US export and trade compliance policy (Hawaiʻi): Free template

US export and trade compliance policy (Hawaiʻi)

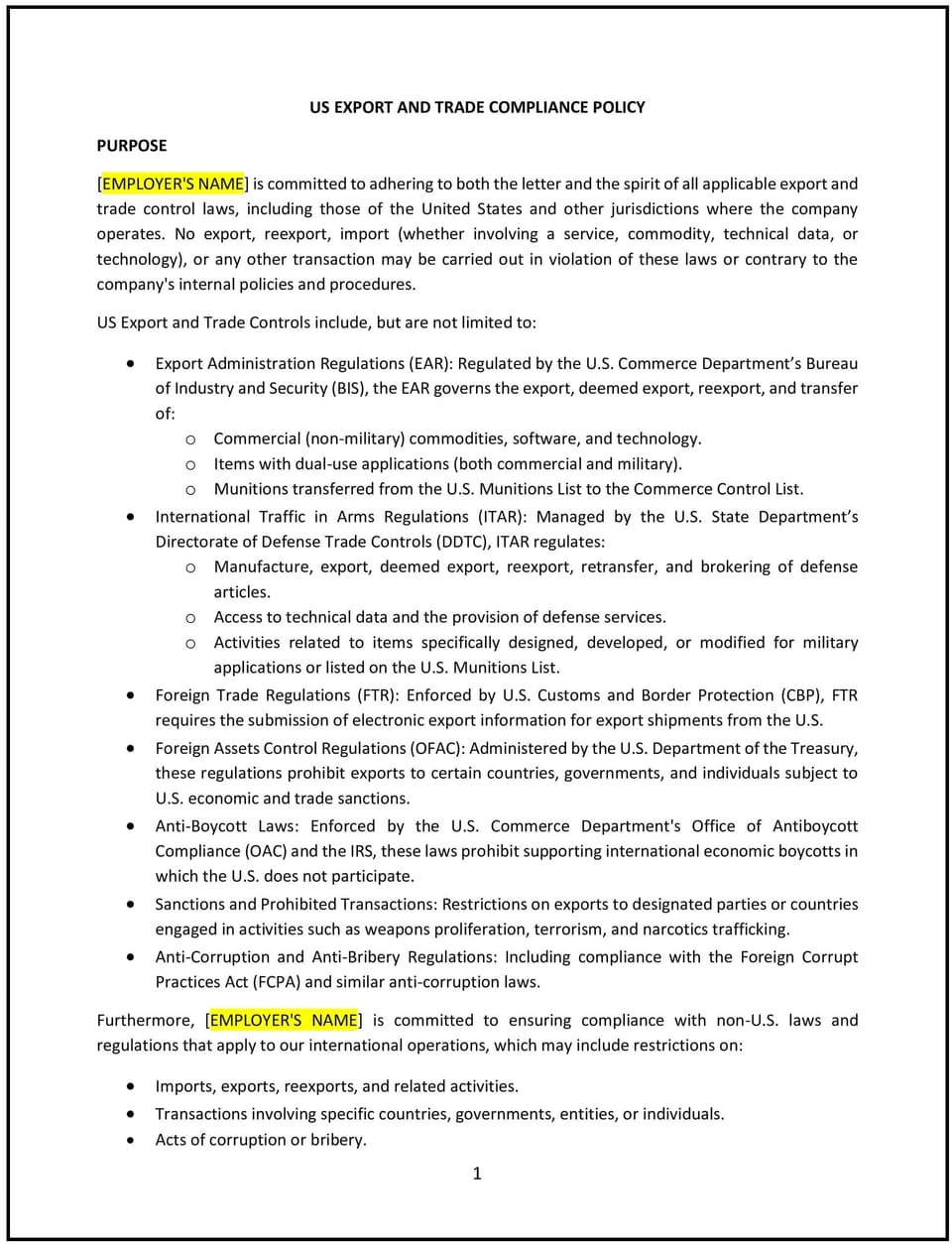

A US export and trade compliance policy helps Hawaiʻi businesses navigate the complex regulations governing international trade and exports. This policy outlines procedures for adhering to federal laws, such as those enforced by the Bureau of Industry and Security (BIS) and the Office of Foreign Assets Control (OFAC), while considering Hawaiʻi’s unique position as a hub for international trade and tourism. It is designed to promote ethical business practices, minimize risks, and support lawful trade activities.

