties?

A: Businesses should vet third parties by reviewing their backgrounds, assessing their compliance history, and ensuring they adhere to ethical standards.

Q: What should businesses do if they identify a potential compliance issue?

A: Businesses should investigate the issue promptly, document findings, and take corrective actions, such as halting transactions or seeking legal advice.

Q: How can businesses stay updated on export regulations?

A: Businesses should subscribe to updates from relevant agencies, such as the Bureau of Industry and Security (BIS) or the Office of Foreign Assets Control (OFAC), and participate in industry training programs.

Q: Should businesses require employee training on export compliance?

A: Businesses should provide regular training to employees involved in trade activities to ensure they understand export control requirements and procedures.

Q: How often should businesses review the policy?

A: Businesses should review the policy annually or whenever there are significant changes in regulations, trade agreements, or business operations.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.