US export and trade compliance policy (Indiana): Free template

US export and trade compliance policy (Indiana): Free template

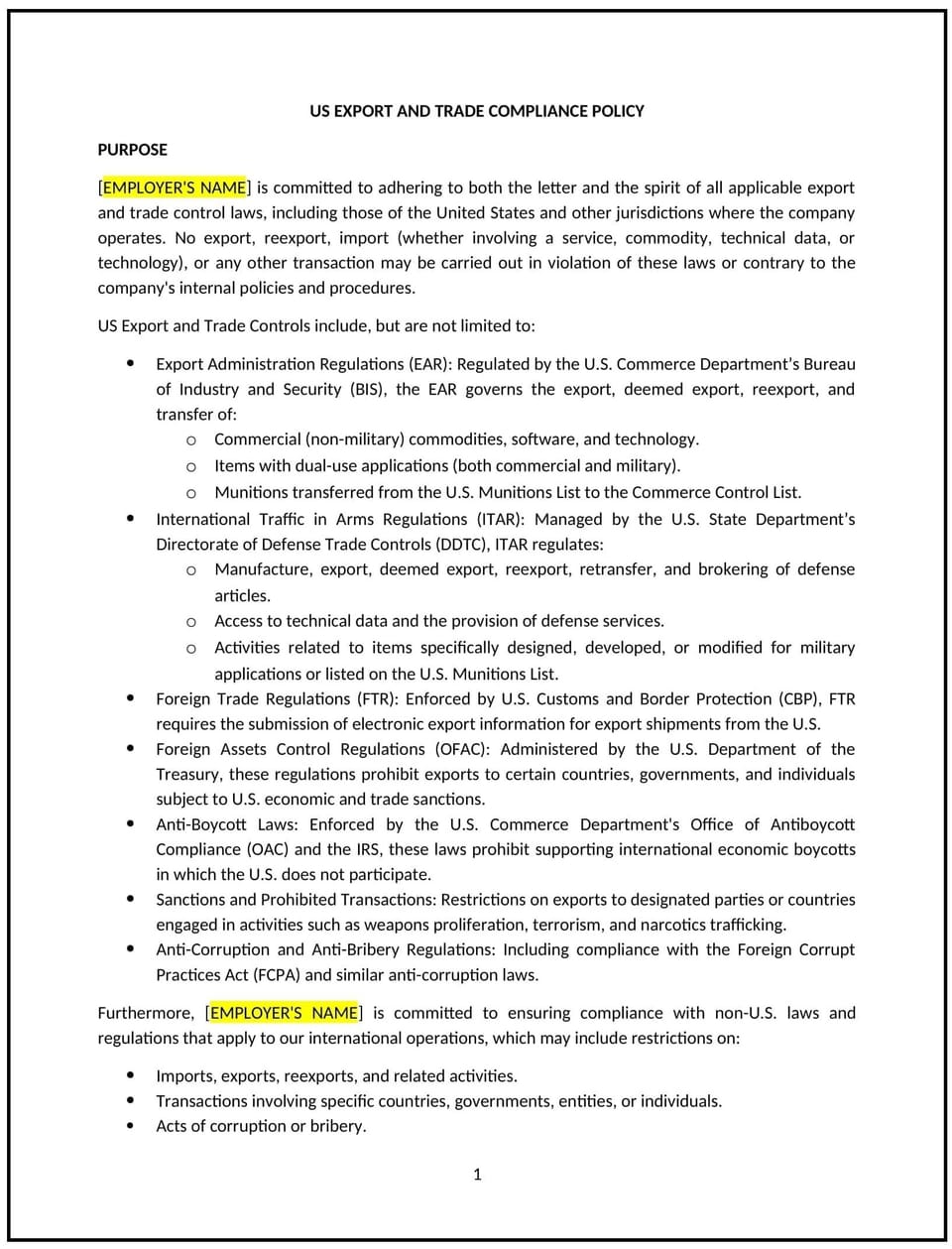

This US export and trade compliance policy helps Indiana businesses establish clear guidelines for complying with export control laws, trade sanctions, and related regulations. It outlines employee responsibilities, procedures for screening transactions, and steps to support adherence to the Export Administration Regulations (EAR), International Traffic in Arms Regulations (ITAR), and other applicable laws.

