US export and trade compliance policy (Minnesota): Free template

US export and trade compliance policy (Minnesota)

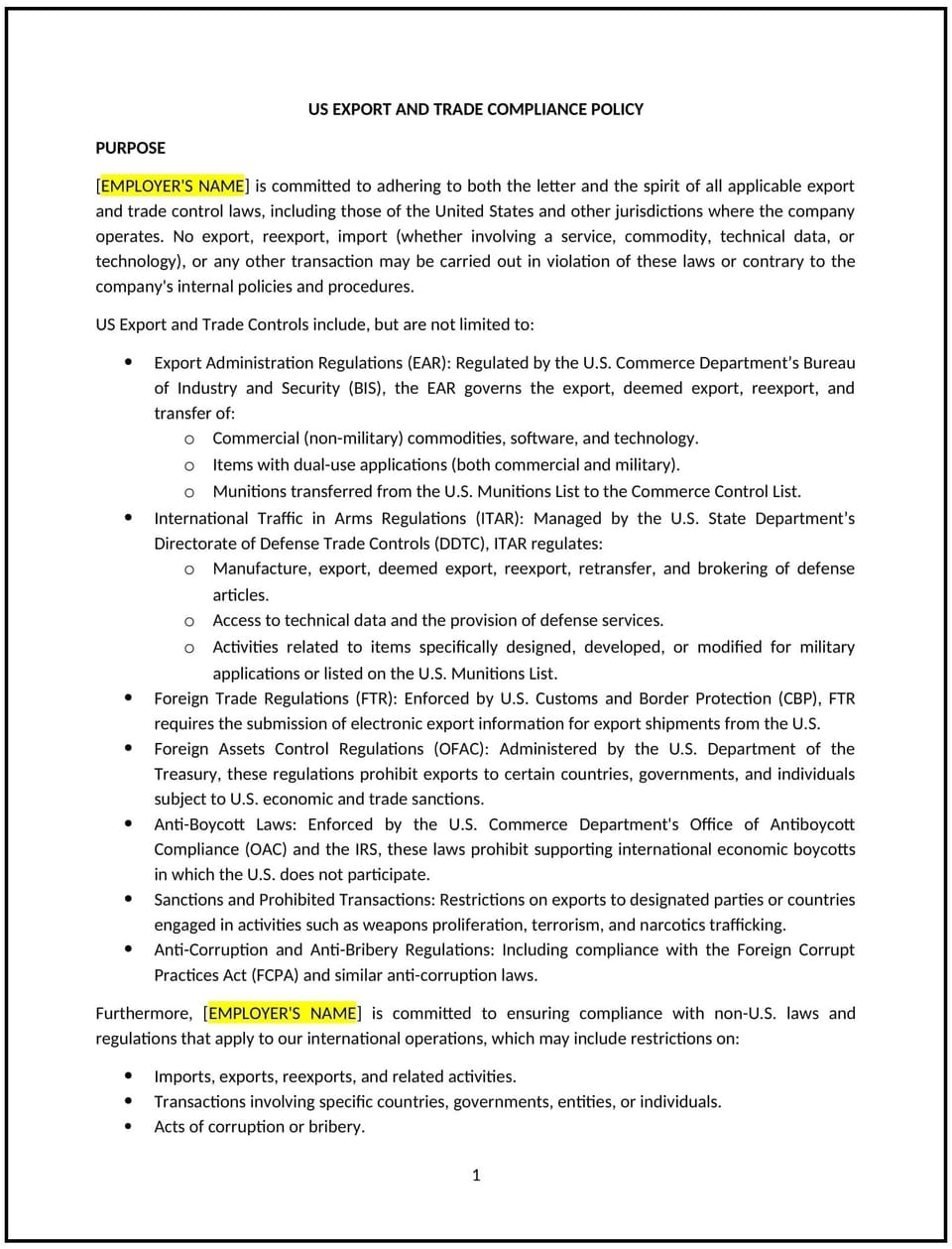

This US export and trade compliance policy is designed to help Minnesota businesses comply with US laws and regulations related to the export of goods, services, and technology. The policy outlines the procedures and responsibilities for managing export transactions, adhering to trade restrictions, and ensuring compliance with federal and state trade laws.

By implementing this policy, businesses can mitigate the risks of violating trade laws, safeguard against penalties, and protect both the company and its employees from legal consequences.

How to use this US export and trade compliance policy (Minnesota)

- Define export and trade compliance: Clearly outline what constitutes export and trade compliance, including the process of exporting goods, services, or technology to foreign countries. Ensure employees understand their role in ensuring compliance with relevant regulations.