By implementing this policy, businesses in Hawaiʻi can reduce the risk of penalties, protect their reputation, and ensure smooth international trade operations.

How to use this US export and trade compliance policy (Hawaiʻi)

- Define scope: Clearly explain which business activities are covered by the policy, such as exporting goods, technology, or services.

- Identify regulated items: Provide guidelines for determining whether products, software, or technology are subject to export controls.

- Screen parties: Establish procedures for screening customers, partners, and other parties against restricted or denied party lists.

- Obtain necessary licenses: Outline the process for identifying when export licenses are required and how to apply for them.

- Maintain records: Specify the types of records businesses should keep, such as shipping documents, licenses, and screening results.

- Train employees: Educate staff on export control regulations, the policy’s guidelines, and their responsibilities for compliance.

- Monitor transactions: Implement procedures for reviewing and approving international transactions to ensure adherence to regulations.

- Conduct internal audits: Regularly review export and trade activities to identify and address potential risks or violations.

- Communicate the policy: Share the policy with relevant employees and stakeholders to ensure awareness and understanding.

- Review and update the policy: Periodically assess the policy’s effectiveness and make adjustments as needed to reflect changes in laws or business needs.

Benefits of using this US export and trade compliance policy (Hawaiʻi)

This policy offers several advantages for Hawaiʻi businesses:

- Reduces risks: Clear guidelines help businesses avoid violations of export control laws, minimizing the risk of penalties or legal issues.

- Protects reputation: Adhering to ethical trade practices enhances the business’s reputation with customers, partners, and regulators.

- Supports lawful trade: The policy ensures businesses can engage in international trade activities while complying with federal regulations.

- Enhances efficiency: Structured procedures for screening, licensing, and record-keeping streamline export and trade processes.

- Builds trust: A proactive approach to compliance demonstrates the business’s commitment to ethical and lawful trade practices.

- Aligns with Hawaiʻi’s trade role: The policy reflects Hawaiʻi’s position as a gateway for international trade and tourism, supporting local economic growth.

- Improves preparedness: Regular training and audits help businesses stay informed about regulatory changes and address potential risks proactively.

Tips for using this US export and trade compliance policy (Hawaiʻi)

- Communicate the policy effectively: Share the policy with relevant employees and stakeholders to ensure awareness and understanding.

- Provide training: Educate employees on export control regulations, the policy’s guidelines, and their responsibilities for compliance.

- Use technology: Implement tools for screening parties, managing licenses, and maintaining records to streamline compliance processes.

- Monitor transactions: Regularly review international transactions to ensure adherence to regulations and identify potential risks.

- Conduct audits: Perform internal audits to assess compliance and address any issues promptly.

- Stay informed: Keep up-to-date with changes in export control laws and adjust the policy as needed.

- Review the policy periodically: Update the policy annually or as needed to reflect changes in laws, business needs, or trade activities.

Q: Why should Hawaiʻi businesses adopt a US export and trade compliance policy?

A: Businesses should adopt this policy to reduce risks, protect their reputation, and ensure lawful international trade activities.

Q: What types of activities are covered under the policy?

A: The policy should cover exporting goods, technology, or services, as well as other international trade activities subject to federal regulations.

Q: How should businesses determine if their products are subject to export controls?

A: Businesses should review the Commerce Control List (CCL) and other regulatory resources to determine if their products require export licenses.

Q: What is a restricted or denied party list?

A: These are lists of individuals, organizations, or countries with which trade is restricted or prohibited under US law. Businesses should screen parties against these lists.

Q: When is an export license required?

A: An export license is required for certain products, technologies, or destinations as specified by federal regulations. Businesses should review the CCL and consult with experts if needed.

Q: What records should businesses maintain for export compliance?

A: Businesses should keep records such as shipping documents, export licenses, screening results, and transaction details for at least five years.

Q: How often should businesses train employees on export compliance?

A: Businesses should provide regular training to employees involved in international trade, particularly when regulations or business practices change.

Q: How often should businesses review the policy?

A: Businesses should review the policy annually or as needed to reflect changes in laws, business needs, or trade activities.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.