US export and trade compliance policy (Kentucky): Free template

US export and trade compliance policy (Kentucky)

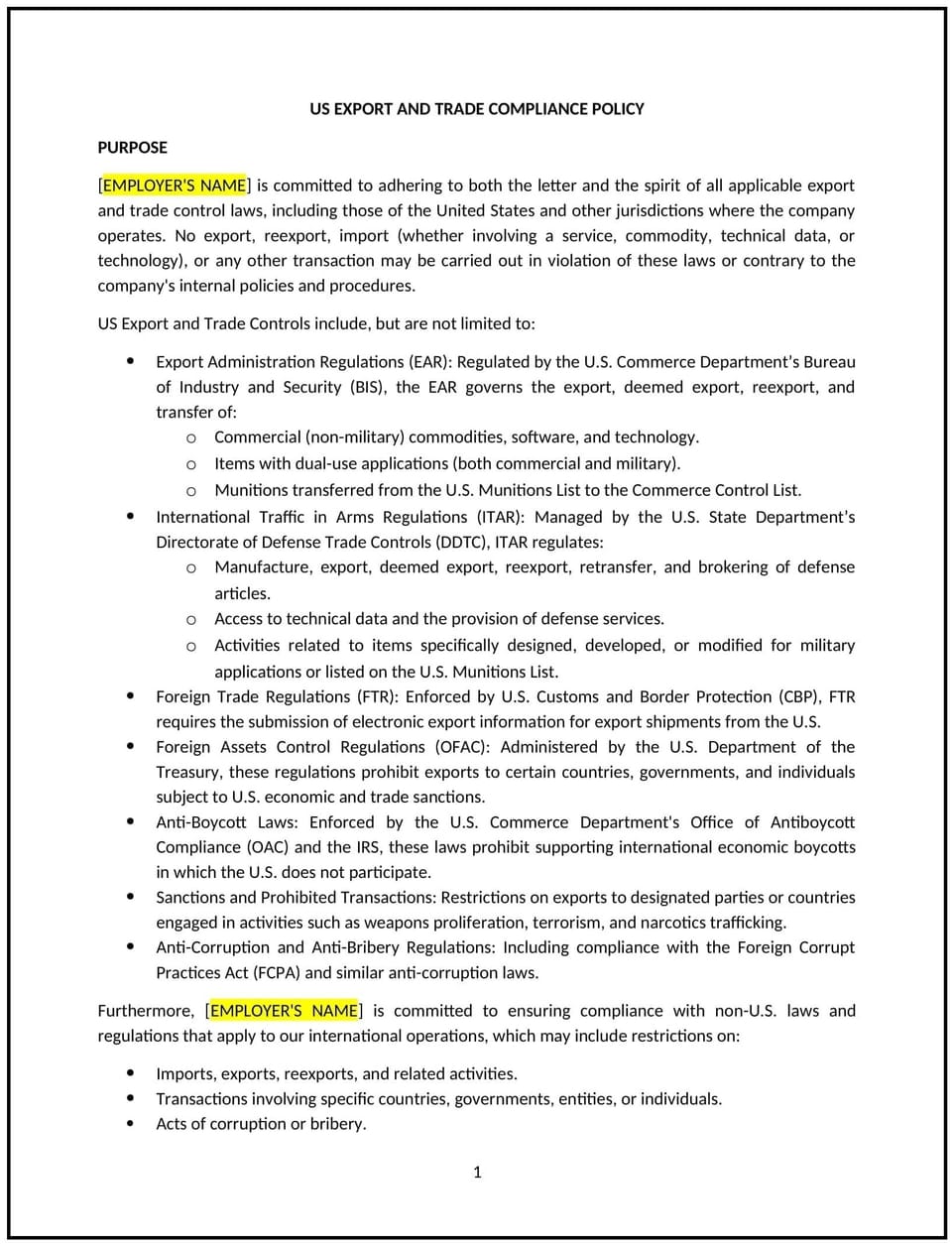

A US export and trade compliance policy provides Kentucky businesses with guidelines to ensure that goods, services, and technology are exported in accordance with federal regulations. This policy helps businesses navigate complex export laws, mitigate risks, and maintain a reputation for ethical and lawful operations.

By adopting this policy, businesses can manage trade activities effectively, minimize penalties, and ensure alignment with applicable trade laws and regulations.

How to use this US export and trade compliance policy (Kentucky)

- Define scope: Clearly outline the business activities covered under export and trade compliance, such as shipping goods, transferring technology, or providing services internationally.

- Identify regulatory requirements: Provide an overview of applicable laws, such as the Export Administration Regulations (EAR), International Traffic in Arms Regulations (ITAR), and Office of Foreign Assets Control (OFAC) requirements.

- Establish screening processes: Detail procedures for screening customers, suppliers, and transactions against restricted or denied party lists.

- Include licensing requirements: Specify when export licenses are needed and outline the steps for obtaining them.

- Address record-keeping: Provide guidance on maintaining documentation for all export transactions to meet federal requirements.

- Highlight penalties for violations: Clarify the potential consequences of non-compliance, including fines, legal actions, or loss of export privileges.

- Require periodic training: Encourage regular training for employees involved in export-related activities to ensure understanding and adherence to regulations.

Benefits of using this US export and trade compliance policy (Kentucky)

This policy provides several key benefits for Kentucky businesses:

- Reduces legal risks: Minimizes exposure to penalties or sanctions by ensuring compliance with export and trade regulations.

- Protects business reputation: Demonstrates the business’s commitment to ethical and lawful international trade practices.

- Enhances operational efficiency: Establishes clear procedures for managing export activities and navigating regulatory complexities.

- Promotes accountability: Encourages consistent application of export compliance standards across all relevant business activities.

- Improves trade relationships: Builds trust with international partners by ensuring transactions meet legal and ethical standards.

Tips for using this US export and trade compliance policy (Kentucky)

- Communicate the policy: Ensure all relevant employees and managers understand the policy through onboarding and regular updates.

- Leverage compliance tools: Use technology to automate screening, record-keeping, and monitoring of export activities.

- Monitor regulatory changes: Stay informed about updates to US export laws and adjust the policy as needed.

- Conduct internal audits: Regularly review export activities and documentation to identify and address potential compliance issues.

- Provide regular training: Schedule periodic training sessions to keep employees and managers informed about current regulations and best practices.

Q: What activities are covered under this policy?

A: The policy covers exporting goods, transferring technology, providing services internationally, and any related activities subject to US trade laws.

Q: What regulations do businesses need to follow?

A: Businesses must adhere to laws such as the Export Administration Regulations (EAR), International Traffic in Arms Regulations (ITAR), and Office of Foreign Assets Control (OFAC) requirements.

Q: How can businesses determine if an export license is required?

A: Businesses should assess whether the item, service, or technology being exported falls under regulated categories and follow the steps outlined in the policy for obtaining licenses.

Q: What is the purpose of screening processes?

A: Screening ensures that customers, suppliers, and transactions are not associated with restricted or denied parties, helping businesses comply with trade laws.

Q: What documentation should businesses maintain for export transactions?

A: Businesses should retain records such as invoices, shipping documents, export licenses, and communications for the time period required by federal regulations.

Q: What are the consequences of non-compliance with export laws?

A: Non-compliance can result in fines, legal actions, loss of export privileges, and damage to the business’s reputation.

Q: How often should export compliance training be conducted?

A: Training should be provided during onboarding for relevant employees and periodically thereafter to ensure understanding of current regulations.

Q: How often should this policy be reviewed?

A: The policy should be reviewed periodically to align with changes in US export laws and business practices.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.