- Establish a compliance framework: Develop a structured framework to ensure compliance with US export control laws, including those administered by the Department of Commerce, the Department of State, and the Office of Foreign Assets Control (OFAC). This framework should include screening processes, documentation requirements, and reporting procedures.

- Specify restricted countries and entities: Identify countries, entities, and individuals subject to trade restrictions, such as those on OFAC's list, and define procedures for screening export transactions to ensure compliance with these restrictions.

- Set procedures for export licensing: Outline the process for obtaining the necessary licenses for exports that require government authorization. Include the steps for submitting license applications, tracking their status, and maintaining records of approvals or denials.

- Address reporting and documentation requirements: Specify the documentation required for export transactions, including export licenses, commercial invoices, and shipping documents. Businesses should also maintain records of all export transactions as required by US law.

- Train employees: Regularly train employees involved in exporting or handling trade compliance to ensure they are aware of the laws and best practices related to export control. Training should include how to identify restricted transactions, complete compliance checks, and handle export documentation.

- Implement a compliance audit system: Establish a regular auditing process to assess adherence to the export and trade compliance policy. This should include internal reviews, checks for violations, and steps to address any identified issues.

Benefits of using a US export and trade compliance policy (Minnesota)

Implementing this policy provides several advantages for Minnesota businesses:

- Mitigates legal risk: A robust compliance framework helps businesses avoid violating US export laws, reducing the risk of fines, penalties, and reputational damage.

- Promotes transparency: Clear procedures for export transactions and compliance documentation enhance transparency, making it easier to identify potential issues and address them proactively.

- Strengthens business operations: By following export compliance best practices, businesses can confidently expand their reach to global markets while ensuring legal and regulatory adherence.

- Improves operational efficiency: Establishing standardized processes for managing export transactions streamlines operations, reducing delays and improving decision-making.

- Reflects Minnesota-specific considerations: The policy can be tailored to Minnesota’s regulatory environment, considering state-specific export initiatives and economic activities.

Tips for using this US export and trade compliance policy (Minnesota)

- Communicate the policy clearly: Ensure that all employees involved in exporting goods or services understand the policy, their responsibilities, and the company’s expectations for compliance.

- Use technology for screening: Implement software tools or systems to help screen transactions, customers, and countries against trade restrictions and compliance lists.

- Regularly review transactions: Continuously monitor and review export transactions to ensure they align with compliance standards and adhere to all relevant legal requirements.

- Work with legal experts: Engage legal counsel or trade compliance experts to stay updated on changing regulations and to receive guidance on complex compliance issues.

- Conduct periodic audits: Regularly audit export activities to identify any gaps in compliance or areas where procedures can be improved, ensuring that all transactions are documented and monitored effectively.

Q: What is considered an export under this policy?

A: An export refers to the act of sending goods, services, or technology from the US to another country. This includes physical exports, software, and technical data that may be subject to US export laws.

Q: Which countries are subject to trade restrictions?

A: Businesses should identify countries that are subject to trade restrictions or embargoes, such as those listed by the US Department of State or OFAC. The policy should outline specific countries where exports are prohibited or restricted.

Q: Do all exports require a license?

A: Not all exports require a license, but certain goods, services, or technologies, especially those with sensitive uses or dual purposes (civilian and military), may require export licenses. The policy should specify the types of exports that require licenses and the process to obtain them.

Q: How should businesses screen potential customers for export compliance?

A: Businesses should screen customers and foreign buyers using export control lists, such as the Entity List or Specially Designated Nationals (SDN) list. This screening helps identify individuals or entities with restrictions on their ability to receive US exports.

Q: What happens if a business violates export and trade compliance laws?

A: Violations of export laws can lead to severe penalties, including fines, trade restrictions, and reputational damage. Businesses should outline the steps taken if violations occur, including internal investigations, reporting to authorities, and corrective actions.

Q: How should employees report a suspected export violation?

A: Employees should report any suspected export violations to the compliance officer or the designated HR contact. Businesses should ensure a confidential process for reporting concerns without fear of retaliation.

Q: How often should this policy be reviewed?

A: The policy should be reviewed regularly, at least annually or whenever there are updates to export laws, regulations, or business practices. Regular reviews ensure that the policy remains effective and aligned with current legal requirements.

Q: Can businesses rely solely on government export licenses for compliance?

A: No, businesses must ensure that all export transactions, even those with government licenses, comply with all applicable laws and regulations. The policy should provide guidelines for verifying compliance even when a license is obtained.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.