By implementing this policy, Indiana businesses can mitigate legal and financial risks while fostering a culture of compliance and ethical trade practices.

How to use this US export and trade compliance policy (Indiana)

- Identify applicable regulations: Specify which export and trade compliance laws apply to the business, such as EAR, ITAR, and sanctions enforced by the Office of Foreign Assets Control (OFAC).

- Establish screening procedures: Include steps for screening customers, suppliers, and transactions against denied party lists and restricted country lists.

- Define employee responsibilities: Clarify roles and responsibilities for ensuring compliance, including identifying export-controlled items and obtaining necessary licenses.

- Provide training requirements: Outline mandatory training for employees involved in international trade or handling controlled items to ensure they understand compliance obligations.

- Address recordkeeping practices: Specify how export and trade-related records should be maintained and the retention period required under applicable laws.

- Include reporting mechanisms: Provide a process for employees to report potential violations or concerns confidentially, such as through a compliance hotline.

- Detail consequences of violations: Clearly state the disciplinary actions for non-compliance, including termination or legal ramifications, to underscore the importance of adhering to trade laws.

- Review and update regularly: Periodically assess the policy to reflect changes in export regulations or business practices and ensure ongoing compliance.

Benefits of using this US export and trade compliance policy (Indiana)

Implementing this policy provides several key benefits for Indiana businesses:

- Mitigates reputational risks: Promotes ethical trade practices, protecting the company’s reputation in domestic and international markets.

- Enhances operational clarity: Provides clear procedures for managing export and trade compliance, reducing confusion or errors.

- Supports employee accountability: Clearly defines roles and responsibilities, ensuring all employees understand their part in maintaining compliance.

- Strengthens international partnerships: Builds trust with global customers and suppliers by demonstrating a commitment to lawful trade practices.

- Encourages proactive reporting: Offers a safe mechanism for employees to report concerns, helping businesses address issues before they escalate.

Tips for using this US export and trade compliance policy (Indiana)

- Communicate the policy: Share the policy with all employees involved in international trade and ensure it is accessible in the employee handbook or compliance manual.

- Provide regular training: Offer ongoing training to employees on key export laws, trade sanctions, and company-specific compliance procedures.

- Use compliance tools: Implement software for screening transactions, managing licenses, and tracking export-controlled items to enhance accuracy.

- Collaborate with legal counsel: Consult with legal experts specializing in export compliance to address complex scenarios or regulatory updates.

- Monitor high-risk transactions: Establish additional review steps for high-risk transactions, such as exports to restricted countries or involving controlled items.

- Conduct internal audits: Periodically review export records, procedures, and employee adherence to identify and address gaps in compliance.

Q: How can businesses determine if an export license is required?

A: Employees should review the Commerce Control List (CCL) under EAR or the United States Munitions List (USML) under ITAR to determine if their product or service requires a license.

Q: What are the penalties for non-compliance?

A: Penalties for violations may include significant fines, loss of export privileges, and reputational damage. Employees may also face disciplinary actions, including termination.

Q: What tools can businesses use for compliance?

A: Businesses can use trade compliance software to screen transactions, manage export licenses, and ensure adherence to denied party and restricted country lists.

Q: How should potential violations be reported?

A: Employees should report suspected violations to their manager, compliance officer, or through the company’s designated reporting hotline.

Q: Are there specific training requirements for employees?

A: Yes, employees involved in international trade or handling controlled items must complete regular training on export and trade compliance requirements.

Q: How long should export-related records be retained?

A: Records should be retained for at least five years, or longer if required by specific regulations, to ensure compliance with legal requirements.

Q: How often should this policy be reviewed?

A: The policy should be reviewed annually or whenever there are changes to applicable export regulations or business practices.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.